GST Being Exploited? 77% Of Consumers Paid GST On MRP; Retailers Forcing Consumers To Pay Double Tax!

Consumers rights are being blatantly violated, and exploited by retailers in India, under the new GST regime. Thousands of consumers have lodged protests, stating that some retailers are charging GST on the Maximum Retail Price (MRP) of the product, which is illegal.

It seems that retailers are clearly taking advantage of misinformation and chaos, which has ensued post-GST in India.

Under Monopolies and Restrictive Trade Practices Act (MRTP Act), the Essential Commodities Acts and the Consumer Protection Act and several other consumer protection laws, it has been clearly mentioned that no retailer or manufacturer can charge a customer more than the MRP of any product.

Will Govt. take action against this practice?

GST Laws Being Violated, Exploited By Retailers

Under the Consumer Goods (Mandatory Printing of Cost of Production and Maximum Retail Price) Act 2006, the Govt. has clearly stated that MRP is the maximum price which any consumer should pay for any product.

All taxes, excise duty, and now GST has to be covered under the MRP, which needs to be printed in bold and showcased on every product.

But it seems some retailers are making a mockery of this rule.

In a recent survey conducted within LocalCircles, a community of consumers, 8800 people participated and shared their woes under GST regime.

Here are some facts which came out from the survey:

- Only 23% of respondents said that they were only being charged MRP of the product. This means that massive 77% of the respondents were being charged additional taxes, despite the laws clearly forbidding it.

- 51% of respondents admitted that they were charged GST on the MRP, and received no discount for the same. This means consumers paid double taxes on the products, and the extra tax which they paid went to the pockets of the retailers

- 20% of the respondents said that they were charged GST over the MRP, but received a discount or cash-back. Only this stat from the survey seems positive, due to the ethical business practices

- 26% of the respondents admitted that they purchased products under GST regime, and didn’t take the bill/invoice. This is again a violation of law, as GST regime pushes for invoice and bill generation for every product sold. The consumers are also at fault here, as they did not ask for the bill.

Proof: Retailers Are Charging GST Over MRP!

The irony here is that Consumer Affairs Department has launched several campaigns, wherein consumers are encouraged to bargain on the MRP as well, because the MRP has a profit margin of 10-35%, normally.

But now, retailers are charging GST over MRP, which shows the unethical business practice of some retailers.

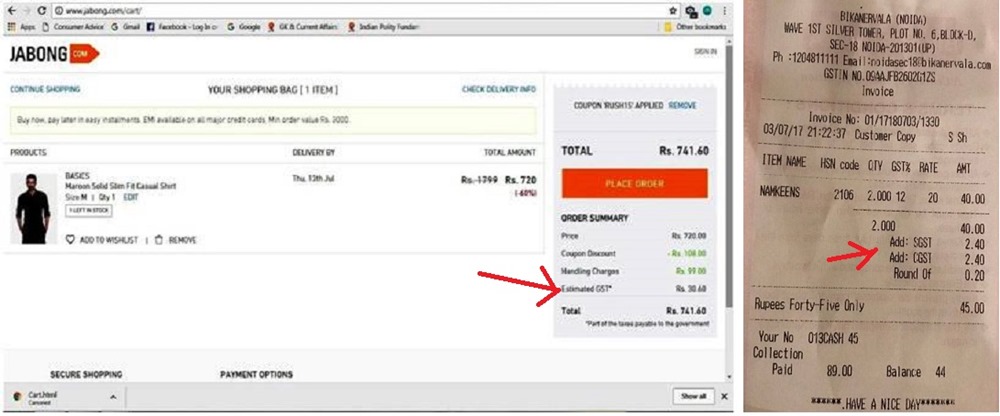

Take for instance this invoice from Bikanerwala in Noida, Sector 18.

They are charging GST on the MRP, which is illegal.

MRP includes all taxes and is the maximum price of any product.

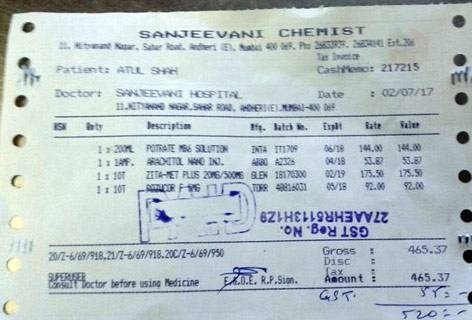

Another gross violation of GST rules:

Here, a chemist from Mumbai charged GST manually, which is a clear cut case of violation of all rules, ever created for consumer rights.

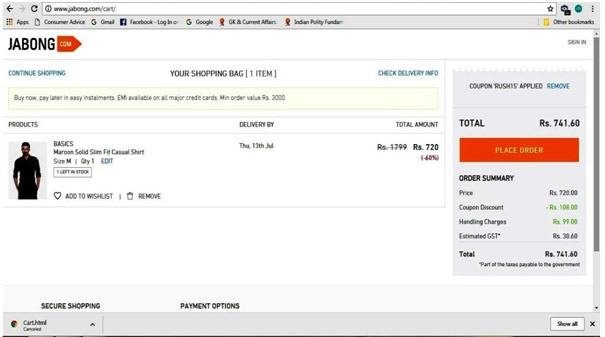

And even online retailers are not missing this chance to over-charge consumers.

An image of invoice generated by Jabong shows ‘Estimated GST’ on the purchase of a shirt:

Last week, Govt. of India informed all that manufacturers are required to update the MRP of every product, under GST. Failure to do so may invite fine of Rs 1 lakh and 1-year penalty as well.

Consumer Affairs Minister, Ram Vilas Paswan had said, “We have told companies to reprint revised rates on unsold goods. Stickers of new MRP should be pasted so that consumers are aware of the change in rates after GST,”

You can inform the Govt. about these issues coming up under GST by tweeting at this Twitter handle: https://twitter.com/@askGST_GoI or via online community ‘Connected Consumers’ created and run by Department of Consumer Affairs on LocalCircles.

Will Govt. now take action against these retailers, who are not only charging more, but forcing the consumers to pay double tax on the products?

Do have any bad experience under GST regime, wherein retailer charged you extra or manually added GST? Do let us know by commenting right here!

d mart is also charging GST over the MRP.

I went out to a Mall in Bangalore and I ordered some eatables. They charged GST over and above the MRP which I think is illegal. They have printed their GST number also to fool us. Why the government is not taking any action against them?

How to complain such illegal activities?

Recently we purchased CP Fittings from one of the Hardware Material Sellers from Bangalore. M/s. New Mataji , they given discount up to 28% on the MRP, really felt very happy and excellent. But here I could not understand that after given the discount on MRP, again they collected GST on total amount. When Discount applied on MRP, means the final rate would be with inclusive of all taxes, then how again the seller can claim GST on the final MRP Rate/Amount? Here with attached MRP Tags and Invoice of the Seller for ready reference. Not able to understand whether this is correct or not. Please help me to understand GST and to take further action.

Dmart charged extra 28% on MRP in the name of GST. I purchased a chair which cost with MRP 646.88 rupees. They charged extra 181 rupees as GST, so total they charged 828. Kindly don’t buy goods when they collecting GST on MRP. Please avoid DMART

Hi Mohul,

Please note that in case of Jabong mentioned above, you are completely wrong. Note that the MRP in that case is 1799 and not 720. And, please be aware that businesses can charge GST on the discounted items provided that the total doesn’t exceed the actual MRP of the product. You need to double check the rules & facts before publishing such articles.

This is happening in all big brands because they used to charge service tax, vat earlier on MRP marked items too, they were never been asked to correct it earlier too.

I recently bought two Benetton shirts MRP: rs 2899 for each (with an offer of buy 2 at 50 percent off)

according to my knowledge my bill should have been 2899 rs.but my bill was 3246 rs which was MRP(2899) plus GST.

What i understand is:

MRP is the final price of a product including all the taxes. If we are paying GST on the MRP, then we are charged double the tax amount that we should normally be paying.

can you please confirm

Yes the same happened with me .The sweet shop charged me extra over the MRP

D-Mart is also charging GST over the MRP.