Jan Dhan Yojana Enters Guinness Book Of Records. But Banks Are Bleeding High!

PM Modi’s ambitious plan to include all Indians under banking system: Jan Dhan Yojana, has been featured in Guinness Book Of World Records. A new world record has been created as Indian Government opened 1.8 crore new bank accounts between August 23rd and August 29th, a feat which has never been achieved before, in any part of the world.

Against the initial target of 7.5 crore new accounts, as of now, 11.3 crore new bank accounts have been opened till now, accumulating Rs 9188 crore.

The subsidiaries and benefits which were supposed to be offered under this financial inclusion plan has already been started to roll out. This includes Rs 15,000 crore under Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS), which will cover 4.3 crore beneficiaries in 300 cities; Rs 6688 crore subsidy to 8.03 crore LPG consumers who are part of Jan Dhan Yojana.

Additionally RuPay card has been issued to all beneficiaries as well.

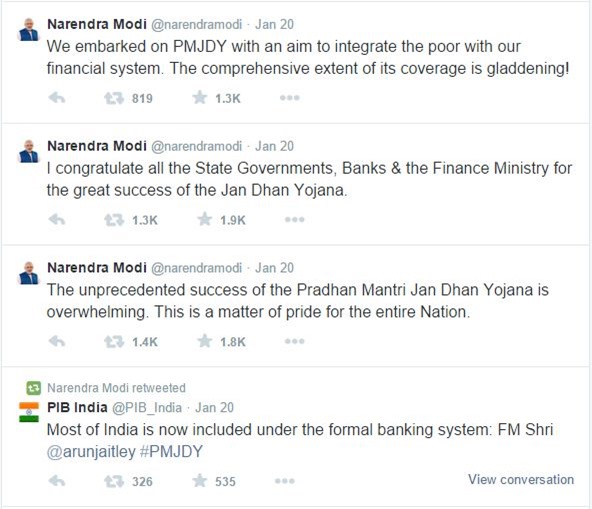

PM Modi congratulated all the concerned authorities for making this scheme a roaring success:

But Banks Are Losing Money

However, not everything seems right with this ambitious financial inclusion plan launched by the Government. One of the biggest concern is empty bank accounts, with no deposit in them. As of November, 2014, there were 7.1 crore bank accounts opened under this scheme, out of which 5.3 crore had no balance in them.

Additionally, under the scheme, account holders will be able to get an overdraft facility of Rs 2000, which can be extended to Rs 5000 based on the credit history. As of November, 2014, Government had infused Rs 5400 crore in various empty accounts, as part of subsidy for the scheme. This amount is all set to increase now, as the total number of bank accounts have increased to 11.3 crore as of now.

Every bank account opened under Jan Dhan scheme is supposed to have RuPay debit card, Rs 1 lakh accident insurance cover and Rs 30,000 life insurance cover, besides the overdraft facility.

FirstPost did a calculation based on these promises, and the number of empty accounts, and concluded that banks may lose upto Rs 13,500 crore per year due to Jan Dhan scheme.

The real trouble will begin when account holders start claiming overdraft facilities and other benefits 5 months down the line. As per some insider sources from banks, unless Government provides heavy financial assistance to banks, the promises would be very hard to fulfil.

The news of getting featured in Guinness Book Of World Records should be celebrated with caution: It is a tough road ahead.