In 2007, Nokia was the undisputed champion and the biggest brand in the mobile phone industry but it is no longer a heavy weight. Nokia which was valued at $150 Billion in 2008 but has now slipped to an overall valuation of only $6 Billion. The company is currently in a bad state and they are losing money every quarter. During the earnings call last week, Nokia posted an operating loss of $1 Billion for the last Q2, 2012.

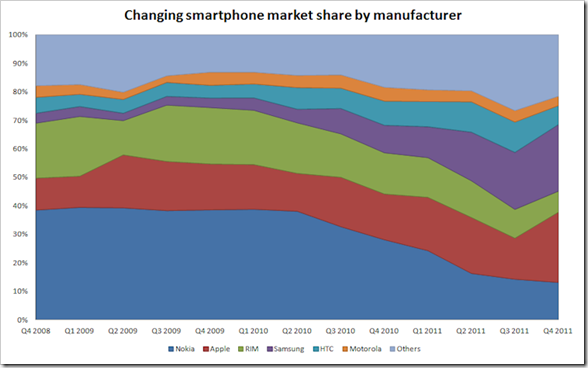

Nokia’s downfall can be linked to the entry of Apple and Google in the smartphone industry with their iOS and Android operating systems. When Apple released the first model of iPhone in 2007, it lacked many important features but on the other hand it also came up with some revolutionary solutions such as capacitive touchscreen, pinch-to-zoom function and the use of accelerometer for the screen orientation.

Just 2 years later, Google came up with their own so called ‘open source’ operating system; Android which, is now the biggest smartphone platform within just 3 years of its entry. Both Apple and Google combined have captured almost complete global smartphone market share.

Things may seem to be going from bad to worse for the fins, but there is a slight silver lining in the cloud. Nokia dominates the multi sim market in key markets such as India and its sales of Nokia Lumia range of smartphones have been promising. As the price of Nokia mobiles start falling and Nokia attempts to appeal to broader spectrum of consumers across different countries, one can’t help but wonder Can Nokia bounce back to compete with Apple and Google?

Contents

Dual Sim domination and the hope of Windows 8

On a brighter note, Nokia is selling a lot of entry level phones in South-Asian and African countries. These sales are largely contributed by Dual-SIM phones, Asha series phones and other phones based on Series 40 OS.

But the problem with these phones is, there is very less average profit per device. On the other hand, Apple earns $575 of profit per iPhone sold and acquires almost 2/3rd of the whole smartphone industry profits.

Nokia currently holds a market share of 30% in India; the case is similar in most other developing markets. Nokia is currently holding the onslaught of Samsung in these markets largely with the help of their Dual Sim Asha series phones.

After joining hands with Microsoft, Nokia released some good smartphones based on the Windows Phone platform. These devices are good, but they are not better than the competition in any way. That is solely because; there were many limitations in the OS itself which ties the device to get any better than devices on competition platforms.

Microsoft displayed their much awaited Windows Phone 8 platform codenamed ‘Apollo’ and from the looks of it, it seems to be a pretty solid update. They have taken a 2-step jump in the hardware with A15 architecture based multi-core processors, HD Retina Displays and a completely new kernel.

It is being reported that Nokia is bullish on the success of upcoming Windows Phone 8 and it is trying to get some exclusive carrier partners in Europe.

The Android Fall Back

Before joining hands with Microsoft as their exclusive high-end smartphone platform, Nokia considered Android and had some discussions with Google.

Nokia had to scrap the plan because they did not want to compete in a platform that ‘already has too many players’. But if nothing works out as planned with Microsoft, Android can still be a viable option. This was voiced aloud in a Finnish television interview by a member of the Board of directors.

If Nokia goes ahead with Android, they will have to try and beat Samsung and HTC which are the only brands doing some innovation for that platform. Samsung and HTC already dominate the Android market but it is not impossible to beat the titans.

Nokia maybe better equipped to take on the challenge of competing with Samsung on the Android platform, but with waning market shares and falling brand loyalty, Nokia may find itself hard pressed to put up a good fight.

Android for now remains just a fall back plan, one that Nokia may not need should Windows8 prove successful. If Nokia does however join the Android brigade, it maybe curtains to all the other mobile operating systems including Windows and Bada and the Meego revival.

Mozilla’s Open Source Firefox OS Can Be a Viable Option Too!

Mozilla, the company behind one of the best and popular Firefox web browser, is prepping up an open source smartphone platform completely based on web technologies such as HTML5 and JavaScript.

Mozilla displayed the Firefox OS codenamed ‘Boot2Gecko‘ on a Samsung Galaxy S2 sample. Nokia might consider it as an alternative choice to Windows Phone as it is built upon open web standards and the platform is ‘too crowded’ as Nokia desires. For Nokia however, this decision would prove their earlier decision to abandon Meego futile. It would probably be a last resort attempt to avoid Android and maintain exclusivity.

For now however, Mozilla’s Operating System may be nothing more than a minor alternative in the long list of mobile OSes.

Can Nokia Bounce Back?

For Nokia the journey from the top of the smartphone market to being just another player has been rather sudden and unexpected. But there was one surprising line of silver light, they sold more than 6 million Lumia devices and their popularity in the US has increased dramatically during the last quarter.

The Nokia Lumia 900 has been one of the best seller smartphone due to good design and LTE connectivity, all at cheap price of $99 which was further slashed to $49. Windows 8 as well as the rise in dual sim mobile sales can help Nokia fight their way back to the top of the smartphone heap, if not beat Samsung, they can surely work their way to become the second leading smartphone vendor in the world. Should Windows fail however, Nokia can still consider other smartphone platforms like Android, Tizen and Mozilla Firefox OS.

It may take a while to see how things pan out, however one thing is certain, the world has seen great comebacks, it may not be impossible to see another one in the offing.

[About the Author: Ashwin Sreekumar heads Marketing at MySmartprice and is an MS graduate from State University of New York, University at Buffalo. He has avid interest in eCommerce, marketing , technology and smartphones.]

Interesting article, but it’s spelled Finns. F I N N S. With a capital ‘F’. We aren’t fish.

Despite a drop in market share, Nokia continued to be the worldwide leader in mobile device sales as it accounted for 23.9 percent of global sales. The second quarter of 2011 was the low point for Nokia, and the third quarter brought signs of improvement. Dual-SIM phones in particular, and feature phones generally, maintained Nokia's momentum in emerging markets. Heavy marketing from both Nokia and Microsoft to push the new Lumia devices should bring more improvement in the fourth quarter of 2011. However, a true turnaround won't take place until the second half of 2012. Nokia was no.1 for long time…we'll wait and watch it's further strategy…although today the market is full of android and iphone which has lots of applications which can easily attract you towards them…apps market consist of fun n gaming apps to attract youth, lot of utility apps for covering variety of target segment.for example sopping n reward apps known as mintm…

http://www.mintmapp.com

Despite a drop in market share, Nokia continued to be the worldwide leader in mobile device sales as it accounted for 23.9 percent of global sales. The second quarter of 2011 was the low point for Nokia, and the third quarter brought signs of improvement. Dual-SIM phones in particular, and feature phones generally, maintained Nokia’s momentum in emerging markets. Heavy marketing from both Nokia and Microsoft to push the new Lumia devices should bring more improvement in the fourth quarter of 2011. However, a true turnaround won’t take place until the second half of 2012. Nokia was no.1 for long time…we’ll wait and watch it’s further strategy…although today the market is full of android and iphone which has lots of applications which can easily attract you towards them…apps market consist of fun n gaming apps to attract youth, lot of utility apps for covering variety of target segment .

for example sopping n reward apps known as mintm…

Well I don’t know if anybody knows it or not but Nokia has announced that they have partnered with Vodafone India and Airtel and Reliance to offer integrated billing solutions on the Nokia Store in India. This would let users download apps from the Nokia Store and pay for their downloads as part of their monthly mobile phone bills or have the amount deducted from the pre-paid balance.

This would surely increase the earning potential of the paid apps that developers submit.

I thinks when the market is full of smart phone makers and people are not getting the name of the Nokia in delivering value worth investing then no way the company can enter and achieve it’s previous position where the Apple and Samsung fighting to become the champion of the global market.

Hi Ashwin,

Good points. Here’s my perspective on this topic:

You presented some interesting scenarios and compelling argument for Nokia’s turnaround. But, I’m afraid there exist many complicated product development, business dynamics, strategic and ecosystem development issues that might play spoilsport.

You used only two critical dimensions (devices and OS). The third key dimension, which would lend significantly to the growth/success of the smartphone ecosystem is the “App Ecosystem”. Now, only iOS & Android have successful app ecosystems (with Blackberry enjoying moderate success from developer economics, but not necessarily from consumer point of view).

Having said that, if I have to summarize the key developments in Nokia’s Smartphone story, they would be:

1) Nokia launched Ovi store in June 2007, a whole year before iTunes app store (and even a month ahead of the first iPhone launch). Great strategy, poor execution… and a well documented case study

2) Nokia’s Symbian OS was getting overburdened and slow for increasingly demanding features, apps and hardware innovations in the smartphone space, so the company realizes it needs a completely new OS for its future smartphones

3) Partners with Intel in early 2010 to start working on Meego and Qt SDK (a cross-platform application and UI framework), the beta versions of which the app developers love and couldn’t wait for Meego devices to be launched

4) “Burning Platform” memo on Feb 10th, 2011… Ditches Meego (close to its launch), talks about ramping down Symbian and adopting Windows Phone (with the first device about 3 quarters away)

***In my mind, Nokia should’ve continued with Meego (which was so close to launch and had ample support of developer community) or actually should’ve seriously considered adopting Web OS by Palm (which again the developers totally loved… that OS died (well, went to HP and died) because Palm was not a hardware specialist and couldn’t upgrade it’s ‘Pre’ fast enough… and, guess at that point who was the world’s mobile device hardware master and who had the best supply chain economics in the world?!?)… Anyway, that’s a whole another “What If??”***

5) Microsoft had mandated hardware specifications (such as 1GHz+ processor, 512MB RAM, 3.7″+ capacitive touch-screen, etc) for OEMs to develop devices on Windows Phone 7.x… and, these hardware specs meant that WinPho devices were going to be pretty costly… making them unaffordable for Nokia’s strong emerging markets (such as China, India, etc)

*** MS eventually launched WinPho 7.6 (which the product marketers call the ‘cost reduced’ version of the platform) with reduced hardware specs to enable bringing down the device costs. Lumia 610 is based on WinPho 7.6… but, I reckon it’s still costly – It is $100 costlier than the widely popular, similar spec’d Samsung Galaxy Y, which runs Android***

6) And, guess what?? WinPho 7.x had virtually non-existent app ecosystem because MS didn’t provide migration path for devices and developers from WinMo 5.x & 6.x to WinPho 7.x… and it’s share also decreased rapidly…

7) Another issue was that as soon as MS & Nokia formed a preferential alliance, other OEMs such as Samsung & HTC who had started working on WinPho 7.x devices had reduced focus from that platform… that meant the onus was primarily on Nokia to populate the world with enough number of WinPho based devices… thus making the OS attractive for the developers

8) While Nokia was busy developing Windows based phones, it’s Symbian devices sales started declining rapidly… hence, adversely affecting its overall smartphone share

***It is a known fact that adopting any new platform, especially a smartphone OS is a 15 to 18 month product development cycle (remember Meego development starting in Q1 2010 and N9 launch in Q3 2011??). Most companies work in the background, and announce their platform change strategy pretty close to the new product launch… this reduces the dip in sales between platform transition. And, “Burning Platform” memo was a strategic disaster (which Stephen Elop himself agreed to during the Q1 2012 earnings call)***

9) The launch of Windows based Lumias could not offset the decline in Symbian based devices

10) So, in retail markets such as India, where Nokia had significant brand equity, its Lumias were costly (and catering to only very high-end consumers) and in developed European markets, the carriers (the long-term Nokia customers, who buy their devices in bulk) were shying away from Lumias because of MS acquisition (and eventual integration) of Skype, which was considered a threat to carriers’ bread & butter – Voice services. So, carriers started boycotting WinPho based Lumias (again as confirmed by Stephen Elop during the Q1 2012 Earnings Analyst Call)

***And in parallel, the Android ecosystem and Samsung were growing rapidly (apart from iPhones & Apple) and the retail consumers and carriers around the world had options of these devices***

11) Another disadvantage for Nokia was that it was not a big brand in the US market… and, one needed to be big in US to be a significant smartphone player (which was exactly what Nokia tried to mend through its Lumia 900 exclusive launch with AT&T)

12) Also, each of the first three Lumia devices at the time of launch had product glitches – Lumia 800 had battery life issue, 710 had memory leak problems and 900 had memory leak issues which was affecting the web-browsing experience over Wi-Fi (and, Walt Mossberg of AllThingsD facing and documenting this issue certainly didn’t help)… clearly, an indication of pressure on engineering teams to launch soon

13) MS somehow managed to coax & cajole the app developers and got the Windows Market Place app numbers to cross 100K… but, it seems a little late… And, here comes the biggest hurdle of them all – Windows 8

This is the story so far. And, you rightly pointed out that Nokia has the options of Firefox OS (recently rechristened Boot2Gecko, with some reportedly amazing web based app development framework), Android and revival of Meego (Tizen currently looks more like a Samsung and Intel only play) outside of Windows. But, again except for Android none of the other platforms have established app ecosystems which would make your devices instantly attractive to customers. And, we don’t know if Nokia is working on any of the platforms in the background (I hope they do not repeat the Feb 2011 blunder of announcing it prematurely again!!).

In the meanwhile, MS has announced Windows 8 for Q4, 2012 launch… and, get this – No Migration Path… AGAIN!! Not for the current WinPho 7.x devices nor for 100K+ WinPho based apps. It might have one of the best SDKs, but which developer would be willing to re-develop his existing app on to a new platform (from the same company), instead of just migrating it?!? And, more importantly, this is expected to adversely affect the current Nokia Lumia sales in Q3 & Q4 as they would not be upgradable to Windows 8 (only to WinPho 7.8).

So, from a Nokia Product Marketer’s point of view, the question (and hopefully, the answer to it) is simple – “My current OS is undergoing a complete revamp, there exist a couple of new and promising OSs, there’s a popular one and there’s an in-house developed one… and except for the popular guy, the app ecosystem needs to be created from the scratch for all others (including my current choice), so I might as well pick and choose the right one and place the bets on a clean slate”… And, I wish it were that simple!! If only Product guys were empowered to make strategic decisions ;).

The quandary for Nokia is that MS has been “financially assisting” Nokia at the rate of $ 250 million per quarter (as confirmed in Q1, 2012 call)… and, as Stephen Elop mentioned in the analyst call last month, MS is closely working with Nokia on its product strategy. So, ditching Win 8 is ruled out (also, reportedly Nokia is expected to announce two Win 8 devices on Sep 5th)… so, ‘other platforms’ strategy in all probability could be ruled out.

So, this is where Nokia currently stands – There exist a number of permutation and combinations, but unfortunately, any direction it might want to turn (for potential comeback), there exist multiple limitations and hurdles. It is not for naught that the financial analysts have written down its stock… and say that the company’s current valuation is for its patents and not for its devices (or networks) business (and, the company seems to realize this… in the first half this year, Nokia filed more patents than it did in the same period in the previous 13 years).

I would love to see Nokia turnaround (for many reasons) and if it does, it’ll be one of the biggest turnarounds in the history, along with Apple… and, guess who both the companies would be thankful to?? Microsoft!! :)

Jayanth – Very well documented points, apart from what Ashwin mentioned in the article and I complete second your opinion on App Ecosystem..

Infact, I think “App Ecosystem” will increasingly play an important role going forth. Microsoft’s OS is probably superior (debatable) but like you mentioned they have near non-existent Apps…

I have seen many surveys that show that “App Ecosystem” is probably one of the top 2 reasons on basis of which consumers choose to buy a smartphone.

For Nokia to come up it just not have to get its strategy right – But it needs tremendous support from Developer ecosystem to succeed.

Their strategy might be on the spot when it comes to hardware / software, but without devs on their side, they cannot do anything, which is probably the toughest challenge in front of Nokia. The same goes for MS phones as well…

Blown away by your observations here. Indeed hardware manufacturers such as Nokia and HTC should start considering the OS and ecosystem in their scenario planning as well. The SDK of WIndows 8 seems great and it immediately adds to the developer community the entire population of Windows PC developers( atleast that was promised in the keynote of Windows 8 launch).

Migration is indeed a critical issue but perhaps applications can be given some sort of compatibility. Windows 8 Phone and Windows 8 PC promise to integrate the entire personal computing experience.. i guess what Microsoft is hoping to do is woo existing developers to perhaps redevelop if not for the meager Windows Phone users atleast for the large population of Microsoft PC users.

Nokia’s case will be looked often as one of short sight and rather hasty decision. But should Windows 8 work to their advantage, people may ignore the whole Meego fiasco and the 1 year Lumia debacle.

Lack of number of device models and installed base on Win 8 (in 2013) would be an issue to entice the app developer community… and, this when the competing iOS & Android ecosystems would already have 3 to 5 headstart… The earliest signs of Win 8 success (considering everything is going to be bang-on from the word Go!) would only be visible in Q2/Q3 2014.

The success of Win 8 for Nokia is at least 18 to 24 month cycle starting Q4, 2012 (from the launch of the first Win 8 device), in terms of sufficient number of device models being launched and they contributing to significant sales. Until then, the company somehow needs to sustain the cash flow, shareholder interest, retail consumers and carrier customers interest and its brand equity…

Probably, the board should consider bringing back Jorma Ollila & Kai Oistamo, the original Nokia boys… at least, that could get back some shareholder & carriers’ confidence… bringing back Steve Jobs worked for Apple in 1997. Nokia could probably use some guys with requisite passion and emotional connect with the company at the top :)

Good article, amazing scenarios and is a good way to demonstrate scenario planning. Nokia bounce back is possible but not probable…