Pay your Maharashtra Govt dues Online [Duties, taxes, excise, etc]

The Maharashtra government is going full throttle the online way.

While online VAT payment is mandatory since more than a year now, the state government has moved a step forward to ensure that all types of tolls, taxes and statutory fines are paid online to plug loopholes in the system.

In latest, the Government of Maharashtra has launched an electronic portal – Government Receipt Accounting System (GRAS) – to receive online payments in addition to the conventional modes of payment. Thus, government departments offering e-payment facility include Foods and Drugs Administration, Excise, Directorate of Accounts and Treasuries, Transport, etc.

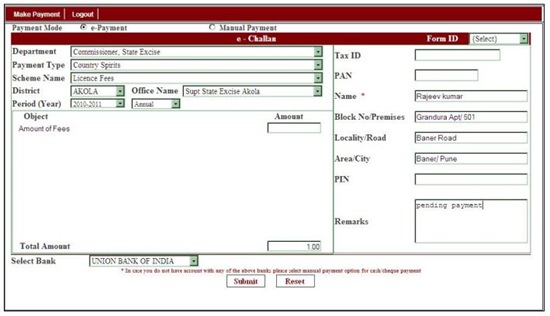

GRAS Challan

Citizens can now pay their taxes online from the selected banks through the internet portal without going through the hassles of meeting government employees personally. What’s more, this is a 24×7 facility available round the clock to the tax-payers.

Furthermore, the GRAS site guides you to a single challan online form that allows you to make instant online payment for your personal taxes as well as behalf of the firm you work for.

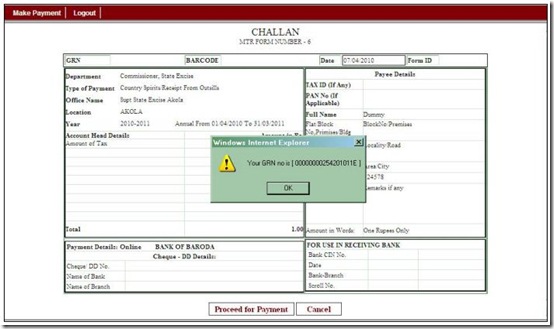

In fact, the best part of this online portal is that it allows you to make e-payment even without registration of any kind, based on generation of a key 16-digit government reference number (GRN) to uniquely identify the payment to be made by the user.

16-digit GRN Number Generation

All one needs is an internet connection, minimum knowledge of using browser for e-payment, and, of course, an internet enabled banking account for making online payment. However, the portal also provides facility to make manual payment, either by cheque or cash, at any treasury.

List of Banks in GRAS tie-up for net banking payment:

- State Bank of India

- State Bank of Hyderabad

- Union Bank of India

- Punjab National Bank

- Bank of Baroda

- Bank of India

- Indian Overseas Bank

- IDBI Bank

Disappointedly, none of the private sector banks have a tie-up with the GRAS portal, which could be a huge road block for the Maharashtra government to promote online payment gateway for collecting tolls and taxes. Hopefully, the state government pulls up its socks to include at least leading private sector banks in the scheme of the things, if not smaller ones.

What say?

Its very good information please tell us how to pay stamp duty for partnership firm.

I own N.A. Land in District Pune of Maharashtra State. Can I pay its N.A.. Tax On_Line? If so please give me the relevant information for the same.

Thanking You in anticipation.

Yours

C. M. Soman.