Flipkart Raises $700M Fresh Funding From Steadview & Others [Updated]

[Updated: 22nd December]

Last week (in article below) it was rumoured that Flipkart had raised around $180 million funding from Hong Kong based Steadview. The rumour had a very conservative number in terms of Funding. Flipkart on Saturday has officially announced that they have picked up $700 million (Rs. 4434 crore) from number of investors including Steadview.

Along with Steadview, this round of funding included investors like Baillie Gifford, Greenoaks Capital, T. Rowe Price Associates, Qatar Investment Authority, along with existing investors DST Global, GIC, ICONIQ Capital and Tiger Global.

The official statement from Flipkart stated,

“As with previous funds raised, these funds will be used towards long-term strategic investments in India and to build a world-class technology company, delivering superior customer experiences.

Flipkart Limited (incorporated at Singapore) has filed with ACRA Singapore for conversion to a Public Company. This is a mandatory procedure for all companies where the number of shareholders exceeds 50. This filing ensures we are in compliance with the laws of Singapore and is in no way indicative of any upcoming IPO or of any corporate activity that the company is engaged in either in Singapore or any other part of the world.”

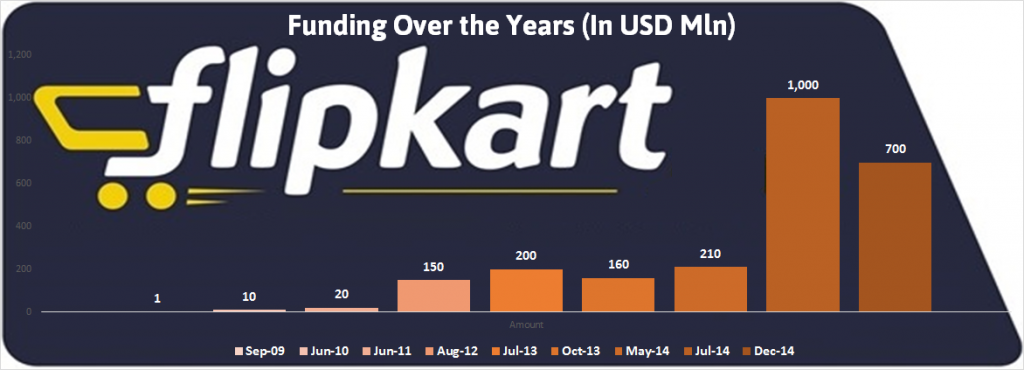

Here is chart that shows Flipkart Funding till date, with years.

Their is no word on Flipkart valuation based on this round, but in our view it is not less than $11 Billion.

[You can also see the funding table below.]

[Previously written on 16th December 2014]

Steadview, Hong Kong based alternate asset management has announced that they are investing $180 million in Flipkart. This investment has been made against their new valuation of $11 billion or roughly Rs 69,000 crore.

Steadview had earlier invested in Urban Ladder and Ola Cabs, and it would be their first venture into ecommerce niche.

One unnamed source from Steadview shared with ET: “Steadview has committed $100 million of the $180 million and as the subsequent tranches close, more new investors will come in,”

Last month, we had reported strong rumors about the possibility of this investment round and apprehensions that Flipkart is looking forward to a valuation of $10 billion+. The actual valuation has actually surpassed our expectations.

This would be 9th round of investment for Flipkart, after it raised $1 billion from Tiger Global, and other investors in July this year. After this investment round, Flipkart was valued at $7 billion, a record for any Indian ecommerce company.

Including this investment, Flipkart has raised $1.2 billion this year alone, compared to $627 million raised by Snapdeal and $2 billion committed by Amazon for its India operations.

Till Date Flipkart has raised a total of USD 1931 Million in nine rounds. Here are the details.

Funds Raised By Flipkart Till Date – USD 1931 Million

| Round | Who Funded | Date | Amount |

| First Round | Accel India | 2009 | USD 1 Million |

| Second Round | Tiger Global | 2010 | USD 10 Million |

| Third Round | Tiger Global | June 2011 | USD 20 Million |

| Fourth Round | Naspers / ICONIQ Capital | August 2012 | USD 150 Million |

| Fifth Round | Naspers, Accel Partners, Tiger Global, and ICONIQ Capital | July 2013 | USD 200 Million |

| Sixth Round | Dragoneer Investment Group, Morgan Stanley Investment Management, Sofina and Vulcan Capital, Tiger Global | Oct 2013 | USD 160 Million |

| Seventh Round | DST Global | May 2014 | USD 210 Million |

| Eighth Round | Tiger Global, DST Global, Accel Partners (plus other new investors) | July 2014 | USD 1000 Million |

| Ninth Round | Steadview Capital, Baillie Gifford, Greenoaks Capital, T. Rowe Price Associates, Qatar Investment Authority, DST Global, GIC, ICONIQ Capital, Tiger Global. | December 2014 | USD 700 Million |

| Total | USD 2451 Million |

Rs 69,000 crore worth Flipkart is now bigger than several traditional publicly listed companies such as:

- Dabur India which is worth Rs 41,000 crore

- Godrej Consumer which is worth Rs 31,000 crore

- Grasim Industries which is worth Rs 25,000 crore

- Mind Tree which is worth Rs 10,000 crore

- Hero MotoCorp which is worth Rs 5160 crore

It has become almost half of Wipro now, which is valued at Rs 1.34 lakh crore and almost one-third of Infosys which is worth Rs 2.1 lakh crore.

Ecommerce experts are also speculating that some initial investors in Flipkart can use this latest funding round to ‘cash out’ from the venture.

We had earlier reported two mega deals of Indian eCommerce which can happen anytime: Amazon-Jabong and Alibaba-Snapdeal; which looks more prominent now after this latest round of funding Flipkart has received. And Tata Group is also testing waters of this new niche, as they too have some big plans.

The battle for supremacy between Flipkart, Snapdeal and Amazon has now transformed into a new level after this latest round of investments.

We will keep you updated as more news come in related with this news.

This phone is super

[…] Hong Kong based alternate asset management has announced that they are investing $180 $700 million in Flipkart which brings their new valuation to $11 billion or roughly Rs 69,000 crore. [We are updating this […]

BSE and NSE listed Intrasoft technologies is another e-commerce company with low base and unknown look interesting but making some losses like flipkart and snapdeal in online shopping division. It is good only for long term and patience investor.Venture Capitalist Intel Capital is investor of Snapdeal . They have also invested (around 12% holding) in Intrasoft technologies and sees good future of their fast growing online retail shopping 123stores dot com in USA and likely to launch in Canada first then in India. Very soon like Intel some of the other Venture Capitalist investor of FlipKart and Snapdeal like Yuri Milner’s DST Global , Tiger Global, Naspers , Iconiq Capital , Accel Partners, Morgan Stanley Investment Management ,Singapore sovereign-wealth , Nexus Venture Partners , Indo-US Venture Partners ,Bessemer Venture Partners , Kalaari Capita and Qatar Investment Authority will have eye on Intrasoft technologies

The word over valuation applies here,They’re probably not more than $7Billion with the funding now. I am sure Kunal bhal wouldn’t be surprised with the $11B over-valuation.