GST Regime: 4 Crucial Bills Passed in Lok Sabha; FM Says Some Commodities May Become Cheaper!

After 7 hours of intense debate, Lok Sabha finally passed 4 crucial GST bills, which means that July 1st rollout of GST regime across India is now almost confirmed. The GST Bills approved by the Lok Sabha now needs state level discussions inside State Assemblies, before being implemented pan-India.

After passing of the 4 important bills, which will actually form the base of GST regime, Finance Minister said that one GST implementation is completed, ‘some commodities’ can become cheaper. He said that the actual rates of those commodities would depend on whether the rich is accessing them or the poor.

He said, “Today you have tax on tax, you have cascading effect. When all of that is removed, goods will become slightly cheaper.”

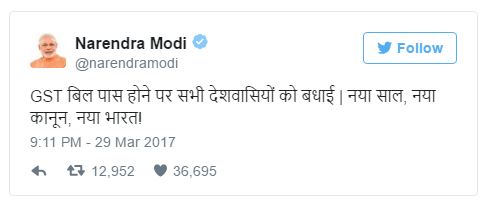

Immediately afterwards, PM Modi congratulated the nation on passing of the important GST Bills, as he tweeted

Which GST Bills Were Passed In Lok Sabha?

The four crucial bills which were passed by Lok Sabha yesterday are:

- The Central GST Bill, 2017

- The Integrated GST Bill, 2017

- The GST (Compensation to States) Bill, 2017

- The Union Territory GST Bill, 2017

Before passing of these bills, Govt. had to cut down more than three dozen amendments proposed by the opposition parties.

These 4 bills were passed after GST Council met for 12 meetings between September 2016 and March 2017.

What Are The Controversial Issues In The GST Bill?

As of now, real estate and petroleum products have been kept outside the ambit of GST regime, because further discussions are needed to understand its complexities. Besides, every state has their own rules related with taxation of these products, and bringing them under one unified tax structure seems tough.

Besides, during the discussion, several key pointers were raised by the Opposition, related to implementation of GST regime.

For instance, coconut oil shall be considered as a luxury product or an essential product? Now, coconut oil is extensively used in Southern states for cooking food, hence, it should be considered as an essential food product, but in North India, it is mainly used as hair oil, hence, it is a luxury product there.

The issue of Kitkat also surfaced: Should Govt. consider it as a biscuit or a chocolate?

Regarding the controversies, Minister Arun Jaitley said, “It is no one’s case to place items like baby food in the higher tax slab. Similarly, hawai chappal and a luxury car cannot have the same tax rates. That is something the GST council has decided with unanimity,”

GST Council has already formed tax-rate slabs, which range between 0% to 28%.

Here is a recap of all GST related news we have covered:

290% Cess On Tobacco Products Planned Under GST; Govt. Will Soon Impose ‘Fat Tax’ On Junk Foods

Ecommerce Portals Can Now Breathe Easy – GST Council Caps Tax Collected At Source (TCS) To 1%!

GST Roll Out By July 1st Confirmed; FDI Rules Would Be Eased For Multi-brand Retail

GST Portal Is Now Live; Migration Of 65 Lakh VAT Payers, 20 Lakh Service Tax Payers Started!

GST Council Goes Soft On Rule Breakers; Tax Evasion Upto Rs 2 Crore Would Be Bailable!

GST Portal Is Now Live; Migration Of 65 Lakh VAT Payers, 20 Lakh Service Tax Payers Started!

IT Dept Release Draft Rules Under GST Tax Filings; Now, Tax Payers May Need To File Monthly Returns