Stock Market Pre-Opening Session–Overnight News to be Reflected in the Opening Price

Starting from today, the stock exchanges have opened with a 15 minute pre-opening session for the 50 stocks in the NSE’s Nifty index – in order to arrive at an indicative equilibrium price point at the start of the trade.

The Bombay Stock Exchange and National Stock Exchange have introduced the pre-opening sessions starting from 9 AM for the securities forming constituents of the NSE Nifty and BSE Sensex, in a move to allow the overnight news to be suitably reflected in the opening prices.

Further, the market for other securities resumes from 9.15 AM and will close at the regular time of 3.30 PM on the bourses.

Under the old system, the open price of a security was based on the first price traded on the exchanges. Often, such opening rates could be manipulated by some freak trade fed into the system based on order placements at market prices on the opposite end.

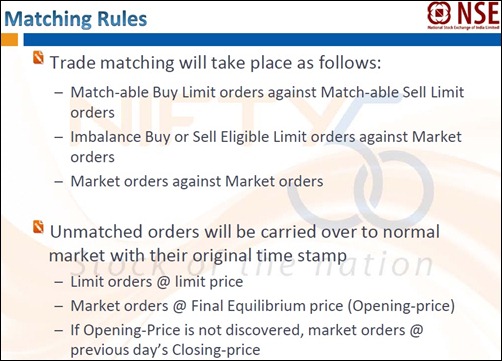

However, with a makeover in the rules, now the orders are accumulated for the first seven minutes of the session, followed by a system driven random halt anytime between 7th and 8th minute. During the next 4-minutes window, trades get executed at a single price backed by appropriate order matching mechanism.

The pre-opening session will give an idea as to what the market is going to open like and can be perceived as a preview to the opening tick on the bourses which will reduce initial price swings.

A point to be noted over here is that only ‘Limit’ and ‘Market’ price orders will be allowed to be placed in the pre-opening session conducted to discover the market-determined opening price at which maximum quantity of orders can be matched. Orders that do not satisfy the margin requirement shall not be able to participate in the pre-open session.

In short, it would be akin to a movie-trailer before the real movie begins.

what the mr.Altaf Rahman says is perfectly correct.our share market is dependent on wall street,nikki,shanghai, sgx nifty, on ftse, cas ,dax etc. .the world market affect us more than our own economy.its a shame.

What is the exchange trading? Huge halls where run at once come to mind, something cry out and stockbrokers swing hands. In the modern world – the markets unite, trade becomes basically electronic, fulfillment of operations occupies now few seconds.

Wow !! Nice information.

Market controllers have addressed the abnormal trade related issues very professionally. As explained the moves are very logical.

However I also have a suggestion (just my two paisa).

Why trading can not go on round the clock? The reason why I am suggesting this is some thing like this :

Suppose some explosion happens at Reliance Refinary at 11.30 am. (I am a strong supporter of Reliance and wish them all the success. The example is only to explain my point of view. Please do not misunderstand me and write negetive comments for even thinking about it) As soon as the news spreads, RIL stock will crash. Those who are near TVs and sitting on trading terminals will immediately sell RIL and get into cash assuming when the stock hits bottom they can again buy back. Those who are late in getting the news will sell after the stock has crashed to its lowest. Sounds logical. Isn’t it? The logic is those who get right info and take right action first will benifit. Similarly those who are late in getting info and reacting late will lose. Sound logic.

Now suppose the same explosion occurs at 9 pm. Suppose I hear the news first. But I can not sell till 9 am tomorrow morning. By then every tom dick and harry will know and all will place sell orders at the same time. No benefit for me in being the first to get right information.

Why?

Because we all have to wait till the Sun comes up. Why we have to wait till Sun comes up? What has the Sun got to do with trading? If they would have allowed trading round the clock, I would have benifitted. So why not trade round the clock?

Similerly suppose if some earthquake shakes some country and its rulers are killed. The next day its currency crashes. Why wait till next day to reflect the event? Why not this moment?

There are so many other examples like this.

The reason why they trade only after the Sun comes up is our centuries old practices which we are still following.

In olden days all activities were conducted during day time and as soon as sun sets, people will retire to their homes to have dinner and sleep. No worldly activities (except few such as marriage functions) So we are subconsciously following the same practices. Now we are living in modern times where info passes in seconds around the globe. Factories run round the clock. Hospitals are open round the clock. Power plants run round the clock. IT industry run round the clock. Then why not trading??

I feel we should start trading round the clock i.e. 24 X 7 to reflect stock prices as events happen without waiting for clocks to tick to certain point.

Just my two paisa to make readers think and debate.

Now suppose the same event

its not very practical round da clock trading. Let people sleep “araamse”. Otherwise, the working class people who dont get the time to trade in day time, will trade @ night. People will become greedy and that will effect their day time life. Sorry buddy, its not an good idea. Ya, one thing is possible. Increase in trading hours. Trading can start from 7:00 am to 10:00 or 11:00 pm. So that maximum people can have an exposure.

about one thing m sure altaf ; if the trading goes round the clock,,,,,,,,then,,,,,,,,,the nifty or any stock that gives GAP UP or GAP DOWN opening,,,,,,,,,will not take place…………

and the market will flow in much slower pace…………..