RBI To Make Funds Transfer Via Smartphones Faster, Easier & Secure With UPI & USSD

RBI is working towards making funds transfer via smartphone easier and more secure. This was revealed by the RBI Governor, Raghuram Rajan, while speaking at the IDRBT Banking Technology Excellence Awards function. Rajan also shared that RBI is working to provide tax benefits to customers who transact digitally.

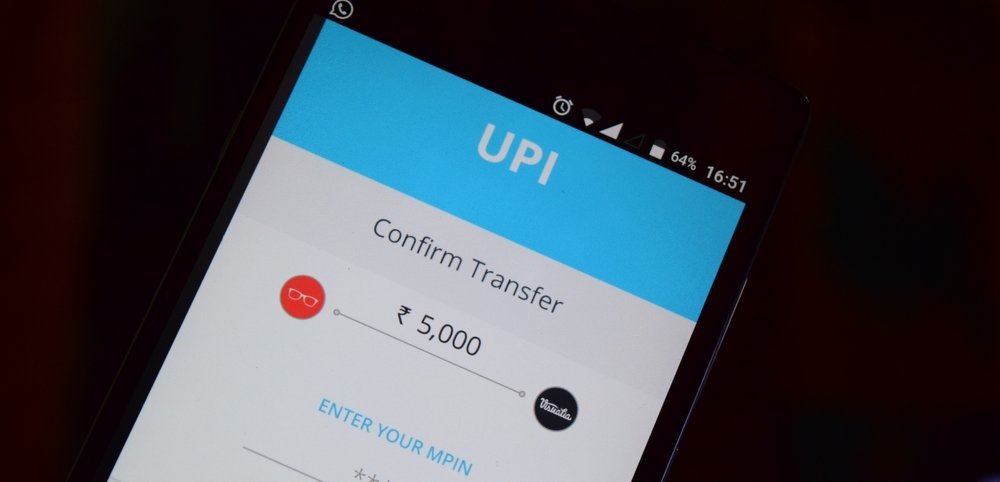

Mobile banking services are now being encouraged through USSD banking (Unstructured Supplementary Service Data) and UPI (Unified Payments Interface).

“I am especially enthused by UPI, as smartphones become more widely available. Transfers from bank account to bank account will become easier in a few weeks via smartphone through the Unified Payment Interface,” said RBI Governor.

Rajan explained this by saying, a villager needing to pay a shopkeeper only needs to pay the latter’s alias- say [email protected] to transfer funds. So in this way, none of the party needs to visit a bank for depositing and transferring funds.

The transfer would be done electronically without much human intervention and delay. This looks very similar to PayPal where you can transfer funds to anyone by just knowing his/her email id.

Rajan also said that despite the huge potential, activation rates and usage levels of electronic payment services remain at low level even when the growth is picking up. The fear of taxation when transacting online also reduces the adoption rate of digital banking services, but RBI is planning tax benefits for those merchants who push for digital transactions.

“Some tax benefits to those merchants who show increases in digital transactions, and perhaps innovative ways to encourage customer participation, may be beneficial,” Rajan added.

The governor also laid stress on the importance of having robust security systems in place which can even protect the privacy of unsophisticated users. He also emphasized that the payment systems should be cheap and scalable suitable to the current economy where we have huge transactions of small ticket sizes. He also said that the payment systems should be able “to talk to each other”, i.e. interoperable.

Rajan also said that there should be a speedy and fair resolution of customer complaints and said, “so long as customers adhere to a reasonable level of care, residual risks should be absorbed by the operator”.

“Banks have a very high level of responsibility when adopting digital channels – to not only ensure security of the channel at infrastructure level, protect data security and personal privacy at system level, but also address the need to build customer awareness on security matters,” Rajan said while focussing on the importance of selecting the right digital channel.

RBI would soon be laying down a framework for customer liability in case of electronic payments. This will make the customer grievance process easy and standardised while taking it to a whole new level.

RBI is pushing for digital transactions for putting a curb on black money and for increasing the tax receipt of the government. In January this year, the government introduced additional 1% tax on car purchase with cash, and now the government is also planning to ban all cash transactions above Rs. 3 lakh.

Last year, the government also made PAN card mandatory all transactions above Rs. 2 lakh and introduced tax benefits for transaction made via Credit/Debit cards.

Real-time money transfer using innovative and secure ways is the need of the hour now. RBI’s effort on the same can act as a catalyst in making Indians transact digitally.