Why is Indian Stock Market rising when Economy is falling?

Economy is at its worst, Rupee’s value is slipping, and estimates of GDP growth are falling by each report.

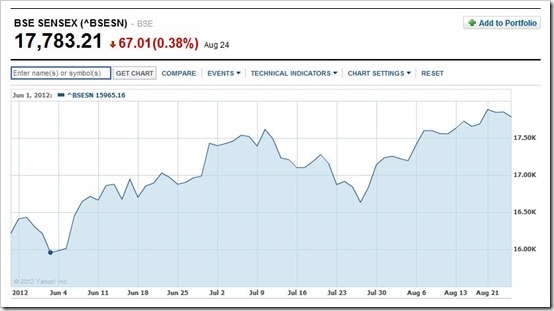

When all looks so glum then why is Sensex the index of growth booming?

Firstly economy and Sensex are two different things, but a booming Sensex infuses investor confidence in economy. Hence it is important for the Sensex to stay float at all times. Currently we are close to 18k at 17,783, though a fall of marginal 0.38% on Friday; it shows no sign of stopping.

Why?

FII – Foreign Institutional Investors are the answer. Economies all over the world are failing, including the emerging markets like India and China. But there is much more confidence in the Indian market than others.

Because every time there is a chance of slowing down or a big correction takes place, suddenly someone pumps in money (black money) and the Sensex bounces back. If not completely gradually, though faster than it will be if everything was happening due to legitimate reasons. So there is a fair amount of investor confidence. There is nothing called overnight phenomenon without any major fundamental change in economy.

So, we have had a lot of FIIs, $11.5 billion has been pumped in the stock Markets by them since January 2012. Things were basically worse off in other countries. Though off late most of the big stock indices have shown a positive trend like the US’s S&P 500 has gained 7.9% and Ibex-35 of the sour Spain is doing well.

This is because of nothing but a hope, that Euro crisis will be resolved using bailout packages, hence infusing liquidity into the markets. This hope stemmed from the fact that European Central Bank’s governor is keen on saving Euro and had categorically said that he would do “Whatever it takes” for the same. US Federal Reserve may follow suit and propose a bailout package if the economy fails to pick up.

So following the global trend of hope and the local trend of magic (black) money being poured in along with the FIIs, the Sensex (for now) is aiming for the sky.

The need of the hour isn’t just bailout money. Bailout money is like buying a kid chocolate because he scored less.

Though it is necessary to give the industries a little something to stand up again and improve productivity, it is important to re-structure the economy and improve the fundamentals. Otherwise we will have to face the same predicament over and over again.

The stock exchange is very flexible we can't say when it will increase and when it will come down, the above information is really very good keep sharing this kind of information. http://www.religareonline.com/

Indian stock market.

http://bizloanfinder.com/

Need working capital for your business loan, small business loans, commercial business loans, business loan rate, loan for business and business loans. Find latest tips, guides to find the capital for your business.

Do we consider this as the repeating of 2008 January Fall of Market? Banks were started shutting down in US in the year end of 2007 & SENSEX was making new High!

Yes

the global trend is very much the same. Infact in 2008 (I am not sure) Europe wasnt in this much trouble, rest whole situation is same as pre-2008

but this time the problem seems more grievous as the world hasn't fully recovered from the 2008 recession