USD Vs Gold – The Price war

The developed economies are under turmoil; reports indicate that Aug 2010 recorded highest number of mortgage foreclosure for the month in US. However gold seems to be going strong in it’s pricing undeterred by US economy.

In the last two decades, the heavy weight battle is gaining momentum, the trend shows it is between USD Vs Gold, particularly when compared with Indian currency.

In the early nineties, India had balance of payment crisis, which made them to pledge gold to IMF for a loan. I still remember, the exchange rate of US Dollars was in the range of INR 20 per dollar and we used to fill motorcycle tank at Rs 20 per litre and 1 gram of 22 carat gold was in the range of 200~250 INR. The early nineties was the time, when talk of globalization started and India started opening up its market. The telecommunication started picking up, the snail mail OR postal mail gave way to Fax mode of instant communication.

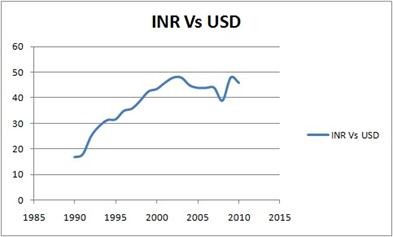

If one looks at the chart, the gold prices in US Dollars from 1985 till about 2002, it was relatively stable. It had been in the range of 200 US Dollars to 400 US Dollars per ounce (10 to 14 USD per gram). This had been the period when US Dollars was considered precious, every country wanted to boast its foreign reserve currency in USD and interestingly this also made US Dollars to claim high which kept gold rate in check. In the period of 1990 to year 2002, USD had appreciated almost 2.5 times, from about 18 INR in 1990 to about 48 INR per dollar in 2002.

Gold Price Movement – 1985 to 2010

Following period of 2002 to till date, US Dollars has been losing steam and more or less a cooling off period for USD. Again, this is when the other heavy weight commodity like gold started gathering steam and winning the price war against USD. Its was about 10~14 USD per gram even in 2000, now its has claimed to be at all time high of about 40~42 US dollars per gram.

Whenever USD appreciates, it bound to have inflationary effects in Indian economy but its indirect. The reason being, common man is not worried about appreciation of USD as compared to Gold and he does not invest in USD.

Question in any Indian mind is, will gold prices reduce or stabilize in near future? Looking at the trend it does not look so, with the world reserve currency – US Dollars seems to have lost out the race.

Not only individuals, but also even country governments consider gold as the safe bet, now. So till a time, there is an alternative to gold, where money can be parked as reserve currency, the "Gold" should be winning, the price war. A recent study by Asian Development bank, predicts China currency Renminbi becoming the reserve currency in the near future.

This might spin off another debate as 18th Century belonged to Germany / France, 19th Century to Great Britain, 20th to US –

Will the 21st century belong to Asia?.

Today USD is just below 45 INR. It is loosing for last few days.

Stock market is going up…. When you think is USD will gain to 47 again … or nearby.

I feel stock market will crash after diwali. and then usd will be back to 47+

A very nice article…

On the similar line to mine thought..i also feel with China allows its currency to deregulate..it’s bound to replace the USD..and shine of gold in near term is going to brighter and brighter….

Thanks Ankit.

My observation on currency related to China & US is that, US wish to have their currency strong and want China also to allow Renminbi to appreciate against USD. However, Chinese says that they are not regulating or manipulating their currency. In any case, to me in a long run only demand & supply of particular currency can determine its exchange rate in a global market.

Also, I feel having strong currency might not always be helpful, it will make import look cheaper than local production and exports costly in the world market.

Nice article.

Earlier there was an article in Trak saying that the production of Gold is going down as all the known mines are now over the plateu. Most are reaching closure.

China is exhausting the known mines at a faster pace. We dont know how long Chinese increase in Gold production will suppliment reduction in rest of the world.

A day will come when we have to do with the available gold only.

In this context its worth while to point here that last year Indian Government purchased 200 MT of Gold from IMF by utilizing dollars from its forign reserves. Its forign reserves now have 6.5% in Gold by shifting 3% dollars to Gold.

A great move.

Altaf… Thanks for your comments. Indeed, it was an information to me that Indian government had purchased 200 MT of Gold from IMF and anyways, it goes as per my indication in the post.

Also, it might be a fact, production of Gold is going down, but increase in Gold price is much more faster and the likely reason is as indicated in the post. Just for a reference in India, prices of Per gram gold was about Rs 800 in 2007 in more than Rs 1700 gram now.