Statistical Highlights of Indian Stock Markets!

Savings and investment are two key macro variables which play a significant role in economic growth. Global emerging economies are experiencing record savings at a time when the developed world has been witnessing a decline in gross domestic saving rates.

Needless to say over here, that the best way to streamline the savings is through long-term investments in the equity markets by funding the corporate growth story. Over the past decade, India’s GDP has almost trebled from $414 billion in 2001 to $1.3 trillion in 2010.

This growth in the size of the country’s economy has been more than complimented by a dramatic 8-fold surge in the market capitalization of the Indian companies from $165 billion in 2001 to $1.3 trillion in 2010. However, it does not mean that this manifold rise in the equity markets and its turnover has been consistent with the increase in the market development and penetration.

Indian Equity Investors Survey 2010 released by MCX Stock Exchange offers some statistical insights on equity markets, stock exchanges, investor distribution patterns and various other facets of the Indian equity markets. Here are some important findings:

Contents

NSE tops the List of Turnover across Stock Exchanges

The total number of active regional stock exchanges across India has come down from 16 at the start of the decade to 4 in 2008-09, including 2 national exchanges. Moreover, National Stock Exchange’s share of total turnover across stock exchanges has surged dramatically from 61.53% in 2001-02 to 92.52% in 2008-09.

Apart from NSE and BSE, the only two stock exchanges that are active are Calcutta Stock Exchange and Uttar Pradesh Exchange as per 2008-09 data.

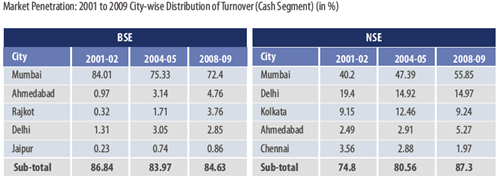

Mumbai Accounts for More than Half the Turnover

Almost 80% of the NSE’s turnover in India continues to come from the top 5 cities of Mumbai, Delhi, Kolkata, Ahmedabad and Chennai as on 2008-09. In fact, the financial capital of India – Mumbai – accounts for more than half the total NSE turnover at 55%; beating Delhi, the second largest turnover roller with a market share of 14.97%, by a huge margin.

This is an indication as to how geographically concentrated is the investor community situated in the major canters’ of the country; thus providing ample scope for market penetration in rural and town areas.

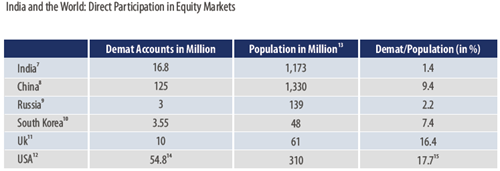

Low Direct Participation in the Equity Markets

Despite the Indian economy growing at a scorching pace of 8.5% of the GDP and the global funds increasingly eyeing the structural story of India; the direct participation of the retail investors in India’s equity markets is only 1.4% of the population – pointing towards woefully low financial inclusion in the huge domestic growth story.

Other emerging economies such as China and South Korea boast of a higher direct participation to the extent of 9.4% and 7.4% from the retail public in their respective stock markets.

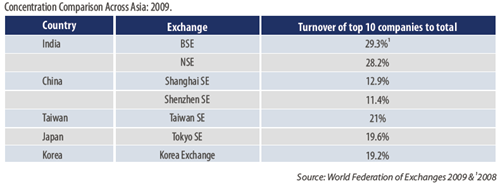

Top 10 Companies Rule the roost on the Bourses

Almost 29% of the exchange volumes in 2009 were concentrated in the top 10 companies of India. In most other major economies like China, Taiwan, Japan and Korea the same stood below 20% for top 10 companies in their respective countries.

Thus, there is still little room for the lagging Indian companies to grow at a higher speed and, consequently, notch higher turnover on the bourses in a bid to facilitate higher inclusiveness in terms of exchange turnover, away from being dominated by the top 10 companies.

Financial Inclusion in Telecom and Insurance

The telecom industry has been the biggest revolutionary story in India and needs no introduction on this business blog. The sector has passed through the phase of high growth and has achieved strong financial inclusion on the back of highly-competitive low tariff structures ensuring deeper penetration within the2 heart of rural India.

Further, the survey also points out that apart from the telecom industry, even the Life Insurance sector has achieved inclusive growth within the country by employing increasing number of agents which has gone up from 1 lakh in 2001 to about 3 million in 2009.

So, can India growth story move forward to achieve higher inclusiveness in various industries?

Hi Viral,

This is very good info on the break down of the exchanges. Despite the high participation from 5 cities, one hear say is that this activity comes from 1 or 2 communities. Not that this bad, but just wondering whether community/ upbringing etc has a role in investing/ stock market participation.

Coming from a middle-class family where my father was a conservative banker, and cousins/ uncles were into banks or other non-risk based work, wondering if such ingrained thinking leads to people staying away from the markets. In cultures where failure is part of the equation and there is less of a social stigma plus there is help/ support for going out there are trying to make something big is probably enabling certain communities succeed?

In India, with a huge youth population I can only speculate that in the coming years, the investors/ stock market participation is going to grow manifold. What one needs is education regarding investing to be imparted from high-school age. This is something I have always strongly believed as money is something we hear-discuss-earn-need or deal with from childhood to old-age. So it is vital to learn about money/ investing and benefit from it rather be a victim of ignorance.

Sorry for the rambling but I think financial education and risk taking is important for people to succeed.

Madhav,

You’ve highlighted a very crucial fact about the Indian stock markets pointing towards lack of investor knowledge and education back home.

In fact, I would further add that it is the higher educational system which should play a significant role in imparting such practical knowlegde which comes handy in managing the monetary issues and saving corpuses of the individuals.

Thanks for your valuable input.

Good article. Just found an error, Isn’t suppose to be India’s GDP has almost trebled from $414 million instead $414 billion?

it should the other way –

India’s GDP has almost trebled from $414 billion in 2001 to $1.3 trillion in 2010.

@ Viral,

Excellent article. It gives a great picture of present stock market situation.

What I can see from the statistics above is that the stock market is exclusively centered around few places.

a) 80% of all stock market turnover is done in 5 cities!!

b) Though demat a/c percent of population is only 1.4, if you take out the 5 cities, I am sure the percentage will go into minute numbers.

c) Turn over in top 10 companies corner major % of turn over, indicating people are reluctent to venture outside.

I know from experiance that people in India broadly participate in IPOs and FPOs but when you see the above facts, it becomes clear that most of the people from rest of India make listing day gains and come out of stock market and leave the secondary market to citizens of 5 cities.

Though we are agrarian society and 70% population depends on agriculture for livelihood, the remaining 30% live in towns, cities who can be persuaded by governments to participate in stock markets. Surely the figure of 1.4 demat a/cs per 100 heads can go up to beat the likes of Russia, S. Korea and China.

One way of doing it is to encourage people to invest in mutual funds. What is happening today is when people see one man making lot of money from stock market, they jump into stocks with out knowledge and after burning hands, badmouth about stock market and scare away potential entrants. If they are encouraged to invest in mutual funds, they will steadily get more returns compared to their FDs and post office savings. This gives them confidence about stock markets. Once they know the mechanism of how stocks operate, they can slowly invest in stocks themselves.

Altaf,

Glad to know that the above info was handy to you in understanding the intricacies of Indian stock markets.

For your further information, the survey stats points out that even top Tier II cities such as Hyderabad, Rajkot, Cochin, Baroda, Banglore and Pune amongst others; hardly contirbute 1-2% to the NSE turnover.

Probably, as you have mentioned, it is tough for the retail investors to stomach the intense volatility dished out by the equity markets and remain stay put with the growth stocks in this wildly gyrating market scenario.

So, unless they learn the disciplined way of investment by apportioning their savings in a systematic way (SIP), it will be very difficult for the gullible investors to TIME the market for the entry and exits.