Times Internet Launches SmartSpends, A Smart Expense Manager App

Times Internet has decided to jump into the lucrative financial tech domain with the launch of their new money and expense management app called Smartspends.

Equipped with an interesting interface and an intelligent algorithm, Smartspends promises to help you “stay on top of your expenses but also ensures that you save on them in a refreshingly new and fun way.”

With this launch, Times Internet is now directly competing against existing money management apps such as Mint, MyUniverse (promoted by Aditya Birla), Walnut, Spendee among others.

Mukesh Kalra, Business Head, Smartspends said while launching the app, “Smartspends is built on a very simple premise – mobile is enabling us to re-imagine everything around money at an unprecedented scale. The app is a smart use of mobile tech to solve a very basic problem of enabling consumers to take control of their money seamlessly”

Contents

What Will The App Do?

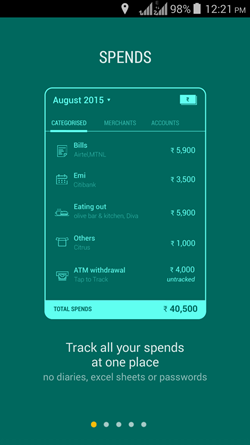

Track Your Spending

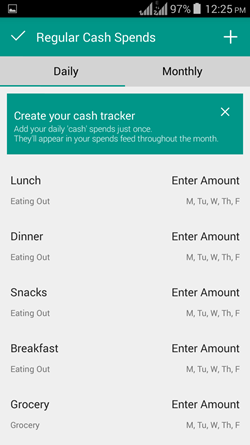

There is a section called ‘Spends’, which automatically categorizes all your spending under specific labels such as Travel, Food, Movies etc. Additionally, users can create a cash tracker so that they can keep an eye on all the money spent: daily, weekly and monthly. This section also helps the user to keep a track on those spending, which are done via cash payment. Categorized under categories such as Lunch, Dinner, Transport, Grocery etc, the total amount shall appear automatically under the Monthly spending feed.

Create Bill Calendar

Smartspends is powered by an intelligent algorithm, which will extract the data from your text messages (where the bill reminders normally arrive), and create a calendar of all your monthly bills and invoices. The ones which are already paid will automatically appear here (in case those texts are deleted, then it won’t appear)

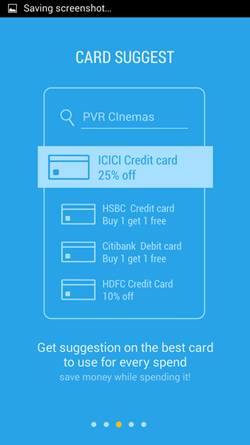

Suggest Best Card to Spend Money

The developers of this app have clearly understood that their targeted audience shall have more than one card in their wallet. Hence, they have created this interesting section where the user needs to add basic details about their cards like the bank, card type and last 4 digits.

Whenever that user wants to purchase any item (offline or online), all he needs to do is open this section and inform the app about the place where they intend to make the purchase. The app will scan their database and provide suggestions about using the best card to make the purchase, in order to save more money.

Offers and Discounts

This can be the USP of the app, which is not present in their competitors. Smartspends will curate the best offers and deals for the user, and suggest them for the optimal shopping experience. Based on the user’s spending habit and proximity to the location, the app will automatically populate this section which has been categorized under: “Ending in 7 Days”; “On your favorite places “ and “By Category”

Fun Cards

Based on your financial data and spending inclination, the app will create fun facts and present them in the form of cards. Exploring one’s own financial records and creating fun facts based on them certainly sounds interesting!

How Can It Save Money?

It is said that every penny saved is every penny earned.

There are three ways Smartspends can help a user to save money:

a) By having an eagle-eye view on the overall spending, the user can comprehend which purchases are necessary, and which aren’t. At the end of the month, while viewing the spending feed, the user can determine which expenses need to be curtailed and how.

b) Savings By Using Debit/Credit Card: The app suggests which card can be used at a particular place for best savings. There are so many offers provided by different banks, that it can overwhelm the user. By offering the best suggestions based on the bank’s offers, this app can help save more money.

c) Best Deals and Offers: When the user will receive the best deals and offers right inside the money manager app, then the probability of it’s usage becomes high, which in turn can result in better savings and better purchase planning.

The app have collaborated with the following banks as of now:

SBI Bank; ICICI Bank; HDFC Bank; CITI BANK; AXIS Bank; American Express Bank; INDUS Bank; KOTAK Bank; Standard chartered bank; HSBC Bank; IDBI Bank; YES BANK

These telecom providers are covered by this app: VODAFONE Mobile; AIRTEL Mobile; IDEA Mobile

And coupon aggregator: Coupondunia

There is no iOS version as of now, as the app is only available on Google Playstore.

Do share your views after using Smartspends, by commenting right here!

Excellent app. I particularly liked the card suggestion feature. I often find myself comparing deals on different sites, and then comparing against different cards to ensure that I pay the lowest price.

This feature will solve the card comparison problem for lot of online shoppers. Absolutely brilliant feature. If they promote this as USP they are sure to outdo all competitors in terms of app download and installation.

Padmini – thanks for your kind words and we are glad that you liked the Card Suggest feature!

App’s logic is bullshit. But Mohul, the way you write any articles adds 1000x value to it.