I had this question in my mind for a very long time – How many Indians are actually covered under Insurance. The reason I was curious about this number was because I am really surprised at the amount of ignorance Indian people have about Insurance – Many of my well educated friends also do not avail of insurance and do not feel any need for it.

The Insurance sector in India was opened to private players in 2000 and with private Insurance companies coming in and sensitizing the citizens through barrage of advertising, the awareness of insurance seems to have increased lately. However, I came across some numbers released by Insurance Regulatory and Development Authority (IRDA) yesterday and looks like India needs to do lot more to increase awareness of Insurance amongst the masses.

State of Insurance in India

According to latest IRDA figures, India has about 57 crore of insurable people. Out of which Private Life Insurance companies have 4.03 crore Policies in force which cover about 4.20 crore lives [upto 31st March 2010].

Here are some of the highlights released by IRDA:

- The insurance penetration has increased from 2.32% to 5.51% over the period 2000 to 2010.

- The number of insurance offices has increased from 2,199 in 2000 to 12,018 in 2010.

- From the single channel system of tied agents which was predominant before opening up of the sector in 2000, multiple channels of distribution comprising brokers, bank assurance, corporate agents emerged accounting for nearly 21 percent of all new business in the year 2009-10.

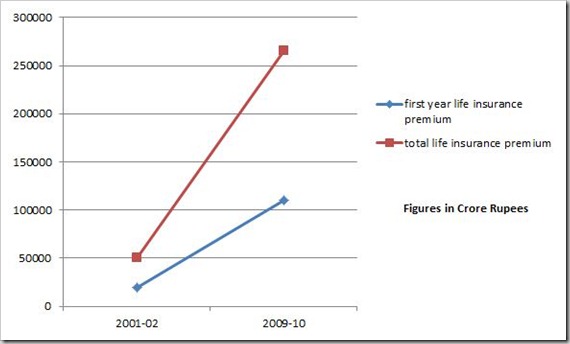

- The first year life insurance premium grew from Rs.19,857.28 crore in 2001-02 to Rs.1,09,894.02 crore in 2009-10.

- The total life insurance premium rose from Rs. 50,094.46 crore in 2001-02 to Rs. 2,65,450.37 crore in 2009-10.

Number of Public & Private Sector Insurance Companies in India

| Life Insurers (As on 20.06.2011) | Non-Life Insurers(As on 05.08.2011) |

| Public Sector: | Public Sector: |

| 1. National Insurance Co. Ltd | |

| 1. Life Insurance Corporation of India | 2. The New India Assurance Co. Ltd |

| 3. The Oriental Insurance Co. Ltd | |

| 4. United India Insurance Co. Ltd. | |

| Private Sector: | Private Sector: |

| 1. Bajaj Allianz Life Insurance Company Ltd | 1. Bajaj Allianz General Insurance Co. Ltd |

| 2. Birla Sun Life Insurance Company Ltd | 2. ICICI Lombard General Insurance Co Ltd |

| 3. HDFC Standard Life Insurance Company Ltd | 3. IFFCO Tokio General Insurance Co. Ltd |

| 4. ICICI Prudential Life Insurance Company Ltd | 4. Reliance General Insurance Co. Ltd |

| 5. ING Vysa Life Insurance Company Ltd | 5. Royal Sundaram Alliance Insurance Co. Ltd |

| 6. Max New York Life Insurance Co Ltd | 6. Tata AIG General Insurance Co. Ltd |

| 7. Met Life Insurance Company Ltd | 7. Cholamandalam MS General Insurance Co. Ltd |

| 8. Kotak Mahindra Old Mutual Life Insurance Company Ltd | 8. HDFC ERGO General Insurance Co. Ltd |

| 9. SBI Life Insurance Co Ltd | 9. Export Credit Guarantee Corporation of India Ltd |

| 10. Tata AIG LIFE Insurance Co. Ltd | 10. Agriculture Insurance Co. Ltd |

| 11. Reliance Life Insurance Co Limited | 11. Star Health Insurance Co. Ltd |

| 12. Aviva Life Insurance Co Ltd | 12. Apollo Munich Health Insurance Co. Ltd |

| 13. Sahara India Life Insurance Co. Ltd | 13. Future Generalli India Insurance Co. Ltd |

| 14. Shriram Life Insurance Co. Ltd | 14. Universal Sompo General Insurance Co. Ltd |

| 15. Bharti AXA Life Insurance Company Ltd | 15. Shriram General Insurance Co Ltd |

| 16. Future Generali India Life InsuranceCo.Ltd | 16. Bharti AXA General Insurance Company Limited |

| 17. IDBI Federal Life Insurance Co. Ltd | 17. Raheja QBE General Insurance Company Limited |

| 18. Canara HSBC Oriental Bank of Commerce Life Insurance Co. Ltd | 18. SBI General Insurance Co. Ltd |

| 19. AEGON Religare Life Insurance Co. Ltd | 19. Max Bupa Health Insurance Co. Ltd |

| 20. DLF Paramica Life Insurance Co. Ltd | 20. L&T General Insurance Co. Ltd |

| 21. Star Union Dia-ichi Life Insurance Co. Ltd | |

| 22. India First Life Inasurance Co. Ltd. | Re-Insurer: |

| 23. Edelweiss Tokio Life Insurance Co. Ltd. | 1. General Insurance Corporation of India |

Conclusion: Although, India has seen more than 10 fold rise in Insurance (coverage as well as premium), the Insurance penetration in India is extremely low compared to most developed countries.

For example, in America, in 2010, over 83.3 percent of people had health insurance compared to just 5.51 percent Indians. Although American health insurance Industry is primarily driven by relatively huge medical bills, India is also moving towards similar path.

What’s your take?

hi all friends

i m in insurance profetion. if any body want insurance policy or pention planning for his owne life must call me or send email to me. my cell no. 098253 75660.

thank you to all

What is the percentage of Insured population in India as on date?

WANTS TO KNOW, WHAT % OF PEOPLE COVERED BY INSURENCE, SAPERATELY LIKE LIC, AND OTHERS.REST IS GOOD.

Indian govt. should take steps to provide insurance to all indians by nominal premium as per their level of living

v.venkata reddy

agent advisor

I was working as a textile engineer,but after retirement from my job,i am working as an financial advisor and agent to max new york life at Ghaziabad,i got the excellent training of insurance field,i had written about how agents of max new york life advises their customers in my blog http://vinay-commercial.blogspot.in

recently i am also started to provide health insurance of max buppa.

my mobile number is 9873495770

Hey thanks for sharing information on different providers in public and private sector. I personally had a good experience with Royal Sundaram health insurance – http://royalsundaramhealthinsurance.weebly.com/. They offer plans which provide excellent benefits and have different plans as per the requirements of the common man. Just to keep updated on health insurance terms I keep on browsing through the blogs and articles; one of their articles clearly explains their health plans, guys who are looking for a plan can always refer it.

Always try to go for full time Insurance advisors rather than a part time one.

Full time Advisors will be ready to help you whenever you want.

Parttime Insurance Advisors may give commitments but interms of service, you have to run for your money.

So, take care before taking a plan.

I am surprised by this article. I was under the impression that state units like LIC, GIC, UTI cover every nook and corner of India. In fact I believe LIC covers more rural areas than urban areas.

Its a very informative description. Came to know names of public and private sector insurance companies in India.

Private Sector is a boom in insurance sector but many of their executive try to fool persons interested in insurance. They tell us some thing and sells us some thing. So beware of taking a policy from private sector.