Paypal woes continue for Indian users. Early this year in February, Paypal had completely stopped withdrawals to India, be it for Individuals or Business citing RBI regulations.

However, few days later they had resolved local bank withdrawals for Business users, where the user has to enter something called as Export Code, which would identify that the transaction was for cross-border merchant transactions, and not P2P money transfer.

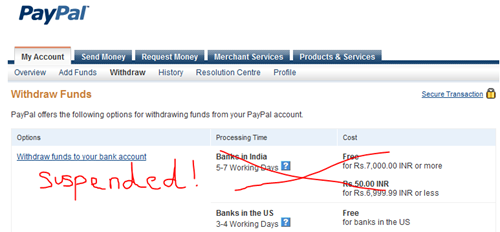

However, the problems with regulatory authorities in India seem to have re-surfaced and Paypal has stopped Electronic Funds Transfer to Indian local banks. However, cheque withdrawals are still available.

Here is the notification that Paypal has sent in an email to all Indian Paypal users as well as posted it on their Paypal blog:

Hi everyone, it’s Dickson Seow, from the Corporate Communications team. I’d like to give you an update on PayPal accounts for our India users.

In accordance with regulatory instructions, there will be a change in our withdrawal functionality in India starting on August 1, 2010. At present, you can request for either an electronic or cheque withdrawal of funds from your PayPal account. From July 29, 2010 onwards, you will only be able to request for a cheque withdrawal of funds from your PayPal account.

We sincerely apologize in advance for any inconvenience caused from this change and we are working hard to restore the electronic withdrawal service. In the meantime, we are bringing this matter to your attention so that you can plan your future withdrawal activities accordingly.

Our India users can find the cheque withdrawal process here. In order to help you deal with this change and until further notice, we will refund the US$5 cheque withdrawal fee to you for cheque withdrawals made on July 29, 2010 onwards.

If you have any questions, please contact PayPal customer support by logging into your PayPal account and clicking on ‘contact us’ at the bottom of the page.

Again, we apologize for any inconvenience caused from this change in our withdrawal functionality. We will provide ongoing updates to you here. We thank you for your attention and patience as we work tirelessly to resolve this situation as quickly as possible.

This does put a lot of Paypal Individuals users as well as Businesses in Limbo, as Cheque payments not only take time but also attract some charges. Paypal has also not mentioned anything about whether and if the Electronics Fund transfer will resume.

We will probably just have to wait to get more details on this.

[…] Fund transfer to India is permanent and the only way they can get money is through Cheque. See some of the comments on our earlier Paypal post, where users have confirmed it from Paypal itself […]

Ans: Yes you can deposit money in paypal in india. Here is the process first sign up in “alertpay account” it’s electronic fund transfer in 44 countries. sign up is free of cost click here: https://www.alertpay.com/?UY8Smmtf4%2b66X61lmEMYKQ%3d%3d. Then transfer money from alertpay to paypal and also to bank

can any one help me , how to transfer money from bank account to paypal in india.

yes you can!

How can we withdraw money from paypal account.

abe yeh hai kya?

Attach your bank account with paypal account and you will be able to do bank transfer easily

Paypal India Update:

With effect from 1 March 2011

1) Any balance in and all future payments into your PayPal account may not be used to buy goods or services and must be transferred to your bank account in India within 7 days from the receipt of confirmation from the buyer in respect of the goods or services.

2) Export-related payments for goods and services into your PayPal account may not exceed US$500 per transaction.

My brother sends money to our mom very often through Xoom. Money gets deposited in my account within 24hrs and their exchange rates are also pretty good. Might work for you guys. try : xoom.com

RBI is acting against Paypal because of fear that will be used to channel funds for anti-national funds and most of the money is unaccounted.

And, how does the competitors fare when compared to Paypal ?

I contacted PayPal support and got the confirmation that

“Yes, the check that you’ll be receiving will be under INR. The check

cannot be cashed; instead, you need to deposit it to your local bank

first to be able to get a hold of the funds. The check must be deposited

in a bank account that lists the exact same name that is listed on the

check.”

This is really crazy! We are getting lots of problem this year. Actual reason is not known by anyone. If Indian PayPal has not registered, then they should do it soon. It’s getting difficult to do business with PayPal. Getting money through cheque is really difficult.

OMG!!!

this is really crazy!! when will the GOVT/ RBI/ PAYPAL OR whatever realize that we are living in the 21st century and that there are many people who depend their incomes on the internet!!

we need fast services and now cheque!!?? And also only God knows how many people in India lost their paypal cheques on the way before it reaches the owner!!

instead of providing us new faster facilities , they are taking away one by one!! this is really bad!!

*someone should throw an over-sized dirty chappal/sandal on their faces!!! haha*

I think we have choice to take cheque and as Mayur showed the cheque was in INR so it will not take more time to get deposited it to our banks and as paypal email also says that “In order to help you with this change and until further notice, we will refund the $5 USD cheque withdrawal fee to you for cheque withdrawals made on July 29, 2010 onwards.”

but here I cannot understand will they refund 5$ on USD or INR cheque ????

On one side our country is moving ahead in technology, and on the other RBI is trying to move backwards.

The reason why they have stopped is that “The RBI is concerned that PayPal operates as an unregistered money transfer company in India.”

Paypal has been operating in India since 3-4 years now and RBI woke up and say its not registered ?? Really ridiculous.

Its Paypal India’s responsibility to register with RBI.

Paypal should pay more attention to people live in india!

Why our regulators make the m & e commerce so difficult? In the digital age, are we going ahead or going back to 1900?

Sagar,

Precisely my point – Instead of putting efforts in creating a process for these kind of situations they are essentially stopping the growth of online commerce in India and thereby also Entrepreneurship.

Arun, What is RBI’s comment on this? Have you asked them? I would love to know why PayPal is prevented from doing electronic transfers to India.

Atul,

As one of our commentators pointed out, – “The RBI is concerned that PayPal operates as an unregistered money transfer company in India” and money transferred via Paypal goes unaccounted.

Actually, by saying this RBI has shown how little they know of whats happening around them…its really sad !

If the solution is to for Paypal to register in India should it be doing that pretty quickly or lose out on all the revenue? Is there any body from Paypal who could comment on the reasons behind Paypal not registering?

I guess this is an opportunity for an Indian company/ company registered with RBI to step up and grab the biz.

Spoke to PayPal this morning (28 July 2010). They say this suspension is permanent. I have received checks from PayPal, when they did not have the facility to withdraw funds to India bank accounts. I faced the following problems, which I brought to their notice today.

1. Check is sent by ordinary post and not by courier. Checks are often lost for this reason.

2. The check takes ten plus days to reach India.

3. Since the check is in US$, it has to be sent for clearance by the Indian bank to realise the funds. This takes 30 – 45 days.

4. From the day one makes a withdrawal request to PayPal, it could talk a total of 30 – 45 days to receive the credit to an Indian bank account. (10 days for receiving the check and about 30 days for the bank to credit the $ check

If PayPal were to send the check in INR and via courier like Google does, the inconveniance would be greatly reduced. (INR check are cleared locall by the Indian banks in three days)

Official PayPal blog post in the matter can be seen here:

https://www.thepaypalblog.com/

Regards,

AK

That’s not the case anymore. You can now receive the checks in INR which are Payable at Par at all Citibank branches in India. So they’ll clear fast, without any fees (if bank is local) but the delivery may take big time. See this PayPal check: http://twitpic.com/19b5cc/full

What if one does not have citibank account? Can I deposit checks to other banks?

Hi

Did paypal have any answers for you regarding the currency of the cheque and whether it would be sent by regular mail or through courier..

Priya