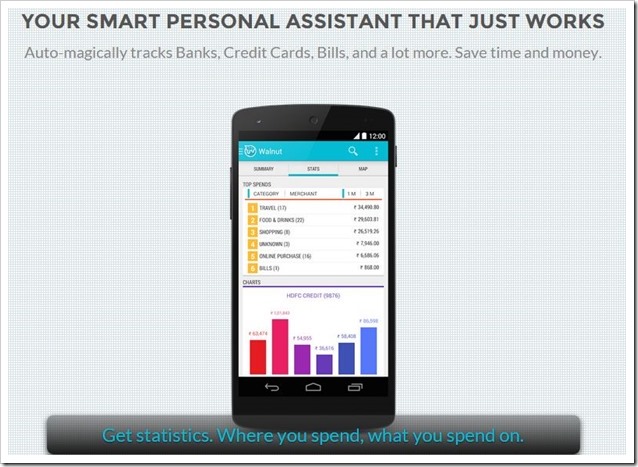

Walnut: An Intelligent Expense Manager App That Auto-Magically Tracks Everything!

Einstein once said that technology will make the coming generations lazy. Mobile applications seem to be proving that right. Apps deal with the basic yet most important aspects of human life- communication, information and management. With such vital needs simplified and automated, our daily lives can be much laid-back.

In Walnut, you can find a new app which will organize your finances and will make you a lazier person. Without opening the app once and without making any manual entry, you can track your expenses with a single click.

Contents

What is Walnut?

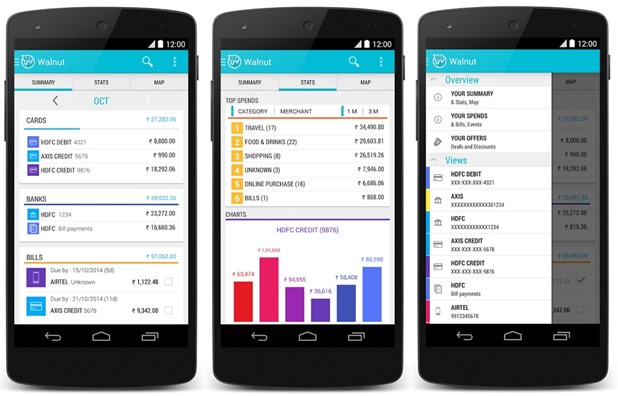

Walnut is an expense manager app that helps you manage your spending, bank transactions and other bills. It is fully automated and it happens based on analyzing the keywords in your SMSs. The app scans your SMS inbox for keywords, filters the SMSs from banks regarding your transaction via internet banking, credit and debit card and adds the expenses in its sheet. All this with proper security settings. (Read FAQs here)

Walnut also goes through merchants’ SMSs (Flipkart, BookMyShow etc) to give complete expenditure details of all your transactions. You can have a good insight of your financial transactions from single day to years at one place at one click.

Walnut promptly reads your SMS coming from banks and merchants. Since the app is SMS based, you don’t need to connect bank accounts or other merchant account details with the app.

Most important feature of the app is it works on its own without much interference. You don’t need to give any inputs of your transactions and expenditure to the app (this feature makes the app stand apart). It starts working the moment you download it.

Currently Walnut Supports following Banks & Businesses:

- HDFC bank, debit and credit cards

- Axis bank, debit and credit cards

- ICICI bank, debit and credit cards

- SBI bank, debit and credit cards

- Citibank credit cards

- Amex credit cards

- IndusInd credit cards

- Vodafone, Idea, Airtel

- BookMyShow, OlaCabs … and lots more to come

How sustainable is it?

The banking and financial institutes will be using technology more and more in coming time, so Walnut has a better chance of growing. The idea of Walnut is unique and useful. The more it improves and helps people manage finance better, longer will be its life. Finance is, after all, a perpetual concern and it will always need a solution.

Competition

There are thousands of expense manager apps like Smart Budget, Daily Expense Manager and Financius. Many of them offer similar functionalities with little changes here and there. Walnut overtakes the others as it goes a step ahead in the SMS analysis feature. None of the apps have zeroed in on the financial factor covering all the aspects from banks to merchants.

Another advantage is that Walnut congregates data. Official bank apps help you track your transactions, but each individual app needs to be downloaded if you have multiple accounts.

Present and Future of Walnut

Currently Walnut is available only on Android platform. Developers need to consider iOS, Windows and BlackBerry users in coming time.

This app works great and helps us to categorize our expenses according to banks, cards and merchants. But sometimes it fails to categorize the ATM cash transaction for particular banks. Developers need to fix such bugs with every update.

Launched just a month ago, it is early days for the app. It needs to be made the common tool for all kinds of transactions. Wallet facility, more insights to merchant SMSs and in-depth transaction analysis are some features that need to be added. Inclusion of easy ecommerce transaction facility and bill payment option can prove good addition to the app.

Brain behind Walnut

Based out of Pune, Walnut is brainchild of Amit Bhor and Patanjali Somayaji. Six months ago, they started working on this idea. The thought process began with studying the communication aspect of apps. The makers were pondering upon how people have moved on social networking apps for communication and how SMSs remain only for financial information.

The duo decided to integrate all the SMSs receiving from bank and merchants under a single app. The focal point now shifted from communication to management. The implementation began in May this year. In two months’ time, the beta version was created and the full-fledge app was launched in October 2014.

How walnut earns/make money ?

may have some tie up with banks or other financial institutions to share the transactions pattern of users with them and get some revenue?

This is exactly similar to Money View. I have been using it for the past 2-3 months and have to say i’m impressed.

But if you are a person who does a lot cash payments like me then you have to still make manual entries in these apps and i think that is something that you cannot avoid.

There is another great app that also analyzes SMS data called – SpendWize..So i believe this is not the only one ..

Awesomely explained Nacho. Best.

I hope Walnut is paying you for promoting their app.

Hmmm; need iOS man for me.

Any similar apps for iOS?