We’ve talked about how IT is changing every nook and corner of the different industry sectors in India Inc. A recent survey by Zinnov Management Consulting revealed key performance indicators of adoption of IT in the Banking, Financial Services and Insurance (BFSI) sector in India.

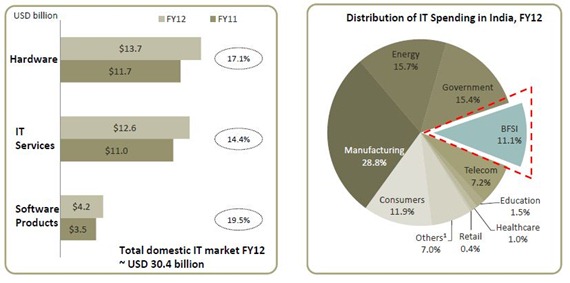

The survey noted that the total domestic IT market in FY 2012 was $30.4 billion. This includes Hardware, IT Services and Software Products and the top contributors were Manufacturing (28%), Energy (15.7%) and Government (15.4%). BFSI sector contributed to 11.1% of total spending for IT in India, or about $3.4 billion.

Recent trends in the BSFI sectors indicate that IT is the backbone of the key drivers behind diversification and growth of Indian Scheduled Commercial Banks. Innovative products like virtual debit cards and services like branchless and mobile banking require a mammoth IT infrastructure. Other facilities like single point account access and internet accessibility are also a reasons why the BSFI sector has seen a nearly 20% growth in aggregate deposits to $1,141 billion in 2010-11 as compared to $948 billion in 2009-10. Bank credit volumes also grew by 26% to %864 billion in the same period.

Other factors like increased regulatory and compliance requirements, significant geographical expansion and competition with foreign banks would have also prompted the banks to adopt IT. It would be fair to assume that increased volumes combined with the need to centralize operations would not be possible without the support of an intricate IT infrastructure.

Similar trends of growth have been witnessed in Financial Services and Insurance sectors as well. And interestingly, these growth trends also suggest that increased use of IT has been pivotal. Non-bank finance companies are increasingly relying on real time processing and implementing new financial products.

Insurance sector is increasing its footprint by finding newer means of connecting to the customer base including mobile, internet and E-Insurance accounts for existing customers. IRDA has requested statutory automation and higher levels of collaboration with banks would have demanded comprehensive IT systems, without which linking and consolidating data would be next to impossible.

To sum up, the Zinnov survey has laid out the 5 fundamental causal reasons for increased IT adoption in the BFSI sector in India. Regulatory requirement and other mandates laid out by authorities like RBI, IRDA, SEBI, etc are definitely at the top of the list. Companies in the BFSI sector are also looking to improve the efficiency of their own internal processes to align business needs with practicality and deliverability to their clients.

Besides regulations and process efficiency, companies in the BFSI sector turned to increased IT adoption to support their own growth strategies. Implementation of systems that allowed better customer experiences was also seen as a key driver. It does not take a rocket scientist to figure out that an enhanced customer experience will also companies to grow and expand their footprints into unbanked portions of population in India.

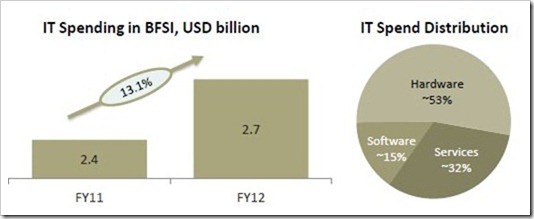

All these factors contributed to a 13% increase in IT spending by the BFSI sector. India Inc has witnessed some key deals go through recently including ones between IDBI Bank and Oracle, BOB and HP, Mannapuram Finance and IBM, Union Bank and Cisco/Wipro amongst others.

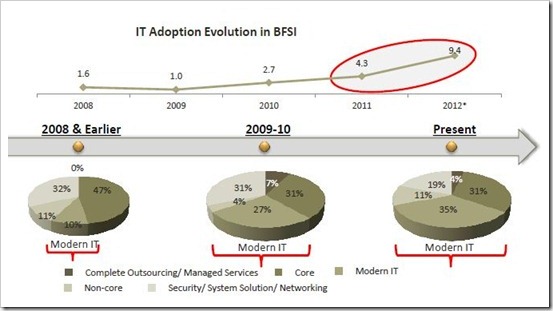

While IT adoption by BFSI sector in witnessed growth of about 63% in 2011, it is expected to double in 2012 based on the numbers tracked in first half of 2012.

So what are the types of IT solutions that BFSI companies are investing in?

Zinnov points out that Core Banking Solutions remains the top driver. Leading institutions like Kotak Mahindra, IndusInd Bank and many other Co-operative banks amongst others are either implementing CBS for the first time or updating their existing systems.

Following CBS, other drivers like Business Enabling Solutions, Peripheral Applications and Security Compliance were the reasons behind increased IT adoption. Axis Bank has incorporated Microsoft Enterprise Project Management to manage workflow while ICICI Prudential uses Workload Automation for process automation. Among other highlights, HDFC Bank implemented a peripheral solution to manage treasury transactions and Axis Bank implemented a SatNav solution to map each of its offices in detail.

Last but not the least, Business Intelligence, Mobile banking and Social networking are tail-end drivers of the surge in use of IT in the BFSI sector in India. Yes Bank is trying to understand its customers’ behavioural patterns by deploying its very own business intelligence solution. Amidst much publicity, ICICI Bank launched its Facebook app to connect with an increasing online customer base.

Of course, there are no free lunches and increased IT adoption in the BFSI sector comes with risks and challenges. Who sets standards for IT systems? Is there adequate compliance for privacy of customer data? Are banks and financial institutions taking adequate steps to secure their systems and data? What happens to the smaller players who can’t afford massive investments to automate their systems?

These are some of the key challenges that the Zinnov survey puts forward. However as India Inc is poised to become one of the most promising investor friendly destinations in the world, an IT friendly BFSI sector is a top asset to have.

Nice Article on importance of IT in BFSI.

Some experts had projected that IT sector will see its bad phase in India now as the US economy is falling but these figures have changed the complete scenario. It is really difficult to grow in business with full pace without technology support.