Flipkart Vs Amazon Vs Snapdeal: Revenues & Losses Comparison

We all know online shopping in India is growing at a very fast clip. At the same time, there is an intense competition in ecommerce space, especially among the top 3 players. Another aspect that everyone is probably aware about is, all this aggressive pricing and discounts are being paid by Venture Capitalists’ pockets.

Flipkart, Amazon and Snapdeal, all of them have raised investments or have commitments of $1 Billion or more. This money is being burned to acquire new customers, offer discounts and pump up products on offer. While we are all aware that these sites are losing money, you will be amazed to know the quantum of loss these ecommerce players have incurred.

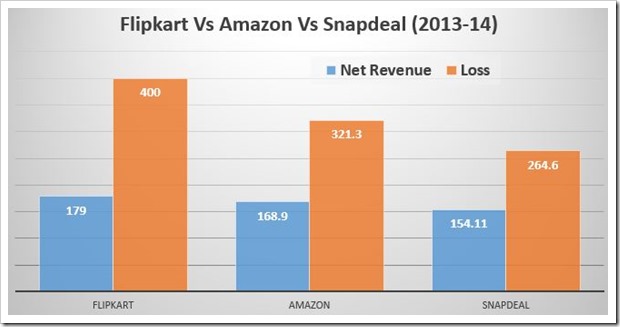

Check out these 2 graphs below and be stunned.

[Data Source: Techcircle]

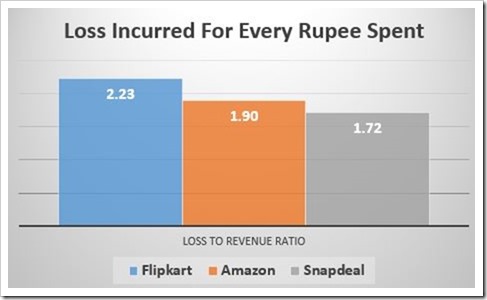

[Data Source: Techcircle]

Note: All figures are in INR Crore

Please note that the revenue figures above are not the price of products sold (GMV), as these are all marketplaces, and their revenues come from commissions they get from sellers or listing fees that they charge to list the products on their site.

GMV or Gross Merchandize Value represents the price of products sold and net revenues is just a fraction of that!

Flipkart leads the race with net revenue of 179 crore followed by Amazon at 168.9 crore and Snapdeal at 154.11 crore.

However, when it comes to losses, Flipkart leads by a much bigger margin and their loss for 2013-14 stands at Rs. 400 Crore. Comparatively, Amazon losses are pegged at Rs. 321.3 crore and Snapdeal had least losses of 3 with 264.6 crore

See the graph below to understand how much loss each player incurs for every rupee in net revenues.

Flipkart leads the race here to losing 2.23 rupees for every 1 rupee of revenue. Amazon loses 1.90 and Snapdeal has least amount of losses at Rs. 1.72.

The question is, how long can this sustain – In my view not very long.

What do you think?

Somebody mislead you and many others follows like BAKRA. NOT even single company from Above 3 is making losses. All are earning too much money. Out of 1000 products they give discount on 10 products to attract customers. And that too they have direct like with companies. Like Motorola sell them phone at Rs.4000 and they sell for Rs.5999 whereas if Same motorola for even a biggest dealer in offline market they selling for Rs.5500, this way eCommerce big players are getting lot of money. This is just one example. Now Flipkart value for 90 thousand crores. Do you have any idea of how much this money is?

I can agree if anyone making losses then it is small sellers on Amazon, Flipkart, eBay, Shopclues etc. Big players making money like hot cakes but, small sellers suffering from losses

I am actually from internal department of this ecommerce site. But, don’t know how someone giving wrong information and other’s are following it in a wrong way.

Get your facts straight! Flipkart’s owner (Sachin Bansal) himself agrees that Flipkart is incurring losses and adds an additional statement that cost of doing business at Flipkart is 53%. He justifies this by saying that it is still in it’s growing phase and it needs investment. Even Amazon when launched (in the US) didn’t make a penny for several years.

The business model they follow is quite new to the industry and no body knows the how it is going unfold (earn the returns). Last week Rakesh Zunzunwala (Warren Buffe of India) commented in similar fashion. Let us take his own words cost of making business today is 53% and it is going on for last 2-3 years. Now even to reach BEP it has to earn 53%. With each passing day it will add burden on the future revenue. So to become profit earning entity it would be tough time time for them. One obvious question could be then how they get huge funding (which is the sole basis of their business)? Only because the PEs and VCs haven’t have many option available for better investment and by their nature they take such risk.

There’s a widespread assumption that consumers will forever compare prices and a near consensus that they’ll ditch Flipkart et al if it reduces its discounts and bumps up its prices gradually. At the same time, during the past year, I’ve observed that prices on Flipkart are generally higher than those on Amazon India and SnapDeal, yet Flipkart claims 70% market share. While it might be lower than its market share two years ago, it’s still big enough. This makes me question the validity of the above assumption and consensus. Besides, as I’d recently highlighted in my blog post “Teardown of Myntra’s App Mantra” (http://gtm360.com/blog/2015/09/04/teardown-of-myntras-app-mantra/), companies like Flipkart and Mantra have probably achieved a critical mass beyond which a “slight” drop in customers may actually be good for their financial health. A 70% market share of customers willing to pay more is perhaps better than a 90% market share of customers hunting for bargains.

Two factors are proposed to support the sustainability of the e retail budiness model. One is BUILDING a huge customer base and getting atleast for some time (this could be even 10-20 years) the soft funding.

Both these presumptions are wrong as many have said, the huge customer base will start disintegrating once these comoanies start pricing for profits. Secondly the VC/ PE investors wont supply the funds in perpetuity. Because once they find that the model is unsustainable, they will start deserting these companies.

Then how these companies are existing?

One because customer is there with them till there is discount i.e. till there is value for money.

Secondly investor is here only because of their basic nature risk takers/potential. And this being

a new business model they will be here for some time.

Why e retailers companies are there except first few big companies like SD FK etc, rest small players are just here to be ME TOO type.

The biggines are here to exploit that huge customer base for generating profits, obviously discounting cannot be the solution but what will be that option they themselves also in dark to find out.

For example payment banks services, here the existing banking set up is inefficient wrt pricing and delivery. In such environment an entity like PayTM can exploit the situation to its advantage and sustain its operations profitably. Plus such venture can provides allided products like e retail that will be icing on cake.

Similar would be the case with OLA.

These two types dhows clear strategy to sail through where as the SD FK rely on emergent strategy, which is obviously, yet to be clearly set out.

Now I can see why there is no much new companies in this business… Have to bear the loss at the beginning to survive. Lets see who wins…!

HeYyy..Frndzz There is A WiN-WiN situation..Yass I agree this all companies are now making Losses bt M sure About that the Future Will there’$

Bcz..Its simple thng tht thy want Frm Customer’$ 4 Pur. thts product nd want to make HaBBit of it.. & In the result all the person make E-Payment.. This ‘E-‘ Word play a big role in A Normal persons life.No boday have to go any were like for Shopping, Ticket Booking ect.ect. Thn if thy Bcm hBbitual of the Using this type of apps nd Overall its Profit’ll increase bcz At thn time no Portion of any disc…

ThankS frndss,

‘nt Of CA…

HiTu..

So hitesh Bhai

How these companies send ordered objects to people

Hi Hitesh,

Its not possible for them to sustain for long period . Only Amazon & Ebay can sustain for long. Let me tell you why.

All these Indian players are sustaining on VC & Angel investment. These investors are asking for 5 times of of their invested money in a tenure of time and to pay their previous investor they approaches another investor. Lets take an example Suppose Marketplace ABC has a investor A who invested 1 Cr USD and asks for returning the 5x money of investment in next 3 years, then when 2.5 year completed marketplace ABC approaches another investor B for an amount 10 cr USD from this investment they will pay the A money which becom 5 cr USD and then commit investor B to pay his money 5 times of investment amount which means now you need to 50 cr USD to investor B, when 2.5 year reaches of investor B they tries to arrange funds are some other investors of Rs. 100 cr USD and commits the 5 times of investment money in next 3 years

So, you can see how they are increasing the money they have tp pay year by year.

Beside this losses, expenses needed to be covered also.

Possibilities of Payment : They can only repay when they will increase their commission 5 times of current commission structure means they will start charging 80% commission on selling amount to the sellers after some years , if they want to come in profit or survive.

Possibilities of money collection : All these are marketplaces, they don’t have their own margin or profit on products. Sellers are selling and no seller has a margin of 80% on their products. So either seller will stop selling or these platform will get closed like Subhiksha

Why Ebay, Amazon & shopclues can survive : Ebay & Amazon never increased on basis of the strategies & source of funding other marketplaces are using. Ebay & Amazon have their own funds to survive. Also they have many other services i.e. Magento, Amazon Web servers, Alexa which are the source of their earning for offering good discounts, and don’t have to repay 5 times of money what they have spent . Shopclues recently achieved its breakeven point , so now everything is their profit only.

Shopclues is also grown on investors fund, but this doesn’t guarantees success for other marketplaces that it will work for all the platforms. Shopclues created its value when only few marketplace websites exists so value of their idea is to much. But if now these platforms will take time to achieve their breakeven then it will tough for them to survive. Just like Subiksha

Days aren’t so far when there will no discounts from any of these giants. We’ll have to buy products on their actual retail price and then people would prefer to buy from some brick and mortar store.

why do you think that people would prefer to buy from some brick and store store.Do you think this is the end for new e-commerce sites.tomorrow may be someone will open a new website and start selling for low prices as these sites have done.I dont think so the offers may go down.if flipkart stops giving discounts then people will prefer ebay or amazon.If they will also remove discounts, then i will start a new e-commerce site and start selling at low to make my profit and finally flipkart will shutdown.And Flipkart doesn’t let this happen.

It is a business of selling business until greater fools are reached. I haven’t bought one thing in Amazon for couple of years. Btw- I go to nearby store every day or week. See how alibaba is losing now.

Pump and dump.

its amazing to see this data superb.

how these online business taking charge in the market and making profit .

If one can glans at the replies above most disagree, under the pretext that “Are they fool to run in losses”. But I personally feel yes they are. One need to remember this is a new business model. Spending funding he amounts such lavishly on discounts won’t survive much longer. Let me ask all the contributes will you buy from these site the discount goes down to bare minimum or nil. Every body will say yes, but these companies believe that the customers won’t go. I feel they don’t know Indian customer, he can safely tagged as value seeker. No sooner he finds that no value is available he will abandon these tracks. Therefore as commented in one of the article in ET last week “It may lead second dot com bubble 2.0”

(I had a small write up on Linked “Will online retail flourish in India?” with similar apprehension in Dec 2014. )

I wrote an article titling “Will online retail flourish in India?” with similar apprehension in Dec 2014. If one can glans at the replies above most disagree, under the pretext that “Are they fool to run in losses”. But I personally feel yes they are. One need to remember this is a new business model. Spending funding he amounts such lavishly on discounts won’t survive much longer. Let me ask all the contributes will you buy from these site the discount goes down to bare minimum or nil. Every body will say yes, but these companies believe that the customers won’t go. I feel they don’t know Indian customer, he can safely tagged as value seeker. No sooner he finds that no value is available he will abandon these tracks. Therefore as commented in one of the article in ET last week “It may lead second dot com bubble 2.0”

all of this is based on the fact that the customer acquired through loss making practices will stick around when discounts are gone.. don’t underestimate the intelligence of the common man.. the Indian common wo/man is extremely aware of value..extremely .. today online shopping is only done to get a discount..the lowest price…if that is not available online…we go look around..we shop around… its a bubble that is on the edge of anti-trust practices.. the hope is to sustain this burn rate for long enough to run traditional retail out of business.. then the customer will not have a choice..but to go online.. i have this eerie feeling that the bubble will burst…starting with flipkart as they are the company with the fastest burn rate in the recorded history of commerce.. its not a sustainable strategy..bait and switch might work in a western cultural environment..we are so tuned into “kitna deti hai” front he riches to the poorest that bait and switch just ends up with the customer saying “c**tiya samjha hai kya” ..rathe than the more western “i’ll take one”

I’m not sure whether this model will work in perpetuity even in the USA: Despite being around for nearly 20 years, ecommerce still accounts for less than 10% of retail sales; Amazon still sells at low prices. When it comes to India, ecommerce is aided by two factors unlike USA: High real estate costs and shabby CX in most brick-and-mortar stores. That said, the bubble, if there is one, may not burst for a long time: Despite making whopping losses quarter after quarter and not coming anywhere close to shutting down brick-and-mortar channel even after being around for almost 20 years, Amazon still enjoys a huge market cap.

Hello, everyone …

I need to compare Paytm , PayU , Mobikwick in terms of their Net revenue , Earnings multiple , profits, valuation .

Can anybody help me with this where to get the data from ???

[…] year, Amazon India lost approximately Rs 1 crore every day for their operations but it hasn’t deterred them from their focus. As per a recent filing with […]

would like understand in detail profit & loss of on e online line company

As per the official figures these online companies are earning more revenues rather they loose.these companies are selling products to customers vat free n excluding other charges. Hence the customer’s craze is increasing for online shopping.

Hey bro those graphs and nos. You have posted look fake since flipkart is leading

Get at least some of your facts right if not all….

Hello Friends,

It is very simple. What will you do if you will get paid 1000 rps for your investment of 50 rps each year for previous 10 years and it is in a such business with a very sound brand value, platform ect.

It is the use of a very normal customer mentality. Just give discount for such time of period, build the customer base than change your strategy to profit making by decreasing the discount value.

Most of people don’t know at how cheap price some of these companies purchase the goods and sell it to customers. They only bare the loss on a limited products like mobiles,laptops and this is only for a limited quantity. After that limits it will be all about the profits.

Say about Flipkart,

It is showing the loss in the sense of their investment in infrastructure development. They have their own inventory. They know their cost of purchase,expenses. It’s loss is for a certain period of time and in future time of e-commerce , it will be the only company which will make a good profit as they have everything in house.

In the other part snapdeal and amazon India are on their own strategy which can not be challenged. In a very simple term is it the two side of a coin that no one can see at a same time.

Flipkart FY14 revenue is around INR 300 Cr and the combined losses of all their firms amount to INR 700 Cr. Please check figures

FY14 revenue is INR 3000 Cr. Typo

That is GMV you dimwit. Know the difference between GMV and Revenue?

Very soon all e-commerce web portals based will face stiff competition from “INDIANS”……Wait n Watch.

Hello Friends,

Online business is more of building a customer base, building a brand and gaining reputation in its initial years which can be say of 10 years.

The more customer base you have, more would be your topline (gross revenues).

In order to create a customer base such sort of websites offer discounts to its customer which often leads to cash loss. These cash losses are funded by the venture capitalists who are investing in the company.

Question – Why are founders carrying on such business which is loss making?

Answer – The loss making process is only during initial years of business (which can be of 10 years) when the business is creating its customer base. At a point of time when the business owner believe that they have maximum market revenue share or they cannot increase their share now on wards, then they may stop giving cash discounts. Now the revenues would be generating cash profits and these cash profits can be sufficient enough to cover past losses of 10 years in just 2-3 years. Also the business would be availing tax benefits of off setting previous losses against present profits.

Question – What can be way of exit for venture capitalists who are investing in loss making companies?

Answer – There can be two way of exits for venture capitalists. First – They can exit in 2,3,5 years when they believe that Brand Value of the business has been created and it can be sold to make cash profits. Second way of exit can be via IPO (Initial Public Offering) which is often a very long term holding process but again very profitable. (Example – Alibaba)

This is the simplest way I can explain present retail e-commerce.

I am a practicing Chartered Accountant and I am also consulting to a couple of e-commerce web sites.

You can reach me on my email id : [email protected]

Hi

These losses are funded by Investors and these are back door entry of FDI.

How can a Company revive from an accumulated loss of close to Rs.800 crores.

The regulators are NOT blind to this and the model has the blessings of regulators.

Regards

The Net revenue which you have mentioned is I guess Gross Profit (Net Revenues – Cost of Goods). Losses which you have mentioned are actually building assests for flipkart, which in future can be sold for much more than the present value of losses. For Example, Flipkart has built warehouses, has developed its own logitics company e-kart and hence developed the logistics service business, it has its own selling arm WS Retail, It has purchased office space and buildings, the website of flipkart is in itself an assent worth 10s of Millions of $$. So yes there are losses but there are assets being created with these losses (Brand value, Real Estate, Warehouses, Million $ Webspace, Infrastructure and services) which can be sold in future to get back the profit.

All three of these companies won’t be there standing on top at the end. Someone is going to come out a sore loser with the reality of facing these losses. Only the strongest will survive to see the light of day to recover these losses as you state.

Very poorly written article..

These companies are happy with their losses as the funding comes through the FDI (we are hearing since past few months worth millions of dollars). Their main motive is horizontal integration to eradicate all sorts of competition and create a monopsony situation.

This will allow them to have a bargaining power in terms of prices and volumes (similar to the book industry in US, Amazon has a monopsony). Such companies very smartly declare themselves as “marketplace” and avoid the taxes in India and still control the prices and discounts.

BTW, Mcdonalds took more than a decade for their operations in India to breakeven!

who were the competitors of Mcdonalds in India ?

We’re conditioned to believe that any famous company must be “doing well”, which in turn means “making profit”. This article busts that popular notion. As for sustainability, well, hasn’t Amazon USA shown that it’s possible to still be a Wall Street darling despite making losses for a majority of its existence? Unlike traditional companies, new age companies are kept afloat with investor money, not profits. All bubbles eventually burst but, a huge amount of money is made by several people for several years until the inevitable burst happens once every decade or two.

[…] is a comparison revenues and losses incurred by top 3 ecommerce players in India. Flipkart, Amazon and Snapdeal. You will be amazed to see the […]

Where did you get these numbers ? They seem phony to me. Flipkart is at a revenue run rate of $2 billion… That is 12000 crore. So, the numbers here seem off by two orders of magnitude.

The figure of USD 2 Billion is the Gross Merchandise Value ( Total sales from their website ), whereas the above figure are Net profit ( All the e-commerce companies in India, charge commission fee from the sellers, as the sellers are being provided a platform to sell )….At the same time, since all these companies are not listed (Amazon is listed in USA, but it doesn’t provide countrywide data) , the numbers mentioned as net profit, might not be true unless the author of these article has access to the data filed with the regulatory authorities :)

Agree with you. A company with a net worth of US$ 12 Billion is showing loss of 400 Carors (Indian Rupee) in FY14. Numbers in the above presentation are fake. FY14 ended with a revenue of US$ 1 Billion. Flipkart is not at any loss till date.

Aww…how cute. Beta bolo – how much is 2+2?

This is Unbelievable and Untrue ! The fact is reverse. These online companies make HUGE profits and FAAAAAAAR outgrow brick & mortar companies. These companies BUY or GRAB other small online companies ….. or these companies are being purchased by other big companies….. this is just not possible, if they incur so much of losses. So dear friends. DO NOT BELIEVE THIS. Believe only your heart & soul, your feelings. CONTINUE YOUR ONLINE SHOPPING.

Chances of this article being correct are very high, as the companies in discussion are making huge investments in infrastructure and supporting the BIG discounts as well ( many products are being sold at loss ); also the valuation of these companies is going high because of the future potential earnings of these companies in the big & lucrative Indian market.

Hello readers,

In a very general way people feel Flipkart and Amazon are better online retailers. We can imagine that these figures would not be a yardstick to measure their future. Yes, the offers were good. They do not pay warehouse charges (normally), huge rents, huge property tax and other such costs. Let us see how they deal with the future.

Financially this is a loss to them, but by business means this is customer acquisition. As a leading e-commerce CEO recently said in an interview that, he says this as an opportunity to grab, and they are not looking at loss figures right now. Also he clearly mentioned, you look at profitability when you have less funding and then you have no way, but to look for profits, until that is the situation, the only idea is to invest in brand, technology & top minds from the country, ultimately to grab maximum customers. All above companies want to scale their business with best possible use of technology and profitability is soon going to follow. Lastly, Alibaba that started in 1999, posted it first EBIDTA profit in 2009, and that was around USD 5 billion then, which was more than what losses they made from 1999 to 2009, i.e. wiping all loss in just a year’s profit. This year their estimated profit is USD 8 billion.

Alibaba made profit in 2001 itself after just 3 years of business…

Which by the way even Flipkart did at initial years…

The point of this article is to point out unethical and illegal practices used by companies to kill competition, no one will object if they bring in operational efficiency and benefit consumers.

Do you also have data around GMV? IMHO whoever has lowest Rs lost per 1000 Rs earned in GMV can sustain in future.

Hi friends these figures r for the government only actual picture is very different, this are all to save tax n all. thay purchased good which are outdated, some time scrap of a company defected who’s costs are very low thay put heavy discounts on it this way both the party earns good profits and ultimate sufferer are the customer no doubt sometime we get good deals also which we won’t get anywhere.

Its my suggestion first check the warranty or guarantee which the online sites offer you its from company side or sealer side, check company is also offering same guarantee or warranty in regular market or local market

Giving too many discounts and offers is one of the several reasons why these companies are not making a positive impact on their bottom line…

Not necessary that these losses are going to continue. As start-ups they have to spend money on marketing and discounts are a way of just that. Its an investment in making people comfortable buying online. Later on, when discounts vanish, people will continue to spend a smaller share of their everyday and non-regular spending online and the companies would continue to make money with some profits.

The author should have also shared what amount of these losses are on account of running expenses, salaries and how much on account of discounts. That will bring more clarity on whether they stand to become profitable. And I am sure VCs have seen that.

All-in-all, make hay while the sun shine by lapping up your fav products at discounts (if you find them, that is). Its a period of freebies for another few months or maybe a couple of years. Post that, these will become regular shopping destinations for all of us.

Do you think they incurred loss without knowing? Do you think they incurred loss without making provision before starting the business? Even the VCs funded them,keeping in view the loss.The loss is to acquire the customers. Coke was not profitable for 15 years in India. They also knew it. It was not their mismanagement that made them incur loss. It is a calculated and estimated risk. So is the case with E commerce business. Soft drink manufacturers spend money on advertisement including paying high price for Celebrities like Sachin or Shah Rukh Khan or Katrina, giving free refrigerator,high incentives to trade and sales people,transportation cost. In case of E commerce also, they buy at high and sell at low price, and this is the cost of customer acquisition and the companies will bleed for a long time. They will keep getting funding,mergers will happen and ultimately they will depend less on big brands, make consumers to get used to their in house brands and earn high margin. Their skill in better sourcing at lower prices will get sharpened as the time goes. I am sure they will definitely do well. Amazon and Alibaba also suffered huge loss.

Snapdeal looks to be on the safer side in terms of losses with less sales figures though. It would be interesting to see how days these companies would pass on time with PE money.

I still can’t believe how these companies are bearing such huge loss. It seems, the frequent festive offers has made this to them.

And yes, these are not going to survive so long in India.

You don’t believe as you don’t have idea AT ALL. This is more of investment than loss and they are in state to carry on with such a huge investment as they have huge pool of investors which are making funding to them again n again. They are yet to come on a platform to make revenue and if you are aware Indian retail industry is the largest among all and contribute to 10% on India’s GDP and it is expected to grow 25% annually. So on this fact, converting these figures to a profit seems a smallest task ever to these firm. Smallest i say again

and the last line you said not going to survive made me laugh and will make others laugh too.

If you don’t have idea about something better read about it and then comment, instead of just commenting for the sake of commenting.

I strongly agree….they are not fools to make any loss making business….their business model is in the rationale of long term profits….