Smartphone Shipments In India To Witness Accelerated Growth in 2016, To Overtake Feature Phones

Indian smartphone market which is a low to medium range phone market is expected to grow at 37% this year, as compared to 32% average growth for the last three years.

2016 would also be the first year for the Indian mobile market when the smartphone shipment would overtake the feature shipments. This would be possible due to the launch of 4G network in the country, and also due to ever reducing price for a set of hardware specifications. The country will witness a huge influx of affordable 4G handsets in the current year.

Mobile Phone Shipments Vs. The Fate of Feature Phones

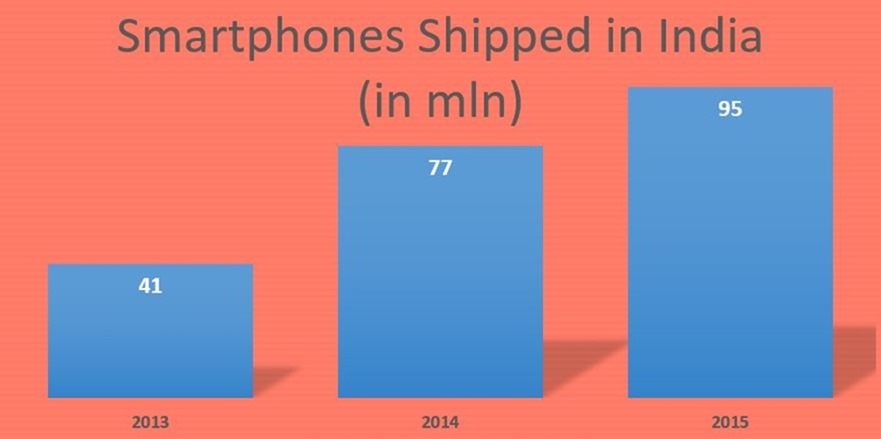

The year 2015 witnessed a growth of 23% in the number of smartphone shipped as compared to just 77 million smartphones sold in 2014. This took the total number of smartphones sold in 2015 to a 95 million.

The total number of mobile phones sold in the country during the year 2015 stood at 239 million. This included 95 million smartphones and 144 million feature phones.

The number of features phones sold in 2015 were much more than the number of smartphones shipped. However, this proportion is expected to change in 2016. CMR predicted the total mobile segment to grow by about 4% over the last year’s shipment of 239 million and stand at 250 million for 2016.

“So, while it has been time and again proved India is a low to medium priced handsets market, 2015, has not added some great feature sets to enrich user experience. However, the industry has been able to offer more to a user for same or even less,” mentioned CMR.

This race for low-priced smartphones began in 2014 and helped in increasing the reach of the potential market, but the rate of growth declined in 2015.

CMR also noted that feature-phone shipment continued to shrink at an average rate of 17% for the past few years. However, the feature-phones are not going away anytime soon.

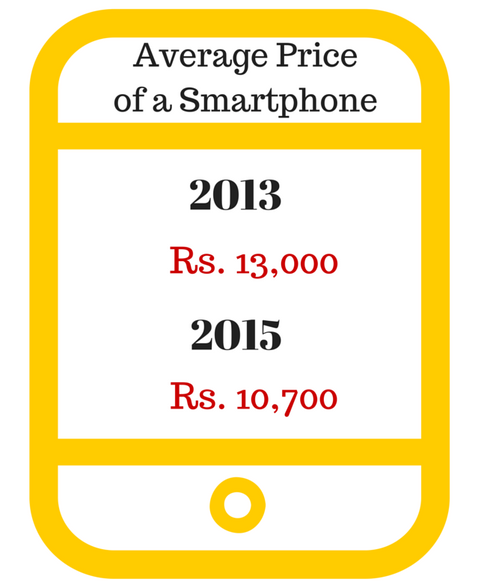

Average Price of a Smartphone

The price of smartphones have also reduced significantly. The average selling price (ASP) for a smartphone was Rs. 13,000 in 2013 (41M smartphones shipped) which reduced to Rs. 10,700 by the end of 2015 (95 M smartphones shipments). All this price reduction has happened while retaining if not bettering the same set of specifications. The smartphone manufacturers are now offering more for less.

CMR also expects 4G-enabled smartphone sales to cross 50 million in 2016, due to penetration into Tier II & Tier III cities, and the rural areas. Phone manufacturers would focus a lot on online sales but would also pay attention on improving their physical distribution channels.

3 out of every 4 smartphones sold will be priced under Rs. 10,000, CMR predicts. Also, the sales of smartphones priced below Rs. 5,000 will also touch new heights.

“We don’t expect any vendor to exit any price bracket in 2016 to focus only on a few niches,” said CMR in its report. This will make the smartphone battle even fiercer for the new entrants, but it will be another reason for the consumers to rejoice.

So, what specifications are you expecting to get under Rs. 10,000 this year? I would expect at least 2 GB RAM, full HD display, 13/5 MP camera combo, and support for 4G-LTE.

[…] […]