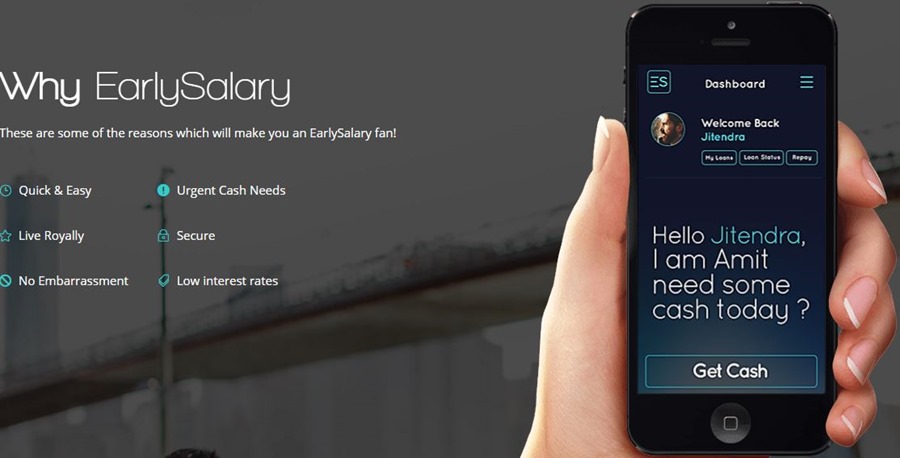

EarlySalary Brings Instant Unsecured Micro-Loans Via Mobile App

EarlySalary.com, a young 5-month old startup based in Pune is attempting to introduce the concept similar to that of payday loans in India using a unique, and innovative concept. Using the power of technology and some social logic, EarlySalary can provide micro-loans via mobile app.

EarlySalary can be best described as a Non Banking and Financial Company (NBFC) which provides unsecured, small loans under Micro-lending category. Targeted audience of this fin-tech startup are young 22-30 year old salaried professionals who need some financial help at the fag end of the month, when their last salary has almost dried up and their next salary is due is some days.

Yesterday, they expanded into Mumbai after setting up base in Pune, Bengaluru and Chennai. Right now, they can instantly provide small loans between Rs 10,000 and Rs 1,00,000 for a tenure of 7 to 30 days and the approval is within minutes via their app.

Founded by Akshay Mehrotra, Jay Jain and Ashish Goyal in 2015, EarlySalary is headquartered in Pune. There is tremendous interest in fin-tech niche right now; and days before their launch, EarlySalary had secured $1.5 million seed funding from Ashok Agarwal of Transcorp Group in November last year.

Social Worth Powering Micro-Lending

While sanctioning any loan, the concerned financial institution such as banks etc always check the credit history of the applicant. EarlySalary also checks the worth of the user before approving any micro-loan, but with a twist.

With their in-built social algorithm, EarlySalary quickly estimates the ‘social worth’ of the user using a ‘Machine Decisioning System’ which is powered by ‘Social Underwriting System’ and a unique ‘Score Card’ before deciding the loan application.

Akshay Malhotra said, “Machine Decisioning hold the turning point for disruption in the Financial and Banking Space. Over the past few months, we have worked towards building our Machine Decisioning System, which is now in production environment and allows us to start scaling operations.”

Before opening an account, a user needs to provide: Facebook account id, bank account verification, statements and PAN Card. Thus, using these few vital details, the ‘social worth’ of the applicant is decided before loan approval or rejection.

For example, in case a user has defaulted on a loan payment, then that person’s friends on Facebook may find it tough to get a loan from them.

How It Works?

Say a person whose age is 25 years, and earning a monthly salary of Rs 60,000 decides to approach EarlySalary and apply for a loan of Rs 30,000. In case the loan the approved based on various factors, money would be instantly transferred to the bank account.

In that case, that person needs to pay Rs 990 as interest, and thus, a payment of Rs 30,990 needs to be made at the end of the 30 day period.

Now, in case that person needs another quick loan of Rs 30,000 but only for 10 days, then an interest of Rs 349 needs to be paid after the end of 10-day period (total payment: Rs 30,349)

The concept of micro-lending, especially payday loans is huge in US and UK and EarlySalary is attempting to introduce the same in India.

With an interest rate of 24-30% for micro-loans, they are charging less than what most of the credit card companies charge for credit, and with easy, hassle free process of loan approval on the backdrop of one’s social worth, the concept rolled out by EarlySalary is indeed exciting and easy.