No Service Tax At Non AC Restaurants, applicable on 40% of Bill Amount at AC places: FinMin

Often when we go for dining at a restaurant and the waiter comes up the bill; there exists much ambiguity and confusion regarding the taxes applicable. Most of the time, in order to avoid embarrassment infront of our guests, we skip the audit, and pay what is mentioned in the bill.

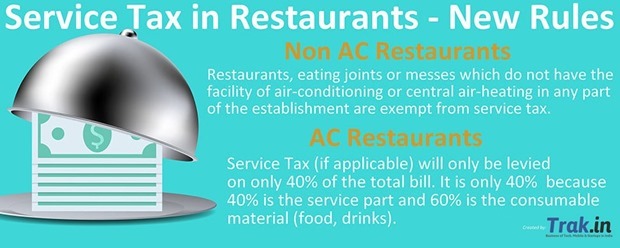

But not anymore; as Finance Ministry has come up with crystal clear guidelines for restaurants all over the country – No service tax on non-AC restaurants and a service tax on 40% of the total bill, in case it’s an Air Conditioned or Air-heated restaurant. Hence, the effective taxation on AC Restaurants will be 5.6% henceforth.

Earlier, when the service tax was 12.36%, the effective rate of taxation was 4.94%.

The statement from the ministry said, “Restaurants, eating joints or messes which do not have the facility of air-conditioning or central air-heating in any part of the establishment are exempt from service tax. In other words, only air-conditioned or air-heated restaurants are required to pay service tax,”

Clear Guidelines for Service Tax in Restaurants

Finance Ministry has made clear that the service tax (if applicable) will only be levied on 40% of the total bill. The constitution believes that within the service industry, food and hospitality niche provides a mixture of service and physical material (food, drinks), which can be divided in the ratio of 40:60; wherein 40% is the service part and 60% is the consumable material (food, drinks).

Hence, the service tax should be applied to this 40% of the total bill, which actually comes under providing service to the consumer.

In case the restaurant is not AC, then there would be no such service tax applicable, as the consumer didn’t receive the ‘service’ which was expected.

In March this year, when the Govt. increased service tax from 12.36% to 14%, including a 2% education cess on applicable taxes, there was much confusion and ambiguity regarding the exact amount which needs to be paid.

After this recent clarification from the Finance Ministry, it is now clear that non-AC restaurants cannot levy a service tax, and in case you are visiting an AC restaurant, then keep in mind that effective taxation is only 5.6%, not 14%.

You can read complete overview of the direct and indirect taxation structure applicable in India and know more about Service Taxes here. In case you wish to compare the major changes after the last Union Budget, this post is highly recommended.

but what if there are two section in same restaurant one ac and one non ac???

The article is not clear on that.

Going by the wordings of the notification and in the absence of any clarification from the Govt., I am afraid that service tax is payable on non A/c section also if it is also located alongwith A/c section.

is service tax applicable on services in non a/c section of an air conditioned restaurant ?

The above article is very precise and clear in explaining about the new norm to people, the catch would be here is to see whether any restaurant/hotel denying this norm by charging taxes on wrong rate and not showing 40% service in the bill. I believe it has been ordered to the restaurants to show 40% service in the bill, so that there should not be any ambiguity.

Very well explained. Thnx!!!