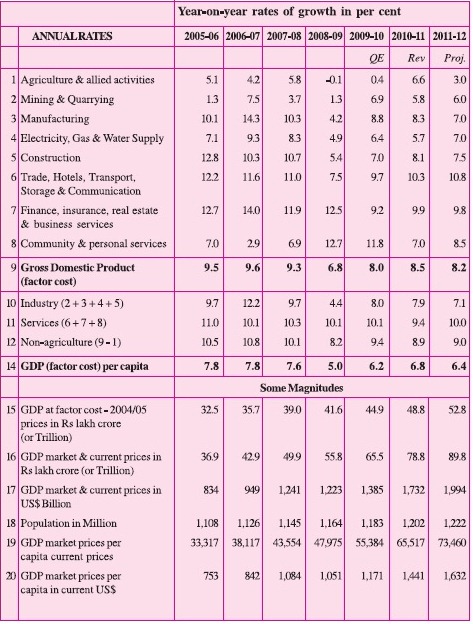

Government of India today released its much awaited Economic Outlook for 2011-12 that pegs the India’s GDP growth rate for 2011-12 at 8.2% as compared to 8.5% registered last year. Given the current adverse global circumstances and high Inflation to boot, expected growth rate of 8.2% looks quite good!

Important highlights of Economic Outlook 2011-12

- Agriculture grew at 6.6% in 2010-11. This year’s monsoon is projected to be in the range of 90 to 96 per cent, based on which Agriculture sector is pegged to grow at 3.0% in 2011-12!

- Industry grew at 7.9% in 2010-11. Projected to grow at 7.1% in 2011-12

- Services grew at 9.4% in 2009-10. Projected to grow at 10.0% in 2011-12

- Investment rate projected at 36.4% in 2010-11 and 36.7% in 2011-12

- Domestic savings rate as ratio of GDP projected at 33.8% in 2010-11 & 34.0% in 2011-12

- Current Account deficit is $44.3 billion (2.6% of GDP) in 2010-11 and projected at $54.0 billion (2.7% of GDP) in 2011-12

- Merchandise trade deficit is $ 130.5 billion or 7.59% of the GDP in 2010-11 and projected at $154.0 billion or 7.7% of GDP in 2011-12

- Invisibles trade surplus is $ 86.2 billion or 5.0% of the GDP in 2010-11 and projected at $100.0 billion or 5.0% in 2011-12

- Capital flows at $61.9 billion in 2010-11 and projected at $72.0 billion in 2011-12

- FDI inflows projected at $35 billion in 2011/12 against the level of $23.4 billion in 2010-11

- FII inflows projected to be $14 billion which is less than half that of the last year i.e $30.3 billion

- Accretion to reserves was $15.2 billion in 2010-11. Projected at $18.0 billion in 2011-12

- Inflation rate would continue to be at 9 per cent in the month of July-October 2011. There will be some relief starting from November and will decline to 6.5% in March 2012.

GDP Growth – Actual & Projected

Check out the full Detailed pdf on Indian Economic Outlook 2011-12

[…] RBI has downwardly revised GDP growth projections for fiscal 2011-12 to 7.6% on account of slackened investment demand, stalled project execution, […]

gdp is ok…. but what about inflation?

controi the inflation and give some specific boost to agriculture sector and industerial sector to increase the gdp

nice growth in 2011

r v anywhere close to China?

india need to come 1 st position…

india needs more.

this is ashok.

india now growing……….but today American economy create a problem front of india.but according to finance expert says that india develop a stromg economy with in 2-4 months.

India is a two speed economy, Those who go out and make a good living and those who blame god for their problems and then cheat others, exploit other, bribe and wait for handouts. I think those people who doubt India's greatness want India to be second rate country, those who know India greatness work hard to succeed and don't run off for to America to become US citizens. Where would India be if Gandhi had been a rich barrister in London.

the 'irrational exuberance' (thanks to Robert Shiller for coining that word and making it so easy to explain things) of India's economic indicators continues to amaze me.

Two things:

1 – Last fortnight, the governor of RBI D subbaro expressed his grief over the poor quality of statistical data supplied to guage macro-economics indicators. I fully agree with RBI governor, given the fact that GDP growth numbers have been revised 3 times already, not because of change in the economic environment, but because of data.

2. The looming double dip recession, corruption, and bad politics is very capable of derailing growth. These factors are not remote possibilities but very probable factors. Statistics 101 will tell you that if there are factors which are highly correlated to the outcome, it must be included to predict more accurate results. I highly doubt that indian statistics agencies do that.

Although I sound like pessimist, but I am just realist. The economic growth is not something you just see in RBI reports, it must be visible to you around you.. is it?

I have strong reservations in the projected 7% growth in Electricity supply and 6% Mining growth.

Mining of both coal and iron ore is clearly in the negetive. Bauxite mining is also stagnent. I am not sure from where the govt projects a 7% Mining growth.

Due to coal connectivities IPPs are slowing down. Unless we see the overseas mines of Indian owners come into production phase and massive coal shipments start arriving at Indian ports, I dont see how 6% Electricity growth is possible.

Beware of the major factor contributing to GDP. Agriculture !!

Compared to last year, this year rainfall is not upto the mark. We may end up with negetive growth if our reservoirs are not filled up fast. Last year, for the first time after independence, all the major, minor resrvoirs (except a few in north) were overflowing which allowed water release to farmers as and when requested. We do not have the luxury this year. A single point less growth in Agriculture will have more than 2 point effect on GDP growth.

Overall I guesstimate the GDP growth of 5-6% for FY11-12 unless something massive happens, like we suddenly double crude & gas output thereby reducing imports massively.

Just my two paisa :)

Out of the numbers stated above the agri growth of 6.6% is quite impressive.

Even the domestic savings rate of 34 % is another bright factor out of the statistics above.

THis is one mark contrast between countries like China,India and the West. The west sees the savings rate as a lost opportunity for lower current GDP growth we look at it as a safe option for higher future growth. Americans never save anything.

India is likely to continue with trade deficit as the consumption of oil is only going to increase not to mention the expected increase in global oil prices.