Telecom Tuesday: Current trends in Indian Telecom Sector

Telecom sector, unlike other sectors has shown the highest growth in terms of competition, benefit for end users, and pricing, social policies, etc. In the post, I want to share current happenings in this industry.

Contents

1. New players entering rural markets:

Although biggies like Airtel, BSNL and Reliance leading in the race to access rural markets, smaller players are not behind. In past few months, DoCoMo witnessing the biggest jump in proportion of subscribers coming from the rural areas (increased from 10% to 18% in one quarter). Even Uninor, albeit on a smaller subscriber base, has a relatively high proportion of subscribers coming from the rural areas at 34%. Aircel is the only operator whose proportion from rural areas has actually gone down.

2. Prepaid tariff’s 40% lower than Postpaid

The competition in terms of pricing has become intense. More number of players, per second plans has reduced the pre-paid rev/min saw a sharp fall from 76p/min in Mar-09 to 55p in Mar-10; a fall of 30%. Post revenues are relatively stable as of now. The reason is that incumbents (majority of postpaid subscribers) right now have no incentive to cut tariffs as MNP and 3G will take some time. However this segment is too going to witness pressure in terms of tariffs

3. C Circle usage higher than A/B circles

The Circle C MoU have held on and even widened the gap versus the A/B circles in the last 12 months. Investors’ concern on C circle subscribers diluting the ARPU have also not materialized given ARPU is in-line with the B circles and only 10% below national average. This usage elasticity for C circle is especially strong as it comes despite a relatively higher y-o-y increase in penetration in these circles.

The two key reasons for this trend are: Low fixed-line usage resulting in fixed-line like usage in wireless and High market concentration results in lower incidence of multi-SIM and prevents leakage of minutes

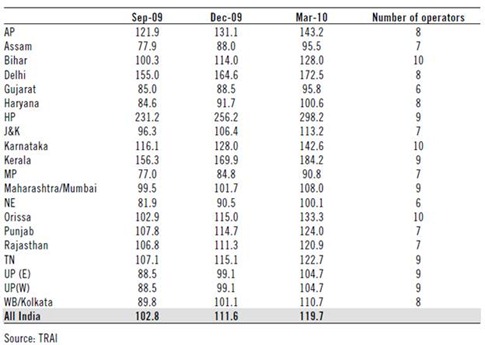

4. Multi-Sim usage is hitting the industry

If you look at the table below, many of the circles have more than 100% teledensity. Even C category circles like Bihar and Orissa’s urban penetration is also at 130% (national average at 120%). This is mainly due to multi Sim usage which is facilitated by handsets and sometimes due to attractive tariffs. The switching cost in this case is negligible.

State Wise Tele-Density

What can you expect from Telecom in the future?

- Fixed line network is likely to be sustained, albeit with a very small footprint. India has already crossed the stage where Mobile lines are in multiples of fixed lines

- The next phase will be crossover between data and voice There will be a process of technical consolidation and system integration of different competing standards in a single platform

- Future vision of telecom is a vision of IT. Telecom will be the springboard of future expansion of IT heralding in an information society. ICT will spread among the masses and will spur innovation, entrepreneurship and growth

(Source:Planning commission’s vision 2020)