Update: We have been getting many calls and emails stating that “ATM usage for home bank is still free. However, various media reports suggest that it is capped at 5 for Metro cities. On the other hand, RBI circular is slightly confusing as well. We are trying to get confirmation on this – Please take this report with a pinch of salt till we get authentic clarification”

Earlier

The new RBI policy regarding ATM usages would be applicable effective November 1st, which effectively curtails free ATM usage.

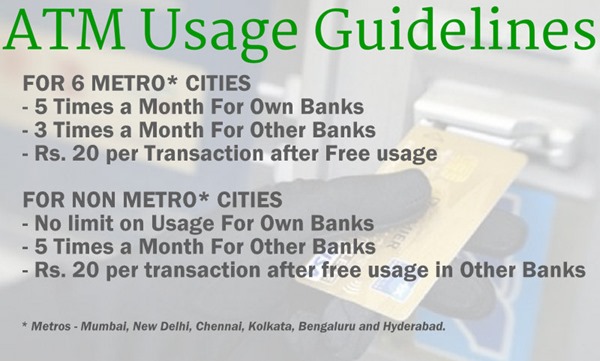

As per the new policy, which was released on Oct, 10th, users can use ATM from their bank only for 5 times a month, and ATMs of other banks for 3 times; beyond which Rs 20 per transaction would be charged for both cash withdrawals and other activities such as balance enquiry and mini-statement.

As of now, this policy will be application to bank account holders of 6 metros: Delhi, Mumbai, Chennai, Kolkata, Hyderabad and Bangalore.

This new policy was announced by RBI is August, when it issued the notification: “Taking into account the high density of ATMs, bank branches and alternate modes of payment available to customers, the number of mandatory free ATM transactions for savings bank account customers at other banks’ ATMs is reduced from the present 5 to 3 transactions per month (inclusive of both financial and non-financial transactions)”

We had speculated about such norms way back in January, which has now being officially implemented.

In places other than these metros, bank account holders can use ATMs of their own bank free of charge, meanwhile other bank’s ATM will have the 5 free transactions rule as before. But considering the ‘woes’ of Indian Banks’ Association, which had pleaded to RBI to curtail free ATM usage considering high expenditure in maintaining ATM infrastructure, this new guidelines will be imposed on other Indian cities by next year.

However, RBI has made clear that the rule of 3 free transactions for using other bank’s ATM is left to the specific banks, and they can alter this rule as per their internal policies. For example, in case a SBI customer maintains a deposit of Rs 1 lakh in his savings account, can use other bank’s ATM free of charge, unlimited number of times.

Another exception is that of Bank of Baroda, which has issued a statement that their customers won’t be charged for using their bank’s ATM (which is capped to 5 free transactions as per recent update). However, using other bank’s ATM is free till 3 transactions.

All the banks will put up notices in their ATM kiosks and branches to inform about their customized ATM policy.

Now, there remains some ambiguity in the overall policy.

For example, say a person uses some other’s bank’s ATM for 3 times in a metropolitan area, then visits a rural town, and then again use some other bank’s ATM. Will he be charged Rs 20, considering that he is from metropolitan area and has already used the free 3 ATM usages. But, the fourth usage in a rural area, where RBI has given 5 free ATM usages for other bank’s ATM.

Our Opinion

This is a flawed and anti-customer policy, which needs some serious debate. Banks do charge annual/monthly ATM maintenance fee, and this additional charges of using one’s own bank’s ATM beyond 5 usages is absurd to say the least. The additional charges should be borne by the both the banks – the one whose account holder uses the ATM and the one whose ATM is being used, and leave the customer alone from this debacle of sharing ATM usage costs.

We will keep you updated about this news, as more details come in.

Do share your views on this ATM usage policy, by commenting right here!

How many times withdrawal limit other ATM?

so does that means total of 8 transitions for metro city’s 5+3 = 8, or 5 total transactions?

Totally senseless and another money making scheme. After encouraging us to come less to the bank and use facilities via ATM, the RBI now comes up with this insensitive norms. Where do working class people like us after paying heavy taxes turn to? I understand a cap on using other ATM, but using your own card ATM and paying a penalty for it is ridiculous!!!

What are the options left for people who want to keep money in the bank and use it only when necessary through ATMs? Do we now go to the bank regularly or keep all the money in our homes and give way to more security issues??

Will India ever not wake up??? Absolutely disgusting and disrespectful!

This is just like any other consumer thing. Its like TV and Internet. In old time we had to give Rs150 to the cable guy for all the channels now we are almost 20 – 150 Rs/Per channel. Its the common tactic used by these people to “fist make people get so much used to it and so much addicted to it by giving it for free and than once they are under the spell charge them and force them so much that they will be ready to do anything and pay from their pockets to get our services.”

Bank pays only ~4% for our saving and charges 13% for loans! Still they are hungry, commen people must do something against it

Totally disrespectful policy introduced by RBI…. i dont think so maintaining of ATMs will cost this much amount..

I have a question in my mind.

If we are using ATM card to pay money either in shopping or restaurant etc by ATM CARD SWAPPING, then also Rs 20 will be deducted from our account if it crosses 5 times in a month.

Please clarify me.

That has nothing to do with ATM, so that case is not applicable here

“This is a flawed and anti-customer policy,” I fully agree.

It appears to me Govt. has no responsibility to the customer.

Many times “ATMs are out of order or cash NOT available in SBI ATMs in Bangalore. Todat I went to 4 ATM Machines and all of them out of order.

Is anybody responsible for the costumer’s inconveniences?

Gopinathan Krishnan is a Scientist by Profession.

ATM used of own bank should not chargeable and for the other bank can given limitation.

I don’t understand why RBI agreed to the demands of banks that the cost of maintaining the ATM’s are high ? If the banks can’t borne the maintenance then they should closed that ATM rather than asking customers to pay for it. They are already charging many fees and annaual charges what is that for ?

I think RBI is supporting banks for gaining something from them..

I have lost nearly 250 Rs as penalty charges from using other banks atm in the last 3 months.. I didn’t notice this until i read this article… thank God, I have stumbled here to save my money hereafter.

This is ridiculous it is very difficult to carry cash everywhere you go carrying and handling cash is not very safe. This destroys the purpose of plastic money. Withdrawal as when feasible was much better.

What a impractical decision, this hurts the service class… where will people like us go… who as it is die paying the taxes… What i poor decision.

This is the worst RBI has done for a common citizen. Please ask the banks to remain open for 24 hrs and 365 days round the year. Keep 15 – 20 counters open in each bank so that people can withdraw money at any time after they come from work exhausted.

appreciate, good question.Now a days banks are too smart bank employees don’t want to idle by increasing counters and extending to 24 hours but customers will wait in queue in counter as well as ATM center and also pay extra amount, after free transaction for fast service.why they are not charging atm usage fee if this is case then exclude ATM usage annual fees.

Acche din ane shuru ho gaye sirf bade logonke, common people ke to din bure din me badalne shuru ho gaye.

this is india doss . marne wale ko …. tadapa tadapa ke mar do.

First of all we should give “Nobel Award” in Finance for those who have designed and approved this.

let’s start going to banks to withdraw 100 rs daily….do this for a month and then the banks themselves will allow free transactions through ATMs

if bank/govt. can not maintain ATM then first stop deducting annual charges then remove ATM and increase employee at banks and let us feel that we are still in twentieth century instead of looking towards 21st century. i feel really ” Achchhe Din Aane Suru Ho Gaye Hain .”

Govt. has engorging the Saving happits on one side, On the other side “ Bank ATM transactions being charged is in a way signal for consumers to move back to withdraw entire money from Bank ”. That means Govt. has indirectly disgorging the people from savings. Early yearly, people would not go to banks to deposit the excess money. But now people deposit the excess money in the Savings Bank account and withdraw the money as and when needed through ATM.

“Prime Minister Narendra Modi on August 28Thursday launched his government’s mega scheme ‘ Pradhan Mantri Jan Dhan Yojana’, declaring that it was aimed at eradicating financial untouchability by providing bank accounts to the poor.

The Prime Minister illustrated his point through the example of a mother saving money and being forced to hide it somewhere within the house. He said the bank officials who have opened an account for such a mother today, would get blessings.

He said a breakthrough was required to overcome the vicious cycle of poverty and debt, and that breakthrough had been achieved today. He said there were similarities between the poor getting access to mobile telephones, and getting access to debit cards. They both had the effect of instilling confidence and pride among the poor, he added.

Now, the poor would be able to do normal bank transactions through non-smart phone as well because of introduction of new technology introduced by National Payments Corporation of India (NPCI).”

On Laving transactions charges for using ATM. How could Poor people use the ATM ????

This will defeat the Dream of the Prime Minister.

The policy is totally flop worst, why should i pay for transaction of our own account for the atm of the bank where i hold and account. This will also lead to a loss as people will withdraw more money at a time and The bank will not be able to use the money and also that people will stop deposting the money in bank as it is a risk that if i finish my 5 transactions it is blocked. Totally a flop policy. Ok reduce the number of transaction to 25 or 50 so that the number of transaction can be controlled and maintenance of ATM can be taken care off.

this is totally rubbish. This is just taking charges on transaction thru atm in the name of other bank.Totally a flop policy. Ok reduce the number of transaction to 25 or 50 so that the number of transaction can be controlled and maintenance of ATM can be taken care off.

welll …. It is totally acceptable that maintaining ATM incurs expenditure …. But the amount they have decided which is 20 is something that requires consideration… From free to 20… They could have kept the charges nominal, lets say 2 and 5 rupees that does not pinch the pocket of customers and serves the purpose … Bank and customers should share the load of expenditure and not bank juz dump off their entire load of expenditure on poor salaried customers.. They should remeber it is actuallythe money from we customer with which they r doing business of lending and and making money… It is highly disrespectful and oppressive of the bank .. As it is ordinar people are not getting interest on FD deppsit also …. It is shameful

Folks, is this policy applicable for ‘salary account’ as well?

This is the most absurd and anti-customer policy I have ever heard of, not to speak of discriminatory. As it is the bank levies a charge on debit cards. Why I should pay anything to withdraw my own money beats reason.

This is only going to raise the workload of the bank staff. Already today I was at the receiving end when I went to get a passbook updated. The clerk complained about the number of jobs I had when I went to him. What he does not realize is that the more money you put in their bank, the more work they are going to have , not to speak of holding a job. Add to that if I have to go to the bank every time I have to withdraw cash and face the wrath of the person at the counter, I don’t see why I need to keep my money with them at all.

Recently I have gone to a Bank ATM. The Bank ATM don’t have the cash . I have to go to the nearest Bank ATM to withdraw. I need more cash for urgent nature but the other bank ATM is limiting the cash withdrawal. Whose fault is not maintaining the cash in the ATM ? How this is going to be compensated . Further whether Bank has the right to tell not to come to the bank to with draw the cash across the counter and asking go to the ATM? Banks are giving only 4% interest . In this they are charging 1) No minimum charges 2) Yearly ATM card fees 3) SMS charges . Bank main function is to do business with our amount , earn profit and give interest and not doing this properly. RBI Governor has done a wrong thing and penalized the public . Further if an Metro residing people gone on tour , Say to Varanasi , Gaya etc and instead of carrying the cash , and if decided to withdrawa @ that place whether this will count in that Non bank ATM/Bank ATM of metro or non metro. Days are not far off that the RBI is going to penalise all account holders that all withdrawal /Deposit etc are to be charged . News papers are also silent and had the Congress Govt is there there will be hue and cry and some body might have gone to Hon court etc etc RBI also see whether all the areas are covered by all Banks ATMS , For example if one is having uco bank account and the bank is far off and no nearest other bank branch is there to open a account and the bank ATM is also far away but nearest say AXis bank opened a ATM what is the position

This is really ridiculous . why should i pay even my money i m taking from my account? RBI is always taking such shit decisions. if you stop to come for ATM obviously people will go for bank.. then your man power will increase. and after some days are you going to open a new branch because of customers crowd in the bank?? Really this is very sad..

I understand the cost of maintaining ATMs are little high and for which All banks are charging annual fee.., More over if this policy apply then there will be a big problem banks have to face in future, due to the charges all people will with draw the amount at one go which will lead to liquid Cash scarcity,, RBI has to re think on this…..,

The policy is totally wrong, why should i pay for transaction of our own account for the atm of the bank where i hold and account. This will also lead to a loss as people will withdraw more money at a time and The bank will not be able to use the money and also that people will stop deposting the money in bank as it is a risk that if i finish my 5 transactions it is blocked. Totally a flop policy.

Ok reduce the number of transaction to 25 or 50 so that the number of transaction can be controlled and maintenance of ATM can be taken care off.

its all about the more n more profit of banks & citizens are not able to understand their policy. I think people should closed their accounts for a period the bank’s shares will goes low within a few days then they will understand

the power of customers…

To all citizens try at once… definitely banks are change their policy…

First banks wanted people to move to ATMs so that workload on their staff reduces. Now with same Bank ATM transactions being charged is in a way signal for consumers to move back to withdraw money from Bank Branches.

RBI’s worst decision ever.Transactions from own banks should have been free.

Everyone is talking about ATM transaction but what about internet banking as ATM’s are involved in internet banking too.

Use “Debit card swipe” app on google play store. To get the ATM swipe count and maintain the summary of all transaction.

If goverment bnk going to charge for transaction in own bank mean the goverment bank users move to private bank. Then gov will goes loss only. Why should I pay for my transaction. For that only they are taking yearly fee for maintainace.

This is one of the wost idea in the bankig sector.

This is not good for banking sector. Why people should be limited to free usage of other banks atm whereas same bank atm is not available at all the location specially when people are travelling. This is just taking charges on transaction thru atm in the name of other bank. How other bank can remind that customers used other banks more than the limit provided. Why customers are going to pay for the network limitation of the bank. Why customers will be charged twice for the same service in the name of annual maintenance fees and service charge for other bank atm.

ATM er charge nile customar ra sabai bank e bhir karbe.

By issuing this notification RBI is helping the banks to earn more and more profit by puting different types of charges on account holders. This will create bad image of RBI in the eye of citizen of our country Bacause banks were alredy charging many charges from accounts holder andty were also earning huge profit by it. So the reason or on the base that the cost of maintaing ATM is high which said by RBI is totaly wrong. So as a citizen and account holder of any banks of our country we have to must rais our vois aganst this wrong policy to save our money.

I agree wit amit. This is really not a gud sign. Hum job kar rahe he ghar se door. Hum to cash bhej ni sakte ghar pe transfer karna parta he father k account pe. Aur atms itna bhir hota he k usna net slow chalta he. 3 ya 4 baar karne par transfer hote he. Kavi to ek din me hota hi ni he. To agar mere 3 baar karne k baad 20 20 rupee katne lag gaya to bhejne se jada mera paisa kat jaega. Isse acha to pehle ka jamana thik tha money order wala. Na hi paise katenge bus thora late pohche paisa.

not a good sign. can understand if people have to pay for transaction from other banks. but why should one pay to withdraw his hard earned money, when he needs from his own bank! if banks r not able to maintain such high network of atms then 1st step should be to slash down on no of atm machines rather than having people to bear the burden of maintaining them. r these ‘achhe din’?

I am also agree with Mr Amit, If the bank is not able to maintain the ATM’s let them close the entire ATM, and let the customers visit the branch for even Rs.100/- withdrawal…. like 1947-1990 years….

Let only people who is having sufficient time for going bank for each withdrawals retain the abnk accounts in banks.. let others withdraw the entire cash once the salary got credited and keep it in the houses.. But who will give the safety for the houses of a normal citizen..?????