Worried about Risks in Equity or MF Investments? Minimize Your Risk with ICICI Pru’s Balanced Advantage Fund!

Over last few years, Mutual Funds have increasingly becoming popular with investors in India, especially via SIP or Systematic Investment plans. SIP allows investors to invest small amounts on monthly basis, which helps in overcoming the volatility in stock markets to a certain extent.

However, even with MF investments getting popular, more Indians still prefer to invest in instruments like Fixed Deposits or recurring deposits as they are worried about inherent risks involved in equity investments.

Also, SIPs are excellent for retail investors who are looking to channelize their monthly surpluses towards their long-term financial objectives — but what about investors who are looking to deploy lump sums of available money for a medium- to long-term timeframe? Dynamic Asset Allocation funds provide an elegant solution.

What are Dynamic Asset Allocation Funds?

As the name suggests, these type of funds essentially invest in both equity and debt instruments. The portfolio of a Dynamic Asset Allocation Fund is rebalanced depending on market conditions and the amount of risk fund house wants to take.

Here is an example: Lets say that initially the mutual fund has asset allocation of 50% in equity and 50% in various debt instruments. If the equities have are performing well during a particular period, it could have increased the equity weightage of the portfolio to 70%. Once the fund house gets enough returns, they may then decide to sell some stocks and buy debt instruments to get the portfolio back to the original target allocation of 50/50.

In such a case, Mutual Fund investors, more often than not, are able to generate better returns and still have safety of Debt returns.

ICICI Prudential Balanced Advantage Fund

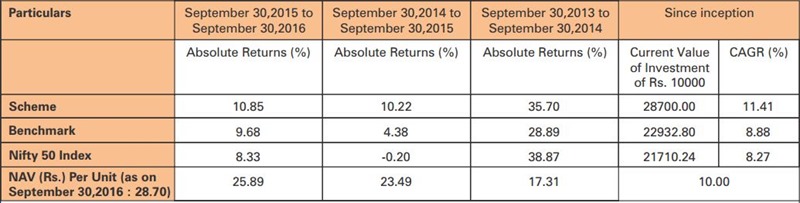

One such Mutual Fund currently popular in Indian market is ICICI Prudential Balanced Advantage Fund, which offers an ideal investment option for investors who are looking at long term wealth creation. The fund has consistently beaten Nifty since its inception and has given investors an CAGR of 11.21 percent as compared to NIfty’s CAGR of 8.06 in the same period.

Here is a look at ICICI Prudential Balanced Fund’s past performance

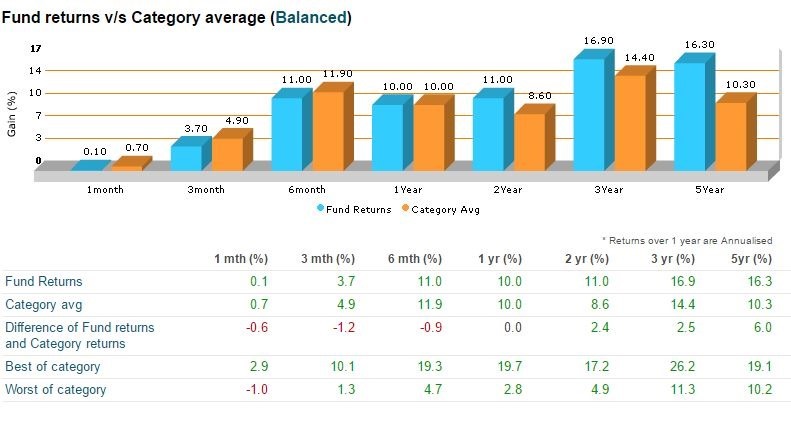

Here is how the fund compares with category average

Source: Moneycontrol

Source: Moneycontrol

While the returns on ICICI Pru Balanced Advantage Fund are quite good, it also offers other benefits. Here are some of them

- Tax Free Returns: As per the prevailing tax laws, the returns earned on this fund after a year are completely Tax Free

- Dividends: ICICI Pru BAF fund aims to provide Tax-Free month-on-month dividends, so this is an ideal instrument for people who are looking to get back their investments in phased manner.

- Automatic Withdrawal Plan: ICICI Pru also also has a facility called as Automatic Withdrawal Plan, which allows investors to do a regular withdrawal of the money they have invested in the fund.

Here is a video that offers overview of ICICI Prudential Advantage Fund

Disclaimer: Mutual Fund Investments are subject to market risks. Read all Scheme related documents carefully before making an investment. It is advisable for investors to consult their financial advisers to find if the product is suitable for them.

Note: This is a Sponsored Post