Rs 11,022 Crore of Frauds Discovered In Public Sector Banks Between Apr-Dec 2014

Between April to December, 2014, public sector banks in India incurred losses to the tune of Rs 11,022 crore due to 2100 cases of fraud. These numbers were revealed in a report shared by Reserve Bank of India last week. In all the 26 PSU Banks under Government of India, all frauds which were higher than Rs 1 lakh were analyzed for the 9 month period between April to December, 2014.

Out of the total frauds, Punjab National Bank reported maximum amount: Rs 2306 crore, with 123 cases of fraud. On the other hand, SBI reported maximum number of fraud cases at 474, but the amount of fraud is low: Rs 1327 crore.

In fact, total frauds discovered between this 9 month period has already surpassed the total frauds reported during 2013-14 fiscal year, when 2593 cases of fraud resulted in loss of Rs 7542 crore. Thus, between the period April to December, 46% more amount was lost due to frauds compared to last full year.

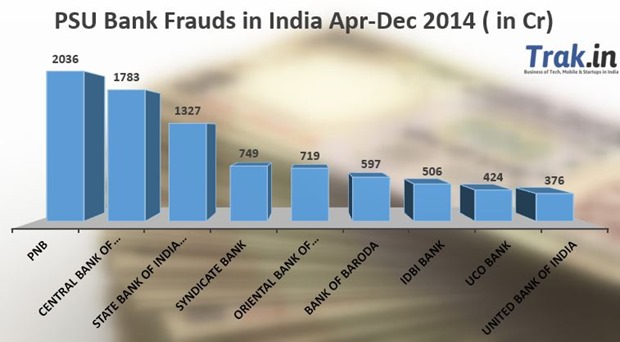

Here is the breakdown of frauds in the major banks, along with the number of fraud cases:

- Punjab National Bank (PNB): 123 cases; Rs 2036 crore

- State Bank of India (SBI): 474 cases; Rs 1327 crore

- Central Bank of India: 174 cases; Rs 1783 crore

- Syndicate Bank: 114 cases; Rs 749 crore

- Oriental Bank of Commerce: 86 cases; Rs 719 crore

- Bank of Baroda: Rs 597 crore

- IDBI Bank: Rs 507 crore

- UCO Bank: Rs 424 crore

- United Bank of India: Rs 376 crore

What exactly is a fraud?

As per RBI, fraud can be “loosely” described as “any behavior by which one person intends to gain a dishonest advantage over another”.

As per Section 17 of the Indian Contract Act, 1872, a fraud can include the following acts:

- A suggestion or an advice from a person who himself doesn’t believe to another person with the intention of causing harm

- Hiding a vital fact which directly results in financial/personal loss

- A false promise made with the intention of never fulfilling it

- Any action which has been initiated to deceive the other person

- Any act which deliberately omits/ignore the said rules of the land and financial institution

As per a report on “RBI Working Group on Information Security, Electronic Banking, Technology Risk Management and Cyber Frauds”, a fraud has been technically defined as:

“A deliberate act of omission or commission by any person, carried out in the course of a banking transaction or in the books of accounts maintained manually or under computer system in banks, resulting into wrongful gain to any person for a temporary period or otherwise, with or without any monetary loss to the bank”

As on March 31, 2013, commercial banks reported total fraud of Rs 1,69,190 crore from 29,910 cases. In 2012-13, Rs 13,293 crore of fraud was detected in all PSU banks in the country.

For more details on the frauds as shared by RBI, you can visit here.