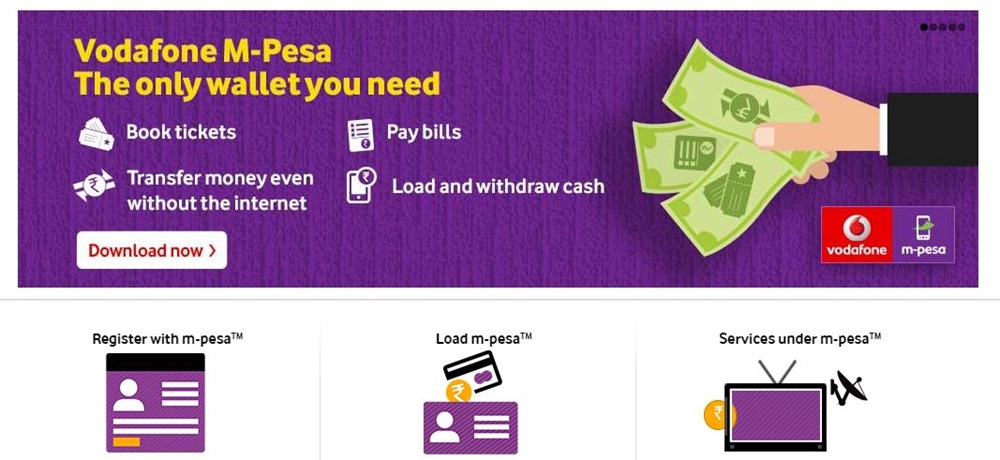

Vodafone M-Pesa Digital Wallet Users Can Now Withdraw Cash from Outlets; Big Bazaar Offers Cash Withdrawal at its Stores

Vodafone’s own digital wallet, M-Pesa has been around for more than a year now and has been put into better use only recently, post demonetization. However, now Vodafone users have another option to withdraw money directly without standing in lines at the bank.

To all the 8.4 million Vodafone M-Pesa customers, the company has rolled out the option to withdraw money from any of the Vodafone outlets through the digital wallet. Subject to availability of cash, users can withdraw from more than 1 lakh outlets around the country.

“The unique cash out feature of Vodafone M-Pesa makes it the ideal digital wallet for masses, enabling users to digitise cash, remit it to family and friends, pay bills and/or withdraw it at their convenience from over 120,000 touch points across the country,” said Suresh Sethi is Business Head of M-Pesa, Vodafone India.

Now, Vodafone users do not have to stand in long queues in front of the banks to only get cash after 2-3 hours. Vodafone outlets will be dispensing cash quicker because the money will get deducted directly from digital wallet, so all you need is your phone number.

Vodafone has also specifically said that even non-Vodafone users can join this service and register for it. The app is available on Google Play Store and Apple App Store for everyone. M-Pesa can also be used to pay for electricity, DTH, mobile bills and other utility bills.

Big Bazaar also has opened up cash withdrawal from its stores around India. The State Bank of India (SBI) helped Big Bazaar activate this facility through the bank’s cash at point of sale (POS) machines.

“We have two dedicated card swiping machines for cash withdrawal. Only one transaction is allowed per person and we are giving only Rs 2,000 per transaction. There was rush in the morning but it thinned out in the afternoon,” said a staff member at Big Bazaar.

How can you withdraw cash from Vodafone stores?

Vodafone has a lot of smaller and bigger outlets in cities, towns and villages in India. You must have a smartphone for the M-Pesa app. Just carry an identity proof to the nearest M-Pesa store and withdraw money, adhering to the limit set by The Reserve Bank of India.

You can top-up your M-Pesa wallets either through either debit card, credit card or net banking. In a way, Vodafone is simply letting you take out money you have saved in your bank, without any additional costs.

Vodafone and Airtel has shown a rapid increase in the use of their digital wallet apps and a move like this will help these companies grow their portfolios. Even Airtel users can install M-Pesa and go to the Vodafone outlets to dispense cash. Now all we can do is wait for Airtel to announce a similar facility for its users.

Between all the tussle, the common man will be the one to benefit. However, this facility should be smooth and there should be availability of cash at these stores. It makes no sense to under-equip these outlets with cash and then turn back people without any money. Very few ATMs around India are working, and this could be the only ray of hope for the working class.

While Big Bazaar’s move has been purely because of affiliation with SBI, the outlet stores hope to rake in more cash soon. It is definitely easier to get money from Big Bazaar stores than stand in line at the banks.

Let’s see how Vodafone and Big Bazaar challenge all the cash-crunch with the new feature as people swarm to the banks to get their own hard-earned money.

Mpesa charges 30rs per transaction…..its not free…..check before u write