BSE Sensex crosses 18000 on declining Inflation & Rate cut prospects !

BSE Sensex is back to its winning habit – the Indian benchmark index has crossed a key psychological resistance of 18000 to be comfortably perched at the highest level since August 2011, backed by emergence of favorable macroeconomic scenario over the last one month.

Not surprisingly, leading the race among the key index (S&P CNX Nifty) constituents, over the last one month, are rate sensitive stocks such as Reliance Infrastructure (54% gains), JP Associates (40%), Tata Motors (35% gains), Maruti (30%), Axis Bank (28%), IDFC (28%) and DLF (27%).

After a spate of negative news on global crisis and deteriorating fiscal environment back home, finally there is a ray of hope at the other side of the tunnel with headline inflation turning down its head and key interest rates on the brink of downward journey.

[Image Source]

On the global front, the Asian markets remained firm on Japan’s central bank expanding its asset buying program by pumping incremental $130 billion into its ailing economy amid global uncertainties. On the other hand, tremors from the Greek sovereign crisis have also subsided for the time being as the country is all set to buy time with a second bailout and avoid default.

Back home, India’s wholesale-price index slumped to over two-year low of 6.55% in January on declining food prices; further sparking hopes to the RBI’s case of lowering interest rates as economic growth weakens and inflationary pressures remains curbed.

Last month, India’s central bank signaled readiness to soften its harsh monetary tightening spree by cutting the CRR by 0.5% to mark a shift in its policy from fighting inflation to reviving growth. This measure is expected to ease structural pressures on liquidity in the system. However, the RBI had retained the policy repo and reverse repo rate at 8.5% and 7.5% respectively.

Thus, with the reversal in macro environmental factors, stocks from the rate sensitive sectors such as banking, real estate and automobiles are the ones to have joined the party with extra vigor to prop-up the benchmark indices to over October-end highs.

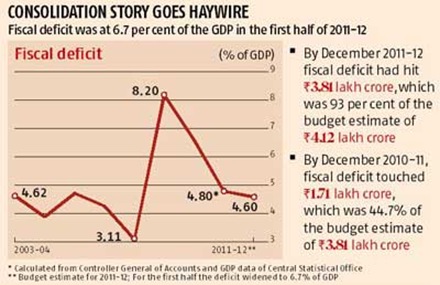

However, not all the optimism is based on improved macro fundamentals, as a part of it can also be attributed to the pre-Budget rally. In fact, every thing is not as hunky-dory on the economic front as is portrayed – for instance, India’s fiscal deficit during April to December 2011 had reached a peak of Rs.3.81 lakh crore, almost hitting the full-year budget estimate of Rs.4.12 lakh crore.

How long do you feel this stock market rally can sustain further?

Market was fantastic today. It was hopeful that market will open higher today but it performed more than expected. we can say that inflation figures and Rate cut roumors has provided strength to the market but the real reason behind this bullish nature is strong asian cue.