The Only Indian ‘Unicorn’ That Has Been Profitable Since Inception | Mu Sigma

In case you are wondering what a ‘unicorn’ is – in business parlance, it is a startup company that has achieved a valuation of a billion dollars or more. India’s much coveted ‘Unicorn Club’ currently features eight startups.

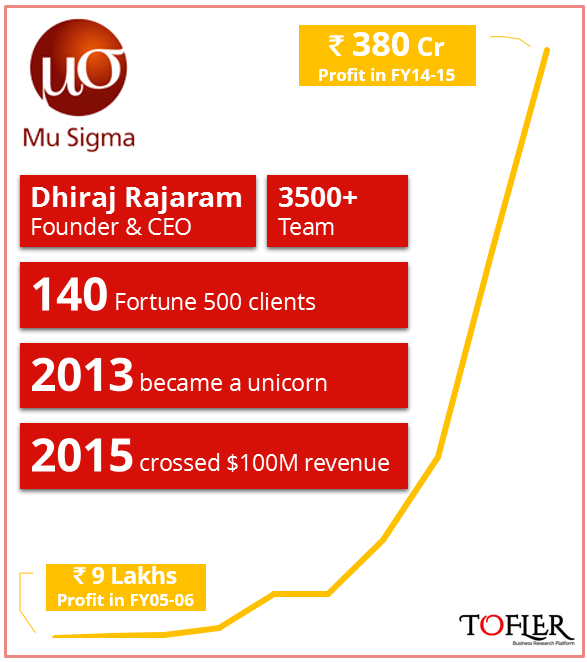

While most of them have now become a household name across the country, majority of them are yet to attain profitability. There is one though, which is much less known among the Indian consumers (understandable so, since it is a B2B business), which not only is a ‘Unicorn’ but has also been consistently profitable since its inception. The name of this Unicorn is Mu Sigma

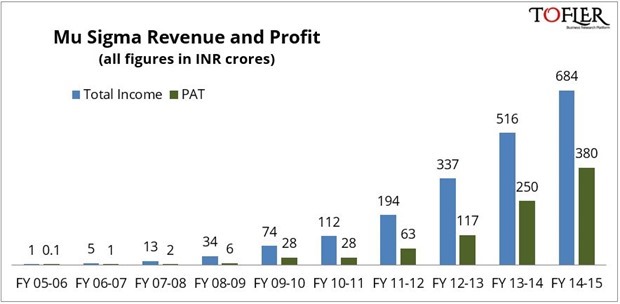

Mu Sigma reported a revenue of INR 684 crores and a whopping INR 380 crores profit in FY 14-15. This is a 32% growth in their revenue from previous fiscal and the profit stands at 56% of their revenue.

About Mu Sigma

Mu Sigma is a Decision Sciences and analytics firm that helps companies institutionalize data driven decision making and harness Big Data. It specializes in the areas of marketing, supply chain and risk analytics. It was founded by Dhiraj Chidambaram Rajaram in 2004.

The company employs more than 3500 ‘data science professionals’ and caters to more than 140 Fortune 500 clients. These include world’s largest retailers, pharmaceutical companies, banking institutions, insurance companies, technology providers, the list goes on. In fact, Microsoft, world’s largest software company, was its first client in 2005 and continues to be till date.

Mu Sigma Growth Story

The growth of Mu Sigma has been spectacular. In 2005, Microsoft became its first client when it began a pilot project with Mu Sigma to understand consumer behavior. That year Mu sigma made INR 1 crore in revenue.

Over the course of a decade, it has acquired some of the biggest companies in the world as its client, including Wal Mart and Dell. It secured funding from FTV Capital, Sequoia, General Atlantic and MasterCard over this period, and attained $1 billion valuation in 2013, being profitable all this while. Following chart presents their revenue and PAT growth since their inception.

The revenue for Mu Sigma comprises of income from analytics and other IT and business processing outsourcing that it renders to its parent company Mu Sigma Inc. This revenue is recognized on the basis of agreed percentage of return on revenue earned by the Holding Company and fellow subsidiaries. The revenue from domestic business comprises time and material contracts in the nature of data analytics services. The major expense incurred by the company is the employee expense which stands at INR 176 crores (70% of expenses).

When Dhiraj Rajaram had sold his house to start Mu Sigma, even he might not have imagined his company would become India’s largest data analytics company and achieve revenue figures of $100 million. Not only does MU Sigma show that a startup can be profitable but also dominate the industry across the globe. With revenue and profits skyrocketing with every passing year, Mu Sigma continues to be an inspiration for entrepreneurs.

About the Author – Vishal and Anchal form the team that runs the Tofler blog. They like to explore and track companies, their performance and senior management. Tofler (tofler.in) is a Business Research Platform.

The numbers regarding the revenue do not seem to correct. The company itself reported revenue of USD 63.2 million in 2011 which comes out to be approx. INR 320 crores (exchange rate of 1 USD=50 INR). You can view the related company press release at the link:

http://www.mu-sigma.com/analytics/pressreleases/MuSigma-Makes-Inc5000-List.html

It might be possible that the revenues mentioned in this article are only related to indian subsidiary of Mu Sigma. If this is the case, then the article should specifically highlight this fact.

Feels like paid news

Is this paid news ?

NO – It is NOT paid news..

Dear Anshuman,

Mu Sigma is not a publicly listed company. It does not report revenues and profits yearly.

And I wonder how the authors were able to get these details from the ‘registrar of companies’ !!!

It’s mandatory for every company registered in India, and that includes pvt ltd companies) to report their financials (and many more documents) to The Registrar of Companies, every year. These documents are made available for public scrutiny by the Ministry of Public Affairs and can be accessed by anyone.

Errata: These documents are made available for public scrutiny by the Ministry of Corporate Affairs and can be accessed by anyone.

If that is indeed the case , can you please tell me where the ‘public’ can access the details of the financials ?

The ‘public’ can view these on the website of Ministry of Corporate Affairs. It’s quite painful to use though! Alternatively, you can try http://www.tofler.in

Nice Blog post. Thankyou for sharing

I am not sure if these numbers are right. The company has 684 Crore revenues and 380 Crore profits, this would mean that all the costs are 304 Crores. Considering that there are 3500+ employees in the company, the total cost per employee works out to Rs.8.68 Lakhs per year and revenue per employee is only Rs.19.54 Lakhs. This looks way too small. I feel one of the data points are not fine here.

Cheers!

Manu

These numbers are not estimated but are sourced from the company’s official documents filed with the Registrar of Companies. In fact the average cost per employee is much lower at close to Rs 5 lakhs per year. There could be two explanations to this – 1) the employee strength of 3500 is global and includes people from other subsidiaries as well. 2) A large proportion of their work force is on a much lower salary package thus skewing the number. One of these or partially both could be leading to such low averages. Hope this makes sense!

If this indeed is a unicorn, why doesn’t it feature in the Crunchbase Unicorn Databse?