Key things to look out for in your CIBIL TransUnion Score and Credit Report

In the earlier article we covered briefly about what CIBIL is and what is the importance of a Credit Score and CIR. If you have purchased your Credit score report recently, then this article is a good reference point as to what aspects of the report you should read closely and what they mean.

Contents

Check Your Credit Score

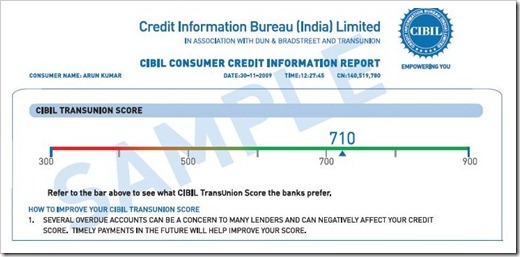

Basically your Credit Score indicates your Credit health. The CIBIL TransUnion score ranges from 300 – 900 and the higher the score it means more credit worthy you are. We had mentioned this earlier as well but it is crucial to understand what is the general credit score range to which credit institutions are lending to –

80% of the loans & credit cards have been given to individuals with a CIBIL TransUnion Score of above 750.

But you must remember that credit score is one of the factors in the loan eligibility process. Lenders also look at your income, other financial commitment, your demographics and your Credit Information Report (CIR) in detail before approving the loan.

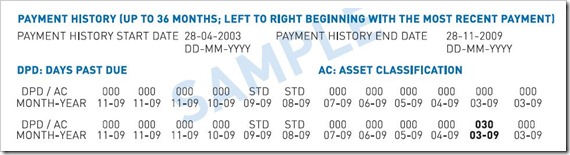

Check Your payment history (Days Past Due-DPD) on loan or credit card

The DPD indicates how many days a payment on that account (be it an EMI payment or a credit card bill) is late that month. Anything other than “000” or “STD” is considered negative by the lender. We have listed below the types of asset classification that can appear in the DPD section:

|

DPD |

Denotes |

Explanation |

|

STD |

Standard |

Payments are being made within 90 days |

|

SMA |

Special Mention Account |

Special account created for reporting standard account, moving towards Sub-Standard |

|

SUB |

Sub-Standard |

Payments are being made after 90 days |

|

DBT |

Doubtful |

The account has remained a Sub-Standard account for a period of 12 months |

|

LSS |

Loss |

An account where loss has been identified and remains uncollectible |

Note: On occasion you may also notice “XXX” reported for your DPD on a certain account which implies that information for these months has not been reported to CIBIL by the Banks.

If there is a number in the DPD column, then it means that the payment is late by that many days. So for example if it is 050, then it means the payment is late by 50 days.

If it is 000 then it means the payment is as per the due date, so there is no deviation or late payment. So it is wise to pay your dues on time to have a clean DPD history.

Check your Account details

This contains details such as the lenders name, account number, account type (is it a credit card, personal loan etc), ownership (single/joint/guarantor), date the account was opened/closed and the last date when these details were reported to CIBIL.

What to look out for is if there are any details reflecting in the account that is not factually correct or have never been applied for. If you find any inaccuracy, just visit our website, click on disputes and initiate the dispute resolution process

Check what is the status of the account

The status of the account is mentioned in the Account Information section. A written off/settled/suit filed cases are not looked upon favorably by the lender. It is always advisable where possible to have a clean account status.

It is very important to understand the “Settled” and “Written off” terminology.

Settled means where there is partial payment (in consent with the lender) done against the total outstanding. Once this is done that means there is no outstanding against your name by that lender. You will notice your amount over due and current balance would have changed to zero.

When you are not able to make payments against the outstanding loan/credit card amount for more than 180 days, the lender is required to “write-off” the amount in question. The lender then proceeds to report this on your CIR.

Check dates

Look out for the last payment date and last reported date. If you are worried your last payment is not reflecting, then check the last reported date. If the payment has happened after that date, then it can take up to 45 days for the same to be updated with CIBIL. This part of the section lets you check the recency of your payment/open-close dates.

Check enquiries

An enquiry means that a credit institution has enquired or requested your credit details from CIBIL. Too many enquiries in a short span can make you seem very “credit hungry” and the lender views your application with caution.

But if you purchase your own CIBIL TransUnion Score (and CIR) it would not reflect in the enquiry section and will not impact your credit score.

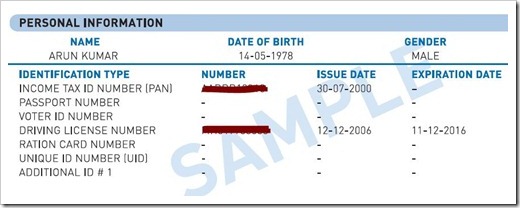

Check your personal details

Go through the personal details such as name, pan card mentioned in your Credit Report. This is important so as to ensure only your details are mentioned in the report.

If you want further details, check out this detailed CIBIL FAQ pdf.

[This guest post has been compiled by the team at CIBIL Consumer Relations]

hello all, can you please guide me on calculating cibil score? Actually I shall have to implement it to a website, But I cannot get any available formula in which i can calculate it. its a very urgent requirement for me. please help me. Thank You.

What does cibil score 00809 imply ?

Credit Card Default – know how credit card debt default affects your credit health, find out the consequences of credit card and loan default. Get assistance on credit default from Indian Credit Advisors. Visit http://www.creditsudhaar.com

02226788717

9773613543