Crowdfunding has now become a global phenomenon and gone mainstream! However, in India crowdfunding is still at a nascent stage. There is no legal or regulatory framework around this new phenomenon. SEBI, India’s Stock market regulatory body is become proactive in this regards and has released a consultation paper that proposes legal, structural and regulatory framework around crowdfunding in India.

SEBI, in recent times, has been taking steps to help startups and SMEs to acquire funds from Capital markets. In June of last year they had released amendments to SEBI Regulations that enabled listing of startups without having an IPO and also released a framework for angel investments in India.

Now, SEBI has released a consultation paper that aims to bring clarity on how startups and SME’s can raise funds through crowdfunding in India.

Highlights of consultation paper released by SEBI

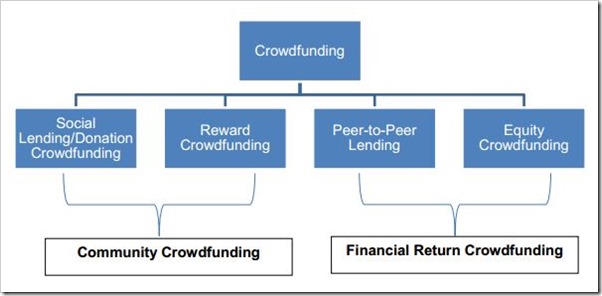

– Crowdfunding Definition as per SEBI: Crowdfunding is solicitation of funds (small amount) from multiple investors through a web-based platform or social networking site for a specific project, business venture or social cause.

– Crowdfunding has been divided into 4 categories: Donation crowdfunding, Reward crowdfunding, peer-to-peer lending and equity crowdfunding.

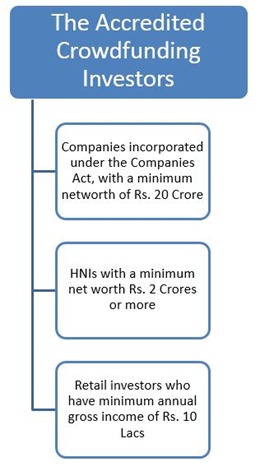

– SEBI has proposed to put certain limitations on who could be a crowdfunding investor. They have proposed the limitations in India after looking at what other countries like US, UK, France and other have done.

Only Accredited investors can invest money in crowdfunding projects and here are the qualifications of an accredited investor.

Retail investors who are eligible needs to pass an Appropriateness Test and will need to avail services of a portfolio manager or investment advisor. They should have also filed tax returns for last 3 years, and have to certify that they will not invest more than Rs. 60,000 in an issue through crowdfunding platform.

Limits to Crowdfunding Investment

SEBI will allow private placement offers through internet based crowdfunding platforms to any number of QIBs and a maximum of 200 HNIs and ERIs combined.

Collectively, QIBs will need to hold a minimum of 5% of the securities issued and a company will be required to purchase atleast 4 times the min offer value per person. A high networth individual is required to purchase at least 3 times the minimum offer value per person.

Also, for a retail investor, the total of all investments in crowdfunding in a year should not exceed 10% of their net worth.

Apart from these, there are certain conditions that an accredited investor should meet. As the investment will be done through Demat, the investors should hold a demat account and the payment has to be made through a DD or cheque. Payments by Cash or Credit Cards is not authorized.

Also, a person will only be eligible as a investor he they are an Indian citizen or a NRI.

Who are eligible to Raise Crowdfunding?

A early stage startup or SME which is an unlisted public company incorporated in India are eligible to raise crowdfunding if they meet following criteria.

- The company intending to raise capital NOT exceeding Rs. 10 Crore in a period of 12 months

- A company which is not promoted, sponsored or related to an industrial group which has a turnover in excess of Rs. 25 Crores.

- A company which is not listed on any exchange

- A company which is not more than 4 years old

- A company which is not engaged in real estate and activities which are not permitted under industrial policy of Government of India.

- The companies should not haves directors, promoters or associates mentioned as a

‘defaulter’ or a ‘willful defaulter’ by RBI or CIBIL.

Apart from these, SEBI also states that a company wanting to raise crowdfunding should not list on multiple crowdfunding platform. The companies should compulsorily route all crowdfunding issues through a SEBI recognized Crowdfunding Platform.

The company interested in crowdfunding should also provide provisions for oversubscription.

Among other conditions, the issuers will not have any single investor holding more than 25% stake in the company and the promoter(s) shall be required to maintain a minimum of 5% equity stake in the company for at least 3 years.

For more details, you can check out the SEBI Consultation paper