Uber Restarts Card Payments; 2FA Implemented As Per RBI Mandate

[Article Updated: See at the end]

Credit card payment mode is now back at Uber. In a press release sent to us, Uber has announced that they will resume accepting credit card payments from their customers across 18 Indian cities.

PayTm wallet, which enjoyed the exclusive payment option since December, would also exist along with credit card option. Thus, Uber is now on-par with Ola and Meru which used PayU and Citrus Pay respectively to accept credit card payments.

Last December, Uber had stopped accepting credit card or debit card mode of payment, as their process didn’t comply with RBI’s 2 step authorization process. But now, they have made the necessary changes within their app, which will enable the 2 step authorization as mandated by RBI.

Android users would be the first to use the credit card mode of payment in Uber app; iOS and Windows apps would be soon updated. The Uber app has now been updated to accept payments from Visa, Master Card as well American Express cards.

Uber has tied up with Zaakpay to process all credit card enabled payments across their platform. Gurgaon based digital payment gateway firm Zaakpay was earlier associated with Uber’s rival Ola Cabs.

In their press release, Uber said, “Adhering to RBI regulations, there shall be 2 Factor Authentication flow built in to the app and we’ll need you to enter your Online Banking Pin or One-Time Password before we can charge the fare to your card. Don’t worry, all your payment information is kept secure and encrypted to the highest security standards available.”

How Will It Work?

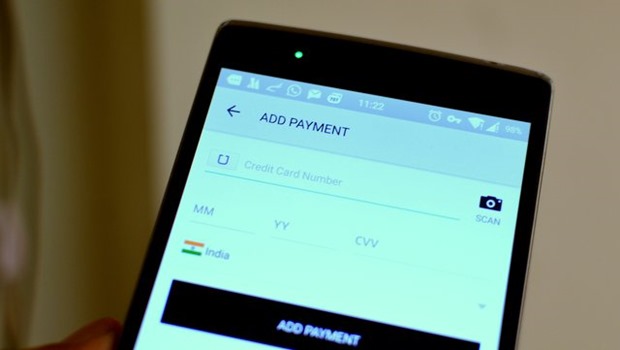

Uber has shared the steps involved in the activating credit card payments:

- Step 1: Tap the account button in the top left corner

- Step 2: Tap Payment

- Step 3: Tap Add Payment

- Step 4: Fill in your credit card information or tap the “scan your card” option

- Step 5: After your trip, you shall see a “Pay Now” button that triggers the 2 Factor Authentication.

- Step 6: Type in your OTP or I-Pin and your receipt shall be sent to your registered email address.

PayTm or Credit Card: Which One Would Be Convenient?

Depending on customer’s preferences, both of these options have their pros and cons; hence can’t be categorized per se.

With PayTm, the biggest issue was constantly loading money into PayTm before making an Uber booking. Those who are active on PayTm, and have pre-loaded cash, this was not an issue. But for those who were not that active on PayTm, this was a great hassle.

However, with credit card, the 2 step verification process can prove to be a damper, especially in those areas where mobile connectivity is minimal, and the OTP message fails to arrive in time. In such cases, the customer will have to wait till the OTP message arrives, and the payment is cleared.

None the less, resuming credit card payment will be a major booster for those customers, who are not comfortable with maintaining a digital wallet like PayTm, and those who use credit cards extensively.

The next step for Uber should be the activation of debit card payment, wherein the card is directly attached with Uber app, and once the journey ends, the payment gets directly debited from the customer’s account without any time delay pertaining to verification.

Uber’s cash mode experiment, which is currently underway at Hyderabad, can also prove to be a major relief, in case it gets implemented across India. Except Hyderabad, there is no other place in the world where Uber accepts cash as a payment.

To give context, last year the Reserve Bank of India had made it mandatory for all taxi companies to follow the two-factor authentication (2FA) for payments whenever the card is not presented physically. This is Uber abiding by the RBI and showing its commitment towards the Indian market.

[Update]

Looks like Uber will also have Mobikwik integration. According to the press release sent to us, Uber users can now use Mobikwik mobile wallet and make payments through Debit or credit cards. Here is the copy of press release sent to us by MobiKwik.

MobiKwik, India’s leading mobile payments network, today announced that it has entered into a partnership with Uber India. Under this partnership, Uber – which has re-introduced card payments for Indian users – will use MobiKwik for powering their new credit and debit card payment experience. This addition of credit and debit card payments will make the life of Uber India users much easier, giving them a choice of payment options, missing earlier.

The MobiKwik payment solution greatly enhances user experience while they pay on Uber as they need not use the existing payment option Paytm which was often reported as cumbersome leading to customer dissatisfaction. Now, users, just need to tap on the credit card option, add their credit or debit card details and make a fully secure two-factor authenticated (2FA) payment powered by MobiKwik. The new MobiKwik card payment service has been live for all Android users for more than a week whilst iOS users will get the feature via an update in the coming weeks.

“We are delighted to partner with Uber and bring India’s best mobile payment experience to Uber users.” said Bipin Preet Singh, Founder CEO of MobiKwik. He further added, “Our solution takes the complexity out of mobile payments, making them easy and seamless. “