Paytm Launches Offline Money Transfers for Feature Phone Users; Ola-Yes Bank Join Forces To Deliver Cash!

Demonetisation has turned the world upside down. While a mobile wallet company has decided to extend their services to those who don’t use internet; a bank and a taxi-app company will deliver cash to their customers, free of charge.

Digital economy has the power to transform, and its clearly visible here.

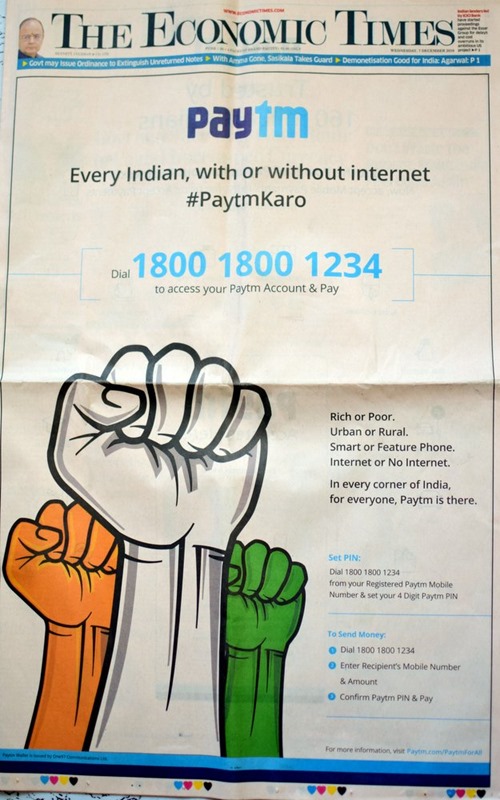

Paytm Launches Offline Payments for Feature Phones

Smartphone is still a major requirement for turning into cashless mode, as various mobile wallet apps are only available in a smartphone, having Internet.

Now, no more.

Paytm has launched an innovative toll-free number powered offline payments interface, which has been designed for those with feature phones.

The toll free number for this service is: 180018001234

After registering with Paytm with their mobile number, the customers having feature phones will receive a 4 digit Paytm Pin. In order to send payments via their feature phone, the customer can either send a SMS with the recipient’s mobile number, amount and the PIN or use the toll free number to do the same.

Nitin Misra, Sr. Vice President – Paytm said, “We are committed to enabling more and more Indians to be able to transact digitally. The launch of our new toll free payment number is another significant step in that direction. This will allow even non-smartphone users across India go cashless.”

This new offline push by Paytm will help them to attract new customers, who don’t use Internet and a smartphone. As per Paytm’s own data, more than a million offline businesses are right now using their mobile wallet for accepting digital payments, and now, they can even receive payments from non-Internet and non-smartphone users.

The popularize offline Paytm transactions, Paytm has embarked upon a huge 360 degree marketing campaign. Every national newspaper is today carrying this full front page advertisement.!

Now, Ola Will Deliver Cash At Your Doorstep

Ola Cabs and Yes Bank launched a service yesterday, wherein micro-ATMs have been installed inside Ola Cabs, which are parked near Yes Bank ATMs and branches. Customers of any bank can simply enter the cab, and withdraw upto Rs 2000.

However, within next few days, Ola will drive the cab with a micro-ATM to the doorstep of the customer, and allow him to withdraw cash upto Rs 2000.

Hence, Ola Cabs will literally deliver cash to you.

Rajat Mehta, Senior President & Country Head, Brand & Retail Marketing, Yes Bank said, “This is part of our commitment to serve as many customers as possible. We are working on a mobile solution with Ola, which means the cab will come to you to dispense money. We are in advance stages of closing out and are hopeful of launching the service in a week to 10 days maximum,”

As of now, Ola and Yes Bank hasn’t planned to charge anything for this service, as this is a purely a gesture of ‘social service’.

Paytm really works great. The popularize offline Paytm transactions, Paytm has embarked upon a huge 360 degree marketing campaign.