High Salaried Indians Pay Much More Taxes Than Most In Developed Nations

When it comes to income tax in India, the salaried individuals, especially the ones who earn over 10 Lakh a year have to pay much higher taxes. Infact, the taxes are so high that they fork out some of the highest taxes in percentage terms.

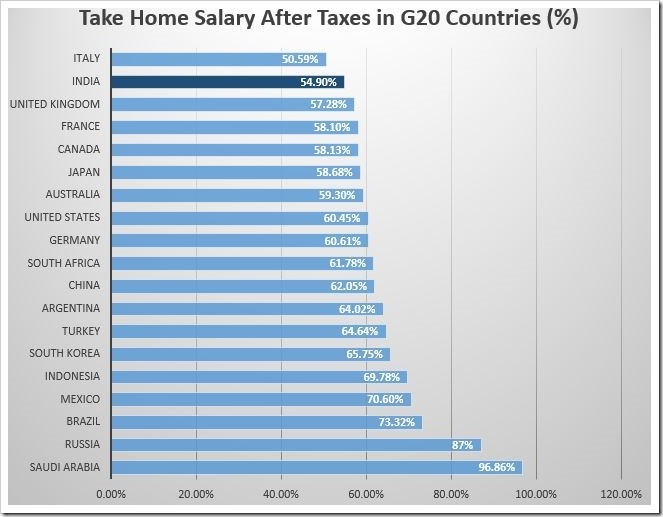

According to recently released survey by PricewaterhouseCoopers (PwC), the take home salary (net salary after income tax and other deductions) of an high salaried Indian is much lesser as compared to their peers in other countries like US, UK Canada, China and Russia.

Among all the G20 countries Italy is the only country where they pay higher taxes. After income tax and other deductions, Indians take only 54.90 percent of their salary home. Compare this to United States, where salaried Individuals take 60.45 percent, Chinese take home 62.05%, Mexicans take home 70.60 percent, Russians take 87%, while Saudi Arabians take a whopping 96.86% back home!

Check out this graphic for G20 countries that will give you a better idea.

Please keep in mind that these numbers are for people earning salary of $400,000 per annum or above. Obviously, this applies to only a fraction of Indian population. But it still goes to show that when it comes t taxes, the more you earn the higher you have to pay.

In India, the tax structure is extremely skewed – Nearly 97 percent of Indians do not pay any taxes at all. For e.g: Only 3.24 crore people paid taxes in FY 2011-2012 in country with 125+ crore people.

Even more surprising fact is that only 1.3 percent (about 4 Lakh) Indian tax-payers contribute to over 63 percent of all income tax collected!

There is no doubt that India needs serious Income Tax reforms, and Government has been trying to do that by implementing Direct Tax Code among other things. The tax structure definitely needs to more uniform rather than skewed.

Another important aspect is that Indian tax structure is extremely complicated compared to most other countries. This needs to simplified, so it is easier for people to file taxes.

Would love to hear your thoughts on this!

Arun, Perhaps you missed my sarcasm in the above :)

More over its only the salaried upper class getting crucified. Every one else, whether it be businessman or farmer or politician or any one whose income can not be established in black and white get the best of the both worlds. They hide the income so they can evade tax and at the same time cry that they belong to some group or set of people which is entitled for some kind of concession or subsidy or free alms.

Another two paisa :)

Excellent stat Arun. It makes me think.

May be the % takeaway salary has something to do with social equality. The more unequal the status, the more rich are taxed to support budgets for the more poor.

May be we should make the contrast between different countries should be a factor to express an index of social equality.

If you read the article in a single sentence – rich takes away only 55% of their hard earned salary and 97% Indians don’t have to pay any tax at all, doesn’t it sound like the perfect country to live in?

Just my two paisa :)

Altaf, I for one believe that this kind of structure (where rich are overtly taxed, and others are not taxed at all) brings about an environment where people are not encouraged to be competitive and give their best. What happens is they think even if I work hard and earn more money, I will have to pay much higher taxes, so my take home income will remain the same. It’s anti-competitive culture and bad for growth.

I’d rather like to see an environment, where Income tax goes away completely and taxes are applied to all uniformly. I do not mind giving sops to poor, so they are taken care of… But I do not agree with the concept that you make more money so you need to pay more taxes..just my 2 cents.

Yup…completely agree with you