Suhail Rizvi, Mysterious Indian Origin Investor Makes $3.8 Bln With Twitter IPO

IPOs or Initial Public Offerings are exciting because it is just like a lottery. Investors buy the lottery tickets years in advance, hoping that when the curtains are raised, they hit jackpot.

And one such jackpot has been won by a mysterious India born investor, who has just made $3.8 billion after Twitter’s IPO went public this week.

Meet Suhail R. Rizvi, 47, who runs Michigan based Rizvi-Traverse Management LLC and host of other funds which invests in companies and then make a fortune out of that. Besides Twitter, he has invested in Facebook, Square, Pinterest and Flipboard. Out of tech world, he has invested in Playboy, and several movie producing companies such as Summit Entertainment which has distributed Twilight movie all over the globe (yes, Twilight, the multi million dollar movie series)

The Twitter IPO Player: Suhail R. Rizvi

In the year 2010, his long time friend and advisor Chris Sacca, who is a former Google executive, informed Rizvi that Evan Williams has resigned as Twitter’s CEO and wants to sell his 10% stake in the company. He didn’t take more than a second to make a major decision, and hours later, he owned 10% stake in Twitter, by paying $340 million to Evan.

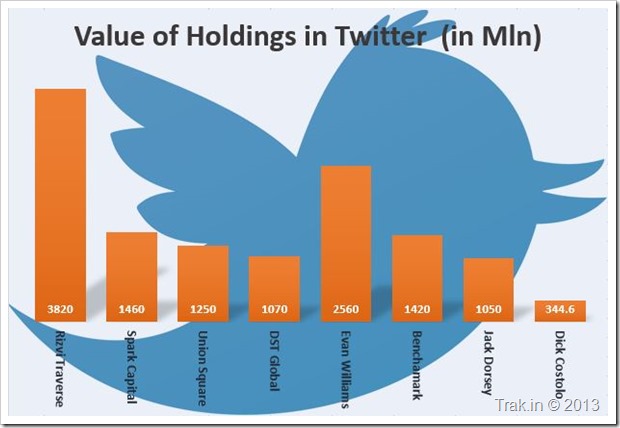

In fact, right now, he is the biggest ‘outside’ investor in Twitter with 17.9% stake; which translates to 85,171,093 shares. Taking into consideration $44.90 price of each Twitter share at the closing of opening day trade, this amounts to $3.8 billion in hard cash.

[Chart created based on numbers from Reuters]

Suhail is a low profile investor, and his whereabouts are known to only select few such as Eric Schmidt, Google co-founder, Richard Branson, founder of Virgin Group, Salar Kamangar, chief executive of YouTube and few other high profile entrepreneurs and rich Arab princes. He is definitely not a Page 3 person, and there is hardly any interviews of him published anywhere.

Last year, his name gained some prominence, when he invested $200 million in Jack Dorsey’s payments company, Square. Other than that, he is sometimes spotted partying in yachts owned by Eric or at Playboy mansions. He is very close to Richard Branson, and it is rumored that he has helped him clinch several high profile investments in the last 20 years.

Suhail was born in India, but was brought up in US. He did his graduation from Wharton School of the University of Pennsylvania and sits on the Wharton Undergraduate Executive Board as well.

Would you have invested in a company like Twitter, way back in 2009-2010? As an investor, how will you describe Suhail’s strategy? Please share your feedback!

[…] Quote from the source: … […]