Satyam letter from Mr. Ramalinga Raju to its board directors admitting fraud !

Now this is a bummer…Here is a letter from Satyam Head Mr. Ramalinga Raju to its Board of Directors.

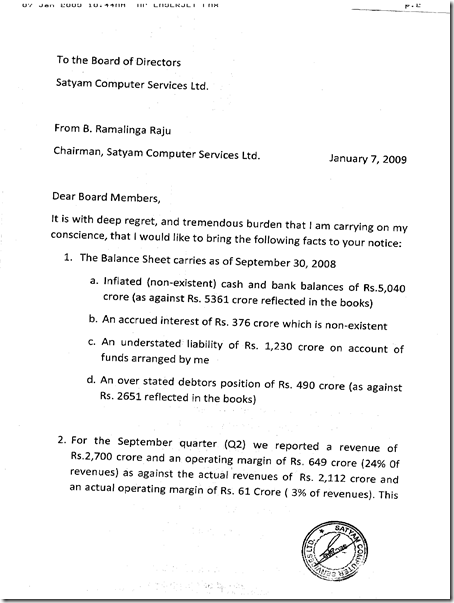

Part 1

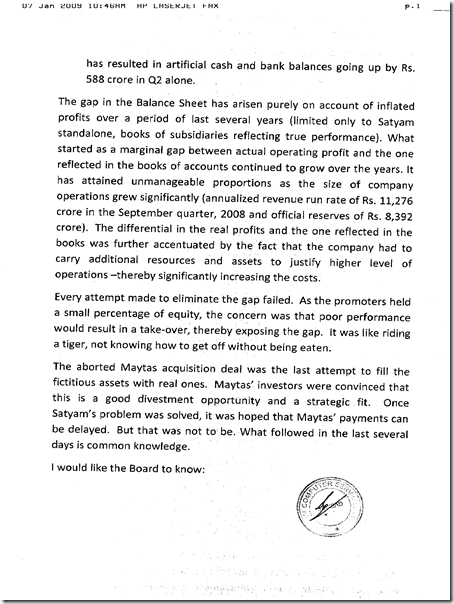

Part 2

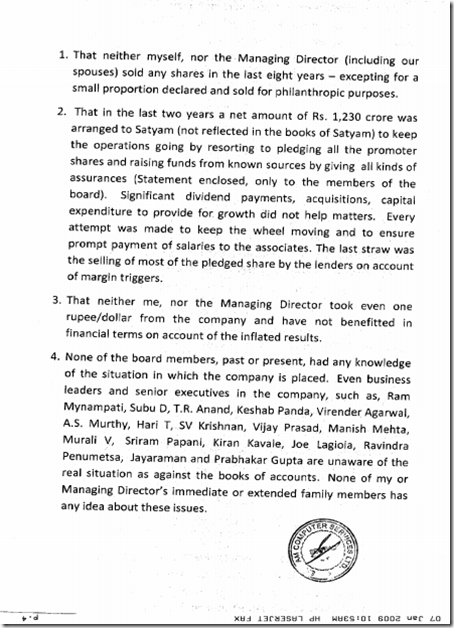

Page3

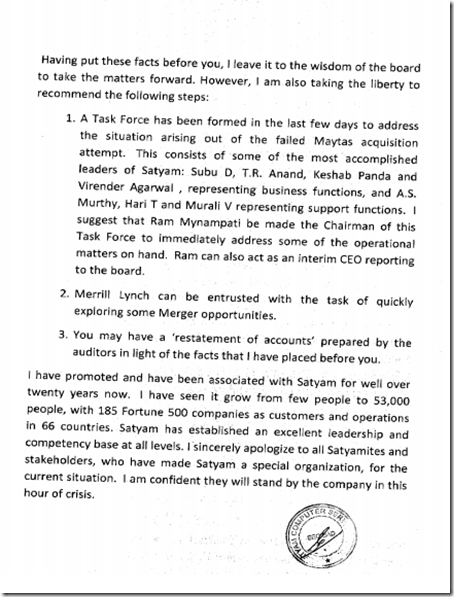

Page4

Page 5

——————————————————

To the Board of Directors

Satyam Computer Services Ltd. Dear Board Members, It is with deep regret, at tremendous burden that I am carrying on my conscience, that I would like to bring the following facts to your notice:

- The Balance Sheet carries as of September 30, 2008

- Inflated (non-existent) cash and bank balances of Rs.5,040 crore (as against Rs. 5361 crore reflected in the books)

- An accrued interest of Rs. 376 crore which is non-existent

- An understated liability of Rs. 1,230 crore on account of funds arranged by me

- An over stated debtors position of Rs. 490 crore (as against Rs. 2651 [cr.] reflected in the books)

- For the September quarter (02) we reported a revenue of Rs.2,700 crore and an operating margin of Rs. 649 crore (24% Of revenues) as against the actual revenues of Rs. 2,112 crore and an actual operating margin of Rs. 61 Crore ( 3% of revenues). This has resulted in artificial, cash and bank balances going up by Rs. 588 crore in Q2 alone.

The gap in the Balance Sheet has arisen purely on account of inflated profits over a period of last several years (limited only to Satyam standalone, books of subsidiaries reflecting true performance). What started as a marginal gap between actual operating profit and the one reflected in the books of accounts continued to grow over the years. It has attained unmanageable proportions as the size of company operations grew significantly (annualized revenue run rate of Rs. 11,276 crore in the September quarter, 2008 and official reserves of Rs. 8,392 crore). The differential in the real profits and the one reflected in the books was further accentuated by the fact that the company had to carry additional resources and assets to justify higher level of operations — thereby significantly increasing the costs.

Every attempt made to eliminate the gap failed. As the promoters held a small percentage of equity, the concern was that poor performance would result in a take-over; thereby exposing the gap. It was like riding a tiger, not knowing how to get off without being eaten.

The aborted Maytas acquisition deal was the last attempt to fill the fictitious assets with real ones. Maytas’ investors were convinced that this is a good divestment opportunity and a strategic fit. Once Satyam’s problem was solved, it was hoped that Maytas’ payments can be delayed. But that was not to be. What followed in the last several days is common knowledge.

I would like the Board to know:

1. That neither myself, nor the Managing Director (including our spouses) sold any shares in the last eight years — excepting for a small proportion declared and sold for philanthropic purposes.

2. That in the last two years a net amount of Rs. 1,230 crore was arranged to Satyam (not reflected in the books of Satyam) to keep the operations going by resorting to pledging all the promoter shares and raising funds from known sources by giving all kinds of assurances (Statement enclosed, only to the members of the board). Significant dividend payments, acquisitions, capital expenditure to provide for growth did not help matters. Every attempt was made to keep the wheel moving and to ensure prompt payment of salaries to the associates. The last straw was the selling of most of the pledged share[s] by the lenders on account of margin triggers.

3. That neither me, nor the Managing Director took even one rupee/dollar from the company and have not benefitted in financial terms on account of the inflated results.

4. None of the board members, past or present, had any knowledge of the situation in which the company is placed. Even business leaders and senior executives in the company, such as, Ram Mynampati, Subu D, T.R. Anand, Keshab Panda, Virender Agarwal, A.S. Murthy, Han T, SV Krishnan, Vijay Prasad, Manish Mehta, Murali V. Sriram Papani, Kavale, Joe Lagioia, Ravindra Penumetsa, Jayaraman and Prabhakar Gupta are unaware of the real situation as against the books of accounts. None of my or Managing Director’s immediate or extended family members has any idea about these issues.

Having put these facts before you, I leave it to the wisdom of the board to take the matters forward. However, I am also taking the liberty to recommend the following steps:

1. A Task Force has been formed in the last few days to address the situation arising but of the failed Maytas acquisition attempt. This consists of some of the most accomplished leaders of Satyam; Subu D, T.R. Anand, Keshab Panda and Virender Agarwal , representing business functions; and A.S. Murthy, Han T and Murali V representing support functions. I suggest that Ram Mynampà ti be made the Chairman of this Task Force to immediately address some of the operational matters on hand. Ram can also act as an interim CEO reporting to the board.

2. Merrill Lynch can be entrusted with the task of quickly exploring some Merger opportunities.

3. You may have a testatement of accounts’ prepared by the auditors in light of the facts that.I have placed before you.

I have promoted and have been associated with Satyam for well over twenty years now I have seen it grow from few people to 53,000 people, with 185 Fortune 500 companies as customers and operations in 66 countries. Satyam has established an excellent leadership and competency base at all levels. I sincerely apologize to all Satyamites and stakeholders, who have made Satyam a special organization, for the current situation. I am confident they will stand by the company in this hour of crisis.

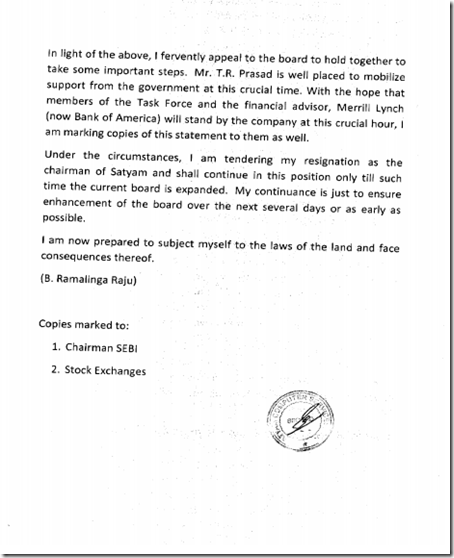

In light of the above, I fervently appeal to the board to hold together to take some important steps Mr T R Prasad is well placed to mobilize support from the government at this crucial time. With the hope that members of the Task Force arid the financial advisor, Merrill Lynch (now Bank of America) will stand by the company at this crucial hour, I am marking copies of this statement to them as well.

Under the circumstances, I am tendering my resignation as the chairman of Satyam and shall continue in this position only till such time the current board is expanded. My continuance is just to ensure enhancement of the board over the next several days or as early as possible.

I am now prepared to subject myself to the laws of the land and lace consequences thereof.

(B. Ramalinga Raju)

Copies marked to:

1. Chairman SEBI

2. Stock Exchanges

———————————————————————

[…] scam at Satyam Computer Services is something that will shatter the peace and tranquility of Indian investors and shareholder […]

[…] 25% growth estimates for 2010 reinforces the confidence of global corporations in India, despite a one-off occasion of Satyam Computers fiasco in the midst of the global recession. Fortunately, the BPO industry has come out unscathed […]

[…] mark on India’s face. Countries around the world are following this story closely and another ‘Satyam Saga’ kind of story may very well tarnish India’s […]

[…] a Single India company features in this list of most Ethical companies in the world. do you think Satyam’s fiasco has anything to do with this […]

Although there has been misgovernance on his part but he cannot be solely critised for this as he did the best to his knowledge to get the company back to Normal conditions and has given his statements the Letter above only when he found that the situation was totaly out of his control.A good part from him could have been his letting the Board know a few days ago so that the situation would have not got this worse. The Board and people concerned should now work properly and concentrate on the future of the employees and investors of the company who are being effected.

The fiasco is unique in its self.

I am sure that the government will take full control of Satyam and its employees. Government must support the company in coming out of the crisis. The employees should work more sincerely so that the clients do not complain and take back there orders.

The problem is just not for the Satyam employees but if the company goes down, we can have severe effects on the economy.

I am sure the companies liabilities cann be paid off by the extra assets which the company has.

Is it possible to run a corporate society fradulently from meny years where the auditors involved. so the company law board & ICAI need to concentrate the areas which are not in our vision.

After all these revelations, its fair to say that he lived up to the companies name (SATYAM). In the end “He Spoke truth nothing but the truht”.

Good atleast he exposed himself but there are so many corporates who are doing this kind of activities from so long and still standing on top. Even i worked for a corporate company and forced to fabricate things to show wrong balance sheets to get loans from big banks like IDBI and later showed them that it is under loses. Thank god i left that company and left this country as well because of all these greedy and corrupted people. What so ever happened is happened but i appreciate his courage to come forward and revealed so that we learn a lesson.

With Madoff and now Raju “coming out”, the next few months may see more such fraudsters exposed. Raju couldn’t have pulled this off alone – there must have been complicity from the CFO, auditors etc.

This is the only way to get ride of such situation. We can not say Raju as 420. He was a chairman of india’s 4th largest company giving employment to 56000 people. All this work done by raju is to save his company’s share. No matters while u r in the field.

Thanks & regards

Humm,

Well what mr. rama did might be unethical for sure i was upset when i heard the news first time but i donot think now that its totally him we can blame he did found the company made 55000 homes earn a livlyhood,its our greedy society and investors who push for more profit and try to suck every posible blood drop from the company.

I think rama loves the company to well to see it go to under ,i think thats why he has desided to be the scrape goat and take all the blame to give the company a last chance to survive has anyone thought about that ?

It is a pitiable situation in the history of world corporates.We saw many frauds and bankrupts in the past but this situation is unique one.People may forget as time passes but the scratch will remain forever. Now all the intelligent in the world must think about the situation and the damage should be assessed. They must take steps that it should not be repeated again.They must think the damage and risks to the investors,customers, and employees separately.

thank you

The declaration made by mr raju in case of satyam is great concern to the indian economy and corporate goverance . it has put auditors, investors,instition and stakeholders in trouble water.

mr rahu has not explained how he has inflated the cash and bank balance and it is just out of imagination to hold such huge cash on hand .therefore is has to be invetigated in roots.

Auditors price water house shold be suspended immediately from alll the places of audits of all compnies.

This is a significant loss of integrity for the company besides the finances.

PwC, the auditing firm, not knowing this is impossible and is complicit in this affair. (Is this loaded with former Anderson Consulting types from one Enron incident?)

The board not knowing this is possible but a few must have been in the know as well.

Family members not knowing is unlikely considering the general feudalistic mindset (continuing the family line in a public company, the Maytas affair, etc.)

The World Bank affair will now be more directly linked to Ramalinga Raju now than before as he has lost all standing.

well there is no doubt about it that Mr.Ramalinga Raju has accepted in front of the public but it is an offence so the stakeholders shoulb be taken care off.They should come up with some solution for them.

hey thanks for the information.Even if the information is on the websites i appreciate your efforts for providing us with this.Atleast we do not have to take pains to go to the websites when we get the postings in the mail and mail box is something we check almost daily infact may be ten times in a day

There is nothing new, this was available on all websites !

Guess you could have done with few thoughts of your own apart from publishing the letter !

whatever has performed by mr.ramalingam raju is ridiculous from his part,but the other members shuld cum with right solution to help the shareholder and the other investor.