In March of 2009, global equity markets bottomed out and the once near – Armageddon status of the global economy began its very slow upward march toward full recovery. Today, over 3 years later, the global economy is still on that upward march toward a full recovery, and we still have not arrived fully.

The European Debt Crisis has roiled financial markets and resulted in a much slower economic recovery than leading economists and analysts predicted. Rising bond yields in peripheral European nations have made it nearly impossible for fragile governments such as Greece, Italy, Ireland, and Spain to access private debt markets in order to raise capital for fiscal operations.

This entire European fiasco has continued to weigh on the economic recovery not only in Europe, but also in the United States, South America, and Asia. As the global economy continues to remain under macro pressure, emerging economies such as India, China, and Brazil have been hit especially hard.

Contents

Emerging Economy Economics

During times of global risk appetite, investors seek yield. They need to produce alpha for their clients, and alpha is not capture by passively tracking the S&P or Treasury Securities. Therefore, many hedge fund managers will seek to put capital to work in emerging markets due to the aggressive returns that are possible.

Hence, countries such as India tend to perform very well during bouts of risk appetite as foreign direct investment flows strongly into the country, which creates more jobs and stimulates further economic growth.

However, this scenario also works in reverse course. The global economy has not always moved up at a nice 45 degree angle over the last few years. During times of economic uncertainty, investors tend to pull capital from emerging markets, such as India, and they, in turn, place that capital in safe-haven investments such as the U.S. dollar and Japanese yen.

Double Negative

Throughout 2012, the Indian economy has been hit especially hard by slow economic growth and high inflation. This double negative is a recipe for disaster in the currency world. Traditionally, investors tend to place capital into higher yielding currencies. In other words, the rupee is a great investment during times of risk appetite because of the high yield attached to the Indian rupee.

When a country’s economic growth heats up too fast, inflation will set in. When inflation sets in, a country’s central bank will typically lower the short-term interest rate target in order to constrict the flow of credit and, as a result, slow economic growth and soften inflationary concerns. Now, when a central bank lowers its short-term interest rate target, investors will tend to sell that currency as the interest rate becomes less attractive for investment.

Rupee Near All-Time Lows

India is currently facing a difficult economic reality as both economic growth are slowing and inflation is rising. This puts India in a tough situation. It can’t raise interest rates to stimulate economic growth if inflation is high because then it risks possible hyperinflation.

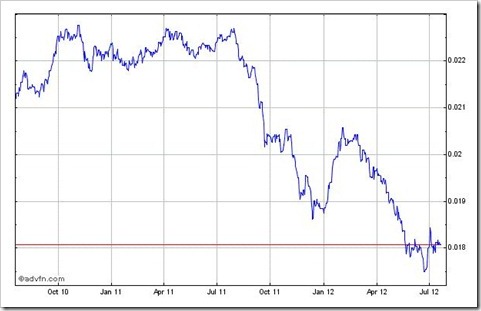

Rupee Vs Dollar [2 Year Chart]

This combination of economic factors, along with fiscal policies that are not exactly encouraging wide-scale foreign direct investment, have caused investors to direct enormous capital reserves out of the Indian rupee and into safe-haven currency holdings, such as the U.S. dollar.

In fact, the rupee is currently trading near its all-time lows versus the U.S. dollars as investors wait for signs of recovery in Europe.

Although the rupee is currently very weak in 2012, it will rebound. When Europe finally stabilizes, and the U.S. economy continues to improve, capital will return to India and the rupee will aggressively rebound.

The billion dollar question, of course, is how much longer will that take?

[This Guest post is written by Sara Mackey of ForexFraud.com]

The FDI Approval for Aviation & Retail seems to have given a huge boost to the Rupee with the rupee having appreciated sharply in the last week

Strength in business and economics to be continued!

Good article to study and very informative about INR vs USD which make INR value still lower due to different global economic conditions.