All you need to know about CIBIL and Credit Score!

CIBIL Credit Scores are increasingly becoming important as nearly all institutions have started using it to scan through Individual Financial history. In this article we try to touch upon everything that you must know about CIBIL and your credit scores.

Contents

What role does CIBIL play?

Credit Information Bureau (India) ltd- CIBIL, is India’s first and leading Credit Information Company. They collect and maintain records of individuals’ payment pertaining to loan and credit cards. These records are submitted to CIBIL by banks and other lenders, on a monthly basis. This information is then used to create CIBIL Transunion Score and Credit Information Reports (CIR) which is provided to lenders in order to help evaluate and approve loan applications.

What is a Credit Score and a Credit Information Report?

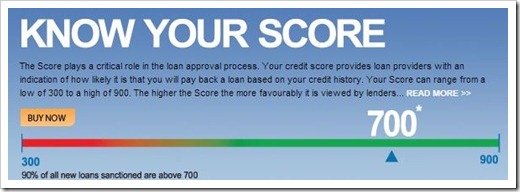

A Credit Score ( is a three digit numeric summary of your credit history. The value ranges from 300 to 900; the higher the numerical value of the score, the more creditworthy is the individual. Your Credit Information Report (CIR) contains the details of all the loans and credit cards that you have taken across lenders along with their payment details and account status.

The Credit Report is broadly divided into the below sections:

- CIBIL TransUnion Score (Credit Score)

- Borrower Information

- Personal Information- This section contains your personal details such as DOB, Pan Card, Voters ID number among other identifiers

- Contact Information- This section contains up to 4 contact details (address and number) as reported by various lenders

- Employment Information- This contains the income details and income type as reported at the time of applying for credit

- Account Information- This is a critical section as it contains all the details pertaining to your Loan (Personal loan, Home loan and Credit card. It details out the payment pattern, account status, current balance, and credit limit among other information.

- Enquiry Information- The section highlights the enquiries that are being made by various lenders. So it details out the name of the lender who is making the enquiry along with for which product and the amount that it has been enquired for.

Where all is the Credit Score used and for what?

– A CIBIL TransUnion Score (and CIR) plays a critical role in the loan approval process. Lenders look at the Credit Score as one of the main eligibility criteria in the credit decisioning process. Higher the score better are the chances for a loan approval. 90% of the loans and credit cards sanctioned are for individuals with Credit Score greater than 700.

– Credit Card companies look at a CIBIL TransUnion Score (and CIR) for not only deciding on issuing the card but also in determining the Credit limit to be sanctioned

– Telecom operators are increasingly looking at the Credit Score for determining the Credit limit to be granted for its post-paid mobile subscribers.

– Lot of employers’ today request prospective candidates to share their CIBIL TransUnion score (and CIR) in order their credentials. The basic tenet of doing this check is to reduce the risk to the organization’s human, financial, informational, technological and physical resources.

What are the factors that affect your Credit Score?

- Late payments or defaults in the recent past

- High utilization of Credit limits

- High percentage of Credit Cards or Personal loans (commonly known as unsecured loans)

- Too many enquiries made in the recent past by lenders. (Generally, if you have applied for loan or Credit cards number of times)

How to improve your score?

- Always pay your installments on time

- Keep your balances low (i.e., the extent to which you use your Credit limit)

- Maintain a healthy mix of Credit (i.e., have a mix of secured and unsecured loans)

- Apply for new credit in moderation

- Monitor your co-signed accounts, joined accounts and accounts where you are acting as a guarantor closely

- Review your credit history frequently throughout the year

[This guest post has been compiled by the team at CIBIL Consumer Relations]

[…] is India’s most powerful and biggest credit rating agency. As of now, it has financial database of more than 260 million Indians, and around 12 million […]

Good info about the process. I felt every one should try to get good scroe, else they need to pay high interest rates.. suresh… http://myinvestmentideas.com

i screwed up my credit score by missing few installments of home loan and also using credit card irresponsibly and had bad remarks on my cibil report…thn a frnd introduced me to this company named creditsudhaar(creditsudhaar) and they helped me remove negative remarks and also improve my score…

Have another perspective on how to apply for CIBIL online at http://www.myfamilyinvestment.com/2012/10/how-to-get-credit-score-online-through.html.

In a country where there is a massive infrastructure requirement that cannot even confirm what is the Tax Deducted at Source of an Individual, CIBIL rating is an instrument “created” by Financial Agencies to mislead you. Till such time, CIBIL rating is not available for individuals to check up, it is at best a scam. Credit Card companies make no money on Individuals who pay up on time. They make 2.95% per month on individuals who do not pay up or whopping late charges on people who pay up late. Whom do you think they will prefer to give cards to?

No bank will offer you a lower interest rate just because you have a rating of > 700. Their own margin suffers. At most, they will offer you a higher loan. Get a fact check.

I think people’s credit rating should be based on the Taxes they pay. Tax Payers (basically honest guys) will have the highest ratings. The higher the Tax you pay- the higher the rating. Simple. Straightforward.

Rox

You must be paying tax on time. you must be paying higher tax also, but this is not the situation with everyone. Cibil importance is there, if banks had checked the history before giving loans in 2008, we would not have suffered from recession. Today`s euro zone crisis is still lingering because of that recession

Nice needful information to all who ever apply for a loan. In none of any other websites said that above 700 points are eligible for Credit card issuance/load approval. It is very new information to me.I will spread this and it is worth to maintian/receive loan.How many years once we can check this credit score? Is by paying the due fees in last date will affect the score?? Does IT returns and Landline telephone bill and Life Insurance policies dues does are taken into account???Please answer because many of the times I paid with late fee..

Vandhana,

By it’s very nature, CIBIL tracks your credit score. As such those things which are “credit/ liability” in nature will be tracked. E.g. loan EMI, credit card dues etc. A life insurance premium is not a liability and not paying premium will not affect your credit score – don’t worry. Same applies to your bills.